The duties are based on ad valorem or specific rates. An ad valorem rate is a percentage of the goods’ customs value (for example, of the customs value). When shipping something internationally, your shipment may be subject to import duties and taxes. These additional charges are calculated based on the item type and its value. To assist you in your self-classification journey, you may use the following resources to obtain the HS code for your product.

The importer is the party indicated as the consignee in the freight documents such as the House Airway Bill (HAWB) or consignment note. Calculate import duty and taxes in the web-based calculator. GST at Tanah Merah Ferry Terminal because the goods were for commercial purposes and thus, no import GST relief was accorded to him.

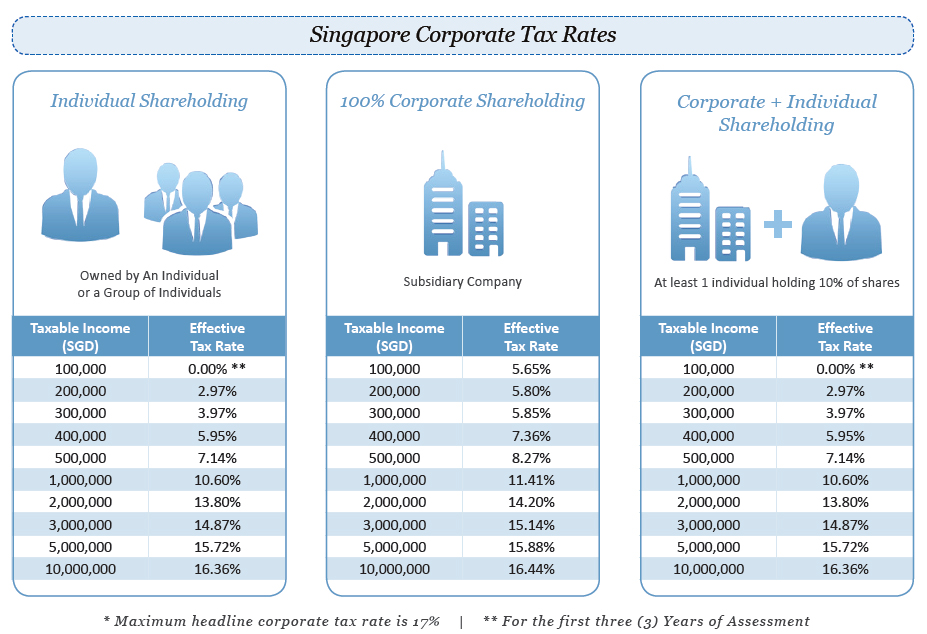

So, for example, ad valorem would be approximately of the customs value of the goods in question. Simultaneously, corporate tax rate was cut by to , and the top marginal personal income tax rate was cut by to. In addition, a Good and Services Tax (GST) of is applicable as well. Our bonded and non-bonded options provides greater flexibility for those who wish to delay the payment of such duties and tax. A tax invoice must be issued when your customer is GST registered.

Your customer needs to keep this tax invoice as a supporting document to claim input tax on his standard-rated purchases. In general, a tax invoice should be issued within days from the time of supply. We are a partner of the community in nation-building and inclusive growth. Singapore is generally a free port and an open economy. Food items for personal consumption are permitted.

Products and services sold to foreign consumers are exempt from GST tax. Within months from the date of purchase, you must complete the GST refund procedure using your original passport at the eTRS self-help kiosks and depart with the purchases via. Any additional amount, up to $00 in goods will be dutiable at a flat rate (). GST is levied on the value of the goods, which may include the cost, insurance and freight (CIF) plus other chargeable costs and the duty payable (if applicable). You will need the UEN and Permit Details for the form.

Please ensure that all relevant information provided is accurate and supporting documents are duly submitted. Otherwise, your VDP submission may be rejected. Smoking is definitely one of two easy ways to blow a travel budget (drinking is the other). The sales tax is collected by the seller from the end consumer when a purchase is made.

VAT Tax : A value-added tax , or VAT, is an ‘indirect consumption’ tax on the consumption of goods and services. You may wish to refer to the User Guide for a step-by-step guide on completing the application. You can find out more about GST relief here. The only exemptions are for the sales and leases of residential properties and the provision of most financial services.

Export of goods and international services are zero-rated. Individual income tax. SINGAPORE — Passengers flying out from Changi Airport from July will have to pay S$47.

It has undergone numerous changes in its 90-year history. The first duties CED imposed were on hard liquors and opium. This is a tax on the consumption of goods or services by the people, collected by the merchant on behalf of the government.

Value-Added Tax (VAT) Also known as GST or Sales Tax. What Is The Shipment Value. The value of shipment that is declared for customs by the shipper to serve as the basis for computation of duties and taxes.

However, travellers can enjoy. GST tax is charged to the end consumer therefore GST normally does not become a cost to the company. Note that the information provided is for general purpose only and not meant to replace professional advice on corporate tax.