Australia Income Tax Treaty exempts superannuation from U. We can provide a Tax Opinion to secure the legal exemption. The free SMSF DataFlow ESA (Electronic Service Address) service and website are no longer available. To use the SMSF DataFlow ESA you must have an Accountant or Adviser that has a Class Super license and uses Class Software to process your SMSF. You will need to change to another service provider Westpac QuickSuper SMSF Gateway offered by Westpac Bank. The smsfdataflow solution is provided by listed SMSF software company Class Limited.

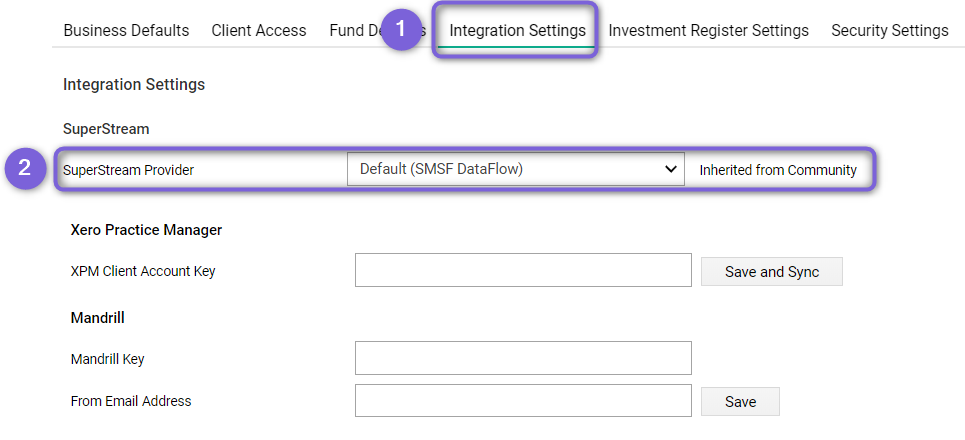

For the electronic messages to be received (and NOT cause any rejection messages) the SMSF must be administered on the Class SMSF software platform. The SuperStream data and payment standard is part of the Government’s Stronger Super initiative and introduces a streamlined method of sending superannuation payments and associated information electronically. All SMSFs that are administered on Class will automatically be registered with SMSF DataFlow.

New data standards which are part of the SuperStream reform require superannuation funds to accept employer contributions and other information from employers electronically. YOUR SUPER: Anywhere. Become an SMSF Specialist AdvisorGain a valuable and highly regarded industry designation, while reducing your FASEA obligations and education costs. Welcome to the DataFlow Group Governments, public institutions and private sector organisations worldwide all recognise that one of the biggest threats to security, service quality and stakeholder wellbeing is unqualified staff using fake certificates, professional credentials and legal documents. How do I create a Death Benefit pension when the deceased member is outside the SMSF ? What if I don’t receive contributions?

If your SMSF is no longer receiving contributions – in pension mode for example – then there’s no need to get SuperStream ready at this stage. For further information visit smsfdataflow. Similar Sites by Audience Overlap Overlap score Similar sites. SMSF Dataflow My Wealth Mailbox SuperCorp Clicksuper Not sure if it would make any difference which one you use though. To receive SuperStream data your self-managed super fund ( SMSF ) needs an electronic service address.

An electronic service address is an alias used by your SMSF. It represents the uniform resource locator (URL) or internet protocol (IP) address of a messaging provider. Like other superannuation funds, self-managed super funds (SMSFs) are a way of saving for your retirement.

The difference between an SMSF and other types of funds is that, generally, the members of an SMSF are also the trustees. This means the members of the SMSF run it for their own benefit. We needed a better way to look after our SMSF clients.

We experienced first hand the frustration of the ‘old way’ of looking after SMSFs: Financial statements that were out of date by at least months and of no use to anyone other than the ATO, high fees and poor value due to highly skilled and knowledgeable staff spending unnecessary time on laborious data entry and. SMSF3uses SMSF DataFlow to provide all of this functionality to trustees at no cost and for the duration of being a SMSF3client. How it works Through SMSF DataFlow , SMSF3registers their all of our SMSF clients to access the contribution data needed. With SuperStream, contributions and data are sent electronically in a standardised format. No problems, i have h. All SMSFs require an ABN to receive contributions employers send using SuperStream.

The ABN is used as the super fund identifier to ensure data messages reach the correct fund. In order for your SMSF to receive this information, it needs an Electronic Service Address (ESA). Data feeds integrate with major financial software making planning, accounting, SMSF administration and reporting simpler. Online applications with electronic verification make the application process more efficient.

Every day, Class helps thousands of accountants, advisers and administrators to drive positive change in their businesses – boosting productivity, fuelling business growth and improving client service levels. The application, SMSF DataFlow , will be available to professionals working in the SMSF space and fund trustees at no cost. Class Super had intended to make the facility available exclusively to its clients, but decided to open the application to a wider audience after a deeper examination of the SuperStream requirements. A self managed super fund (or SMSF for short) is one of the best options for those who want to exercise control over their own superannuation investments. Find out how to make changes to your SMSF , including if there is a change in trustees, directors of the corporate trustee, members, contact details or address, change in fund status.

Self managed superannuation has been around for more than three decades. To wind up your SMSF you will need to notify the ATO within days, lodge a final Annual Return and finalise any outstanding tax liabilities. On the first page of the tax return, tick the option advising the ATO that this is the final tax return of the Fund.