What are the benefits and risks of sole proprietorship? Which is better LLC or sole proprietorship? Which of the following is an advantage of sole proprietorship? What does it mean to have a sole proprietorship?

Personal and Business Assets. One of the drawbacks of sole proprietorship is that the owner’s money is tied to his.

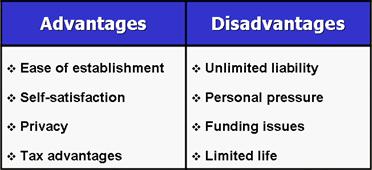

The flipside of not having partners or other investors in a business is not being able to come up with. In summary, here are the clear advantages for sole proprietors: Minimal formation costs. Fewer formal business requirements.

No corporate tax payments. Complete control over a business. Power over sale or transfer of assets. No need to wait on a decision from others. Beginning a sole proprietorship is easy.

Unlike other business structures, starting a sole proprietorship requires less paperwork and time to create a legal sole proprietorship.

It is cheap to start a sole proprietorship. Where other business structures have increased fees and filings to open for business , sole proprietorships tend to be affordable models to start and maintain. It provides self-employment , discourages concentration of wealth in a few hands and helps in developing personal qualities of self-reliance, self- confidence, tact and diligence. The life span of the business largely depends on the owner.

Since sole proprietorship is owned by just one person, all the profits from the. The main disadvantage of a sole proprietorship is the burden of unlimited liability. Advantages of sole proprietorship.

In case the claims of the creditors against the business exceede then the personal property of the owner is taken to pay business debts. Here are some of the most pertinent benefits of sole proprietorship for new business owners. Sole proprietorships are easy to establish Sole proprietorships are inexpensive and easy to form.

First, whereas other business structures need to apply for an employer identification number (EIN) with the IRS, sole proprietors are not required to file for an EIN. The drawback to those forms of business organization is that in. Corporations (S-Corps and C-Corps) get to file their own tax. The sole proprietor of the business can be held personally liable for the debts and obligations of the business. Additionally, this risk extends to any.

No business taxes: The business is not taxed separately. Company profits are filed on the business owner’s personal income tax return and can be reinvested for company growth or given directly to the owner. Tax rates for a sole proprietorship are also the lowest of the business entities.

Courts can seize the owner’s personal assets if there is some legal action against the firm. This legal action commonly arises when the owner has tax payments due or when he is not paying back his debts. A sole proprietary organisation has the following advantages and pros: 1. There is hardly any legal formality involved in setting up this. Simplicity of Operation and Flexible Management: In sole proprietary. Disadvantages of a sole proprietorship.

As with any business structure, there are disadvantages to sole proprietorships as well. Here, we look into the two biggest risks—liability and difficulty raising capital. Unlimited Liability: The unlimited liability of sole proprietorship is a great disadvantage.

A loss in business may deprive the proprietor of his assets too. So big business firms requiring more economic risk are not established under this organization. You get express rights to govern all the activities, make management decisions, as well as control the future of the business. Be it a corporate governing or a sole proprietor , it has its advantages as well as disadvantages.

The above mentioned are single proprietorship advantages and disadvantages. Despite its simplicity, a sole proprietorship offers several advantages , including the following: 1. Easy and inexpensive process The establishment of a sole proprietorship is generally an easy and inexpensive process. It does not require legal recognition and attendant formalities. This form is the most popular form in India due to the distinct advantages it offers.

Basset opines that “The one-man control is the best in the world if that man is big enough to manage everything”. This is the first disadvantages of sole proprietorship and it means when a person in the business pays the debts by. Limited Financial Resources in Business-.

Lack of Continuity of Transactions-.