Dedicated Relationship Manager Who Understands Your Needs And Can Help Your Business Grow. Book An Appointment Or Call Us Today. How do you open a business bank account? What is the best bank to use for a business account?

What do you need to setup a bank account? Can one start a business without a bank account? Most business owners start by opening a business checking account.

The next step when opening a business account is to choose the best. Setting up a business bank account is an important step for start- up founders, sole traders and other small businesses who have decided to set up on their own. Business bank accounts are an important way of bringing all of your business finances together in a single, visible place, meanwhile streamlining your time and efforts and leaving you. Net new purchases must post to that card account to qualify.

To link your Business card account to your Business Advantage Checking account , please visit your local financial center or call 888. You always want your business to maintain a professional edge. When opening a business checking or savings account , all banks are required to obtain information verifying the business as well as the individuals associated with the business. For free business banking you need to operate your account in credit , or within your agreed overdraft limit.

UK business bank account providers require a basic set of information to set up your business current account. You can see the full list of requirements using the simple business banking checklist from UK Finance, the UK’s leading trade association for financial services. One important choice is where to set up your business bank account and what kinds of accounts to get.

Every business is different and has its own product cycles, financial withdrawal needs and specific financial requirements. Simply visit your bank with the needed the paperwork, and the bank staff will set up the account. It is how bills are pai vendors reimbursed and employee wages are met.

Set up a business bank account. Find out when you need a business bank account , and the benefits of having one. Your registered business must be in the UK and you should be registered for tax purposes in the UK. Learn how to set up a business bank account using the following four steps.

The first step of setting up a business account is deciding on a bank. While it’s not technically necessary, it is highly recommended that you do maintain a separate bank account for your business. The bank account should be in the name of your business. So it’s highly recommended that you set up a separate business bank account. Most Banks will spot that you’re setting up an account in the name of a limited company, and likely insist you use a business account under specific terms and conditions.

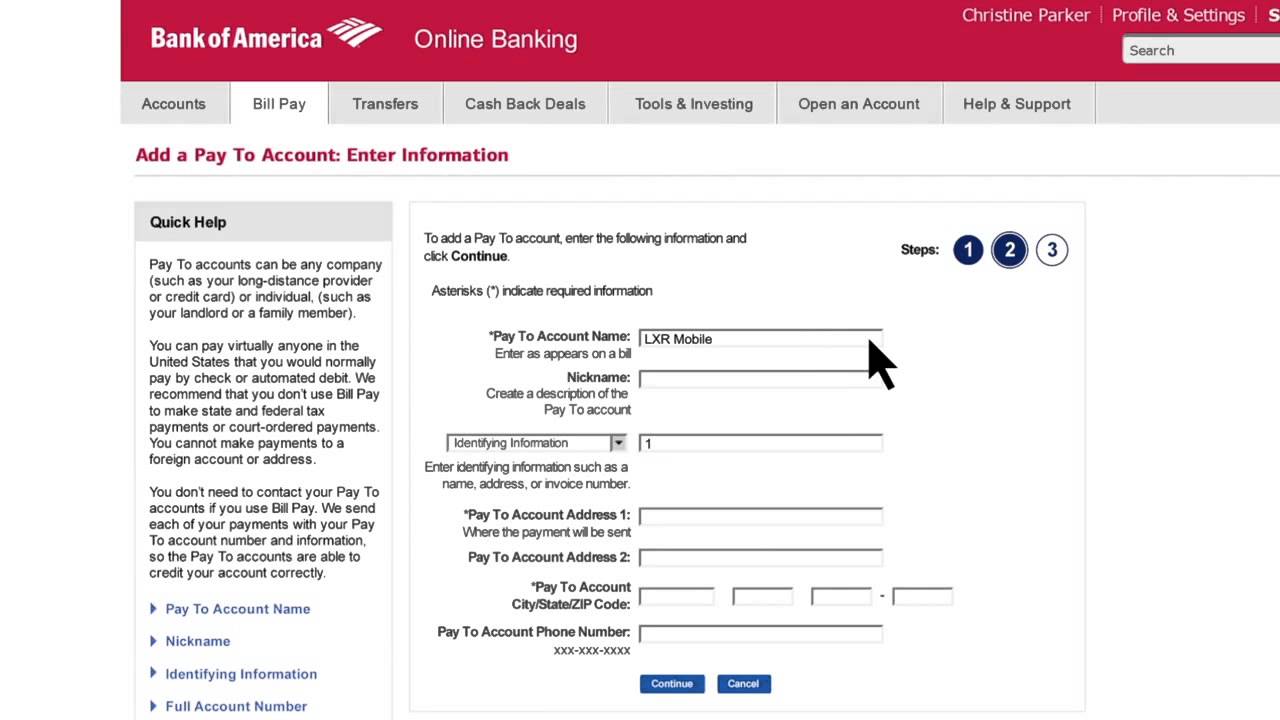

If you have questions about getting an EIN in preparation for setting up your business bank account , reach out to an Incfile specialist today. Before establishing a business bank account for a joint venture, compare amenities such as online banking and bill-payment solutions. Visit the joint venture’s bank of choice.

The products, account packages, promotional offers and services described in this website may not apply to customers of Citigold Private Client, Citigold International, International Personal Banking or Global Executive Banking. Please click on the appropriate link to obtain such information. Protect your cash flow and eliminate costly overdraft charges with a Business Reserve Line, an unsecured line of credit up to $0that is linked to your U. Your Business Reserve Line will automatically advance available funds into your business checking account whenever the balance falls below zero. Bank business checking account.

Decide which type of bank account or accounts your LLC needs to conduct its business. This account will be used to collect funds, pay customers, fund business expenses, and complete other financial transactions. Do your research in advance, gather all the relevant documents before starting the process, and always get in touch with your bank should you have any queries.

This post top questions you should know if you want to choose the right bank for your business account. One of the mistakes which most entrepreneurs make is undermining the need to consider. This allows time to arrange and attend an introductory meeting and for the bank time to carry out all necessary identity checks, and to arrange any chequebooks and paying-in books.

A separate business bank account helps you manage your business finances more effectively and can give you access to additional services, such as overdraft facilities or business savings accounts. They also help business owners to keep track of their expenses, as well as managing cash flow.