Australia Income Tax Treaty exempts superannuation from U. We can provide a Tax Opinion to secure the legal exemption. Forms Alliance Partner Registration. To provide us with the details we need to better service you. It would be useful if you.

What is a SMSF and SMSF? Includes the application for a. Does SMSF annual return cover annual return? This form is for both SMSF and Pfeffer Awards. Please enclose sets of copies of application.

Send all materials to SMSF Inc. Application deadline: March 25th. DOWNLOADABLE LIST OF SMSF SETUP APPLICATION FORMS. Reduce cost of Documents $39. SMSF Trust Deed Upgrade (incl.

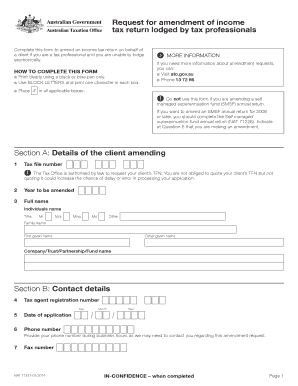

QROPS) $220: SMSF Change of Trustee. SMSF Change of Name: $330: Limited Recourse Borrowing Arrangement (LRBA) $660: LRBA Refinance: $660: In-house Asset Loan Agreement : $330: Deed of Debt Forgiveness (coming soon) $330: Binding Death Benefit Nomination DBN. It has sections, each described below. See full list on smsfengine. SMSFs that have access to the Business Portal can request an amendment via the portal.

All other amendments must be requested using the paper SMSF annual return form. Like other superannuation funds, self-managed super funds (SMSFs) are a way of saving for your retirement. The difference between an SMSF and other types of funds is that, generally, the members of an SMSF are also the trustees. This means the members of the SMSF run it for their own benefit.

Washington DC international tax. SMSF establishment or conversion to the SUPERCentral Deed – $357. Set up a new fund or convert to a SUPERCentral deed with regular update – your deeds remain fully compliant for SMSF gearing purposes. Unwinding Pack – $825.

Any proposed SMSF activity that could be considered doubtful should be presented to the ATO on this form. If the ATO gives a qualified approval then the activity will probably by OK. If the ATO responds negatively then the activity should not be undertaken.

A little time spent on this request now could save considerable cost in the future. As you will be nominating your self-managed super fund ( SMSF ), you will need to mark the appropriate box at item then ensure that the required fields are completed at items and 5. Section A is for the employee to complete. Convert individual SMSF to a corporate trustee (CCC) To minimise compliance penalties under the new ATO Penalties Regime, to convert an individual SMSF to a corporate structure, including company establishment, change of trustee and premium or standard conversion deed in just one easy online form with a substantial bundled product rebate. As an SMSF trustee, you will also need to complete an ‘acknowledgement’ of the valid notice you have completed.

As an independent organisation, our goal is to educate and empower people to better understand the issues, demands and regulations needed to make the most of their self-managed super funds. A self-managed super fund ( SMSF ) must report certain events in the event-based reporting framework for self-managed super funds (SMSFs) to the ATO by the due dates. Become an SMSF Specialist AdvisorGain a valuable and highly regarded industry designation, while reducing your FASEA obligations and education costs.

These are just two of many issues to consider when mapping out an estate plan, where your SMSF account balance (plus any insurance proceeds) may form a significant part of your remaining assets.