What is an ABN for a business? How to apply for an ABN? A successful application. It doesn’t replace your tax file number, but it’s used for other tax and business purposes.

High call volumes may result in long wait times. Before calling us, visit COVID-, Tax time essentials , or find to our Top call centre questions. Your ABN direct to your inbox in just minutes. To set up your ABN , simply follow these steps: Login to your Airtax account or create a new account by signing up to Airtax here if you don’t already have one.

Then click Register when you’re done. Independent contractors are paid for the they achieve and are personally responsible if their business makes a profit or loss. Sole traders, partnerships, and companies all need to have an ABN to trade, as do businesses which have a turnover of $70or more per year. Set up to protect home owners and rectify defective building work early in the life of high-rise strata buildings.

Websites ending simply with. If you have an online business, it is advisable for you to obtain an ABN. Business persons, listen up.

To give you a clear picture, an ABN is not a necessity unless you wish to create a domain space — that is, your online address. A company is a type of business structure. Company registration. You must also set up a register to record details of the members of your company.

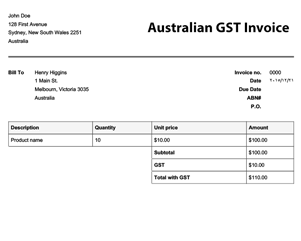

If you are registered for GST the process is very simple. You’ll be asked to choose an option box and sign the notice to say that you read and understood it. Secure an ABN to run your business.

If you’re setting up your own business for the first time, you’ll quickly find that there are a lot of guidelines you must follow from a compliance perspective. Filing for an ABN can save you both time and money when conducting business activities. One of the most important is an ABN. Also, you need an ABN to register for GST. Is the trust entitled to an ABN ? To be eligible for an ABN , the terms of the trust must be set out in a trust deed or the terms must be implied.

It can also be sole traders who join forces under one ABN. Trust – a trustee is responsible for business operations. Setting up an ATO regulated self managed superannuation fund? ABN , GST, TFN – setting up a business can be a minefield of confusing acronyms. Here’s what they all mean, plus four key steps you should take to get you on your way.

If the myGov account is not already set up , then click on ‘Create an account’ and follow the prompts. This can be done by selecting ‘Link your first service’ from the home screen, and following the prompts. You can then set up authorisations in RAM for employees and others. Whether you decide to go solo or seek professional help, it’s important to understand the set-up process.

The SMSF set-up process. Below are the nine steps required to get your SMSF up and running. Step 1: Choose your SMSF members.