How to restructure a promissory note? What are the different types of promissory notes? Does a promissory note need to be?

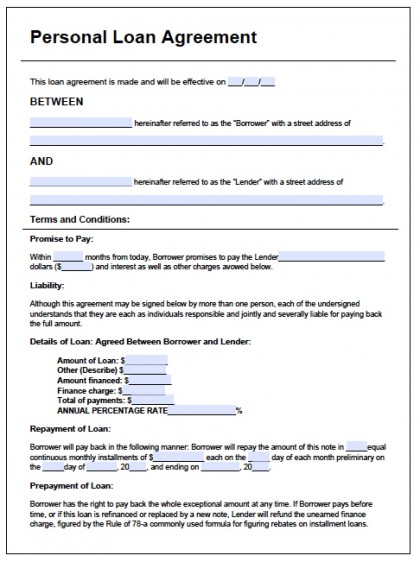

A simple promissory note is a brief document written in simpler terms between two people over a loan or transaction. Thinking about bailing out family or friends? With the economy the way it is right now many of us have been asked by family members and friends for loans. Other articles from usattorneylegalservices. The document holds the borrower accountable for paying back the money (plus interest, if any).

There are types of promissory notes, secured and unsecured. In accounting, they are referred to as notes payable. In the business worl a verbal promise is absolutely legal but it is not that much reliable as compared to a proper documented written promise.

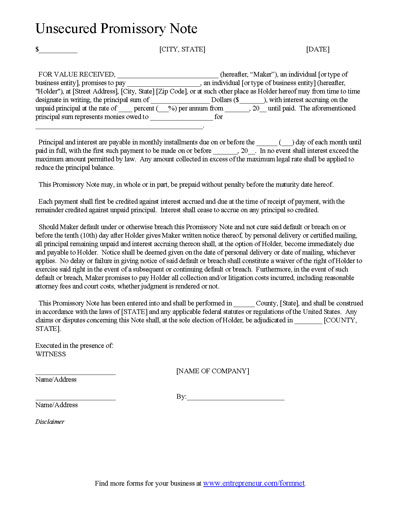

Simple Promissory Note City State Date (Borrower) agrees and promises to pay to (Lender) the sum of ($) Dollars for value receive with interest at the annual rate of payable after (Date). A promissory note is a simple legal document in which a person undertakes to pay a particular debt. The promissory note can be prepared by a bank or lender or any loan officer. It is better to write a promissory note by yourself and this is also a legal and binding contract.

One can use promissory note template word when giving away money to a family member or any other person for short period of time. Taking the time to learn how to write a promissory note, or write an IOU, will help in your collection endeavors. A Promissory Note, also sometimes called an IOU , is essentially a one-sided document by which a borrower of money (most often just called the Borrower ) agrees to pay a lender (the Lender). The maker, will pay back a specified amount of money to the payee, or lender, on or before a specified date or when receiving a request from the payee to do so. These conditions must be addressed in the promissory note and thereafter signed by the parties involved.

In this regar a promissory note meets all the elements of a legally binding contract. A Promissory Note , also sometimes called an IOU, is essentially a one-sided document by which a borrower of money (most often just called the Borrower) agrees to pay a lender (the Lender). It is written or prepared by legal attorney, bank or lending institutions.

If repayment stretches beyond the due date interest will begin to accumulate. Release Form – After a note has been paid in full, the lender will usually issue a release (or can be requested by the borrower). Whether you’re the lender or the borrower in the arrangement, the promissory note must reflect the best interests of both parties. But to draw up a valid promissory note, the document must consist of the necessary components of a legal document. This approach should make it easy for a debtor to make a promise to a creditor in a formal exchange.

The note records information about how much was lent (the principal amount), interest rates, when the payment is due (maturity date), when and where it was issue and signatures. You may also check out what is a note. People lend and borrow money every day, and problems can arise if the transaction is not documented.

Promissory Notes are written agreement that specifies how borrowed loans are to be pai where it will be paid and the when you are expected to pay the said loan. A Promissory Note ideally and clearly contains all the terms and rules how to pertain indebtedness to the note’s payee by the issuer of the Promissory Note. Sample Promissory Note. I, Jane Doe, residing at 1Maple Dr. This money will be used for the purpose of buying a new computer for school.

A Secured Promissory Note is a document that allows a Lender to lend money with the added insurance of having assets property to be handed over to them in the chance the Borrower defaults. This type of note carries less risk to the Lender and usually allows the Borrower to pay a lesser interest rate. Download free printable promissory note templates that may be written in fillable Adobe PDF (.pdf), MS Word (.doc), and Rich Text Format (.rtf).

The note is a written statement by the borrower to promise to pay back the funds within a specific time-frame and interest rate.