What are the tax deductions for a sole proprietorship? How does a sole proprietor pay income tax? How to pay taxes as a sole proprietor?

Is a sole proprietor considered an employee of the business? A sole proprietor is someone who owns an unincorporated business by himself or herself. However, if you are the sole member of a domestic limited liability company (LLC), you are not a sole proprietor if you elect to treat the LLC as a corporation.

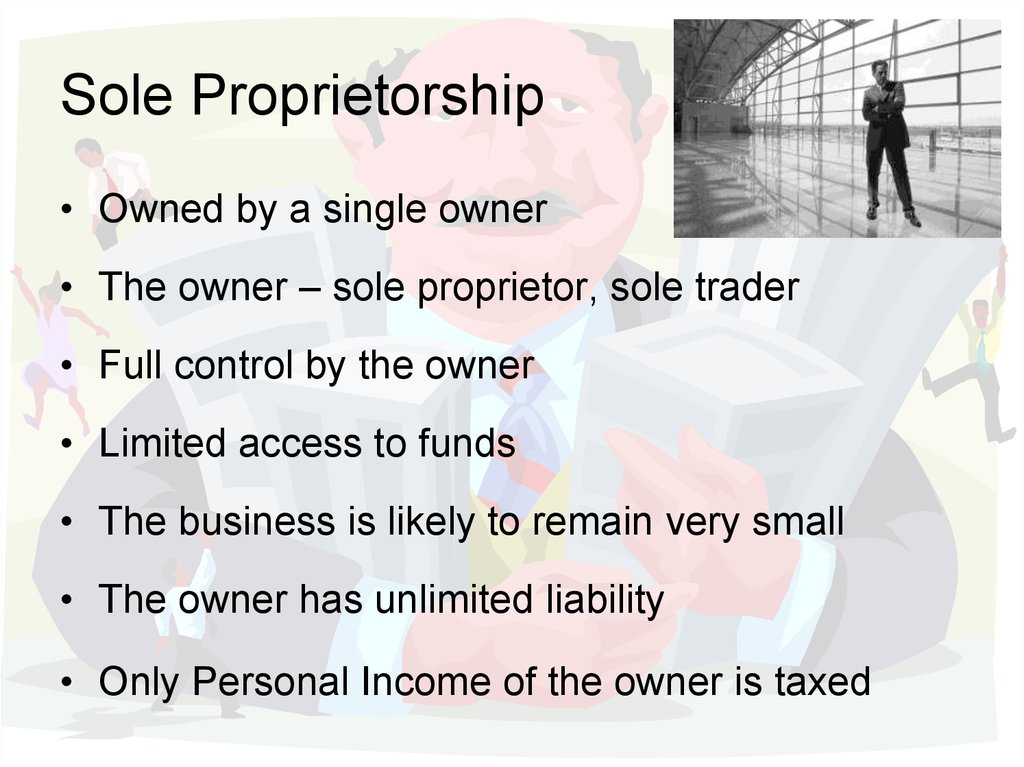

See full list on irs. Sole Proprietorship Taxes Defined. For tax purposes, a sole proprietorship is a pass-through entity. Business income “passes through” to the business owner, who reports it on their personal income tax return.

This can reduce the paperwork required for annual tax filing. But it’s important to understand which sole proprietorship taxes you. A good estimate is typically of income. Lets assume you will be in the – tax bracket based on the fact that you are the sole worker in this cleaning company. Estimate your income after expenses.

Take that number and submit. Technically, a sole proprietorship has one owner, that is the sole part of it. This answer will primarily focus on the federal tax requirements. You are required to report taxes to both the federal and state governments (2) When you are required to report federal income is a bit tricky.

For more on estimated taxes , see estimated taxes for sole proprietors. Self-employment taxes are equivalent to the payroll tax for employees of a business. While regular employees make contributions to these two programs through deductions from their paychecks, sole proprietors must make their contributions when paying their other income taxes.

Another important difference between employees and sole propriet. Unlike a sole proprietorship, a regular corporation (also called a “C” corporation) is considered a separate entity from its owners for income tax purposes. The corporation itself pays taxes on all profits left in the business. The Tax Cuts and Jobs Act dramatically changed the corporate tax rate to a single flat tax of. The business profit is calculated and presented on Schedule C—Profit or Loss from Small Business.

Because you and your business are one and the same, the business itself is not taxed separately-the sole proprietorship income is your income. The “bottom-line amount” from Schedule C transfers to your personal tax return. The IRS tends to take a closer look at tax returns filed by sole proprietors because it can be easy to blur the line between business and personal expenses. Even though your business and your personal tax return are combine the IRS still expects you to keep accurate and distinct business records. As a sole proprietor , the government generally requires you to make estimated tax payments if you expect to owe at least $0in taxes for the year.

Conversely, if you owed no tax for the previous tax year, you generally do not have to pay estimated taxes during the current tax year. The business ownership and IRS tax rules are similar to those of a sole proprietorship or partnership, but as with a corporation, the owners aren’t held personally liable if the business is sued. LLCs are state entities, so the level of legal protection given to a company’s owners depends on the rules of the state in which the LLC was formed.

Form Use this form to – W- Wage and Tax Statement and W- Transmittal of Wage and Tax Statements: Report wages, tips, and other compensation, and withheld income, social security, and Medicare taxes for employees. Self-employed individuals are responsible for paying both portions of the Social Security (1 ) and Medicare ( ) taxes. Do I have to pay Self-Employment Tax ? If you (1) are self-employed as a sole proprietorship , an independent contractor or freelancer and (2) earn $4or more, you may need to pay SE tax.

Ultimately, the returns for your sole proprietorship taxes will depend on the specific tax. First, you will be taxed for the full profits of your business, even if you have not personally withdrawn the money. Unlike corporations (C corps), sole proprietors , partnerships and S corporations are considered pass-through entities. This means that the profits from the business pass through to the owners, who then pay business taxes as part of their personal taxes.

There’s little difference between sole proprietorship taxes vs. A single-member LLC is considered a sole proprietor , for tax purposes, while a multi-member LLC is considered a partnership. Both sole proprietorships and LLCs file tax returns that blend the business owner’s personal income with their business income.

Instea the owner of the business pays personal income taxes on the profits from the business. As a result, the same income tax rates that apply to individuals apply to sole proprietorships. The central tax advantage of sole proprietorships and general partnerships is that neither form of business is considered a legal entity, thus no sole proprietorship or partnership taxes are levied.