What are the disadvantages of owning a sole proprietorship? What is the chief disadvantage of sole proprietorship? Which of the following is an advantage of a sole proprietorship?

One of the reasons entrepreneurs prefer sole proprietorship over other business structures is not having to. Since you are the only owner of a sole proprietorship , you are in complete control of your business. All of the decisions are yours to make.

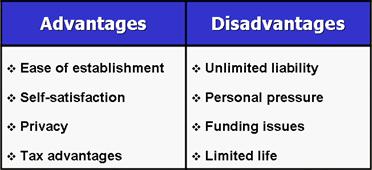

One question to ask yourself is: Do I want to be the sole decision-maker, or would I be more comfortable having one or more co-owners to help with the decision-making? See full list on legalzoom. There are no forms to complete, and no government fees to pay, to form a business as a sole proprietorship. Other forms of business organization may require filing some federal and state government forms, and paying significant fees. For example, in certain situations, a limited partnershipmay come under the authority of securities laws and their disclosure requirements.

An LLC or corporation will require formation documents to be filed with the appropriate state agency, and the payment of filing fees. Since a sole proprietorship does not file any formation documents or annual reports with the federal or state governments, your business operations are not subject to public disclosure like an LLC or corporation. A sole proprietorship does not need to file an annual reportwith the state or federal governments.

The sole proprietorship tax advantages are simplified reporting requirements and not having to pay separate taxes for the business.

With a partnership, business profits and losses must be divided among the partners, and reported to the IRS. All partners must report their share of the partnership profit or loss on their tax returns. If this election is not made, the LLC or corporation itself may need to file tax returns (and pay a separate taxes), with the shareholders also paying taxes on their share of the profits. Organizing your business as a sole proprietorship has several advantages. However, this decision should take into consideration all of your circumstances, including whether you will need others to invest in your business, your personal asset protection needs, and your tax situation.

Beginning a sole proprietorship is easy. Unlike other business structures, starting a sole proprietorship requires less. It is cheap to start a sole proprietorship. Where other business structures have increased fees and filings to open for. Here are some of the most pertinent benefits of sole proprietorship for new business owners.

While forming an LLC has its benefits, depending on your needs and situation, there are also advantages to setting up a sole proprietorship. Costs are minimal, with legal costs limited to obtaining the necessary licenses or permits. One of the functional advantages of sole proprietorships is that they are easier to set up than other business entities. A person becomes a sole proprietor simply by running a business.

Another functional advantage of a sole proprietorship is that the owner maintains 1 control and ownership of the business. Though a sole proprietorship is simpler than other. The advantages of sole proprietorship are vast and varied—especially if your company’s small.

Another one of the biggest advantages of sole proprietorship is the much simpler and.

As long as you’re the. You can protect the name of your sole proprietorship. As a sole proprietor, the legal name of your business is your.

All income you earn from the business is reported on your personal tax return, and you will be required to pay taxes on the income you earn. Despite its simplicity, a sole proprietorship offers several advantages , including the following: 1. Easy and inexpensive process. The establishment of a sole proprietorship is generally an easy and inexpensive process. Certainly, the process varies depending on the country, state, or province of residence.

Describe the advantages and disadvantages of a sole proprietorship and partnership in this scenario. Because you and your business are one and the same, the business itself is not taxed. Disadvantages of a Proprietorship.

Sole Proprietor Taxes. Unlimited personal liability.