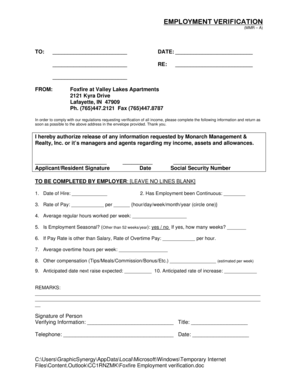

For programs that require. Verification Of Self-Employment Income – DPAweb Written or verbal verification of self-employment income and expenses is required. Writing an income verification is very usual to be asked to verify your income when inquiring about a loan, rental agreement, etc. Every State has a Secretary of State’s officeor equivalent that allows a user to search its database to lookup the principals of the business entity. Have the individual you’ve requested to obtain an employment verification letter from the Principal or Owner of the business.

See full list on eforms. In order to ensure that the employer actually signed the letter, it is best to call during business hours. If the person that signed is not available it is best to ask for a call-back or to ask for someone else who may be able to verify furthermore of the verification. When asking for the letter it may be best to ask for the past pay stubs from the employer. If this is not available then it is best to request the bank statement of the past month from the individual.

This will give you not only their income but also show their spending habits and prove if they are capable of being financially responsible. Often times individuals are paid with cash or they are self-employed. In these instances, it is best to get, at the very least, the past years of income taxes. Everyone in the United States is required to pay taxes to the federal government. Therefore, if the individual is making any kind of money there will be a return on file that they can easily obtain.

This takes about business day and is free. If none of the above solutions seem promising it is best to obtain a credit report from the individual. This can be easily completed by either collecting the person’s information through the Background Check Authorization Form.

Once you have all the necessary information you can perform the lookup through Equifax, Experian, or Transunion. How to verify income for self-employed? What is self employment verification?

Do I have to file a tax return if I have self employment? It is important to provide accurate information for review. Declaration of income is mandatory regardless of your type of business. The agency must determine self-employment using the method the client chooses for each self-employment business.

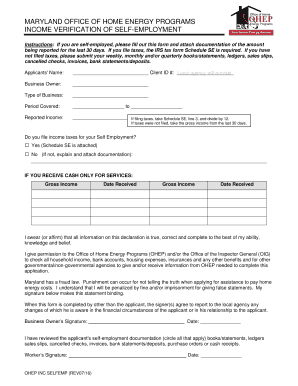

If business taxes for the most current tax year were filed within the last months, the client can choose either the taxable method or the method. Self-employment can be liberating. It can also seem frustrating when it comes to proving your income for insurance or other purposes. Luckily, showing proof of income as a self-employed individual is a lot easier than most realize. Self – Employment Income and Expenses Verification Form.

Medicaid Form Number. This information is confidential and will be used only to determine your eligibility for child care assistance. It cannot be released without your written consent. Client Name: This self-employment income is for the period of through.

SELF-EMPLOYMENT RECORD. You have to file an income tax return if your net earnings from self – employment were $4or more. Customer Call Center. Agents available 7am to 6pm Mon-Fri. Schedule “C”) instead of completing this form.

You may also supply us with your self-employed income information without using this form. Instea you may write the information on a separate piece of paper that you sign and date. Please explain the nature of the applicant’s self-employment ) has been operating in this capacity since _____.

You are not required to complete this form , but you are required to keep accurate records of your self – employment income and expenses. The Department will need a copy of the record you choose to use. If you do complete this form , your DHS office will be better able to determine your eligibility for benefits.

An income verification is an important document because it helps provide a full picture of the borrower’s capacity to pay the loan or debt. In addition to this, the lender may also ask for an employment verification letter in order to demonstrate that the borrower has a steady source of income. Copies Original only. Printing Instructions This form must be printed on letter size paper, using portrait format. Affidavit of Self-Employment Income.

Electronic Visit Verification ;. Reports, Forms , Pamphlets and Policies. You can search for reports, forms , policies and pamphlet and posters with information about specific programs and services. Click on the tab that corresponds with the type of document type you are looking for, or click on the All Documents tab to search through all available documents.