In addition, a Good and Services Tax (GST) of is applicable as well. Corporate Tax Payment Deferment Calculator (XLSX, 28KB) The Corporate Tax Payment Deferment Calculator is designed for companies to view the revised payment due date. The calculator assumes that you own and operate a private limited company that is generating profit and you will receive the post- tax profit as dividend income at the end of the year.

If the tax had kept pace with inflation, instead of 0. Step 2: Enter tax or fee increase for one or more alcohol categories. Enter a ten-cent tax or fee increase for beer as 0.

In the interest of simplicity, some details have been omitted. Your average tax rate is 21. When shipping something internationally, your shipment may be subject to import duties and taxes. These additional charges are calculated based on the item type and its value.

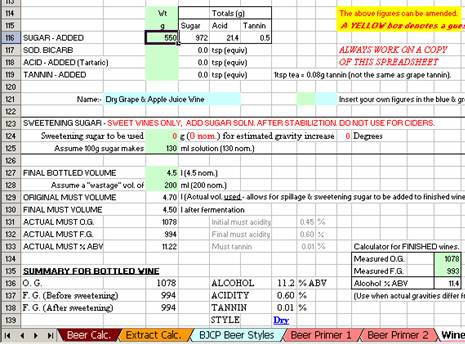

Calculate import duty and taxes in the web-based calculator. BevTax alcohol tax calculator. Federal excise tax and state excise tax for beer, wine and spirits.

Liquor tax for all states in the USA.

Accurate automatic calculations for all tax rates for multiple unit sizes. Bevtax is a sophisticated excise tax calculator for the alcoholic beverage industry. Formula for computation of duty payable on liquors: Exercise duties paid are non refundable. The calculator is provided for your free use on our website, whilst we aim for 1 accuracy we make no guarantees as to the accuracy fo the calculator.

Other than its unique geography as the strategic location to play as the financial hub in the region, the first-class facilities, high-level workforce as well as attractive tax incentives have transformed the island into a hotspot for investors and. You have to enter a decimal number, with dollars and cents, ya jack-tard! According to a guide on proposed sales tax rates for various goods prepared by the Royal Malaysian Customs Department dated Aug 16.

GST relief is granted on goods imported by post or air, excluding intoxicating liquors and tobacco, with a total Cost, Insurance and Freight (CIF) value not exceeding S$400. Free calculator to find any value given the other two of the following three: before tax price, sales tax rate, and after- tax price. Also, check the sales tax rates in different states of the U. The current highest personal income tax rate is at. Engine Capacity (EC) Road Tax Formula (per annum) EC: =6cc: S$4x 0. The state adds an excise tax of cents per gallon of low- alcohol beer.

For regular beer, the tax is cents. That is, up to alcohol. For wine the rate is cents. With the tax hike, consumers can expect to pay between cents and cents.

We are a partner of the community in nation-building and inclusive growth. It is mainly intended for residents of the U. Income Tax Calculator. Online Salary and Tax Calculator 】 provides your income after tax if you make S$390in Singapore.

We calculate how much your payroll will be after tax deductions in Singapore. Find your net pay from a salary of S$39000. How to calculate Singaporean GST manually To calculate Singaporean GST at rate is very easy: just multiple your GST exclusive amount by 0. Technical assistance and management fees for services rendered in Singapore are taxed at the prevailing corporate rate. However, this is not a final tax. For example, in Singapore , we have additional taxes on goods such as alcohol , cigarettes and petrol.

The Excise Duty on cars in Singapore is of OMV. Once the Excise Duty of is added to the OMV, a further GST will be levied on the total OMV and Excise Duty amount. A tax expert therefore might have a sales tax calculator or software to provide the exact rate for the current sales tax.

Actually the addtl charge is 17. The Service Charge is also subjected to the.