Trust Funds : What Are They? What is a self-managed super fund? What are the self managed super fund rules? Can a self managed super fund borrow money? Is a self-managed super fund right for me?

The trustee : The trustee , which can be a single. A self managed super fund ( SMSF ) is a superannuation trust structure that provides benefits to its members upon retirement. The main difference between SMSFs and other super funds is that SMSF members are also the trustees of the fund. If you are thinking about saving for retirement, one of your best options is a self-managed super fund. This is a retirement account that you manage on your own, and that is set up to benefit you (or possibly your dependents) in the event of your retirement.

Although this is a great way to save for retirement, they aren’t for everyone, and these accounts differ from a traditional trust in many different ways. A living trust gives you one of the most flexible ways to plan your estate. But once you get a living trust , then what?

There are a few important steps to follow to make sure your living trust does what you intended it to do—distribute your assets based on your wishes while avoiding probate. As well as providing the ability to verify an account for personal use, CoinJar supports separate entity accounts – for your company, trust , or Self Managed Super Fund (SMSF). This article will guide you through ID verification for an entity account. You’ll need a custodian or trustee to administer the account. A self-directed IRA is most commonly custodied with a passive.

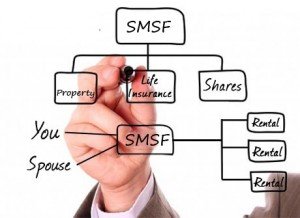

An SMSF is a type of trust. A trust requires trustees , assets and beneficiaries. Self-managed super funds (SMSFs) are a way of saving for your retirement. The difference between an SMSF and other types of funds is that the members of an SMSF are usually also the trustees.

This means the members of the SMSF run it for their benefit and are responsible for complying with the super and tax laws. Schwab provides self -directed investors with low pricing,. The benefits of self – managed. If the person is under age 6 a parent, grandparent, guardian or court can establish a. Pooled trust managed by a nonprofit.

The person (or a parent, grandparent, guardian or court) can transfer his or her. Superannuation is about good investment combined with tax effectiveness. Self managed super funds allow you to maximise these benefits.

Our access to high quality investment research together with holding our own Australian Financial Services Licence, allows us to tailor an investment portfolio to your individual needs. Technically, a mutual fund is a type of. A managed fund is an investment where your money is pooled together with other people’s money and is invested in a common investment goal by the fund manager. Managed funds are also known as ‘managed investments’ or ‘managed trusts’, because they are a type of trust where the fund manager holds and controls the money on your behalf.

The do-it-yourself super method allows you to be more closely involved with what you invest in, and offers tax benefits that major providers do not. Brokerage Services Available Through ETC Brokerage Services, Member SIPC, and FINRA. Tasty income: funds that pay or more. How inheritance tax could be made easier for 250people.

May to (eventually) get her way on Brexit, predicts investment bank. A UCITS structured as an investment company or Irish collective asset management vehicle (“ICAV”) may appoint a management company or it may operate on a self-managed basis. A SMIC must comply with many of the same authorisation requirements as management companies.

Transfers to self – managed superannuation funds. Self – managed super funds are a great way to save for your retirement. It offers flexibility in terms of controlling your investments.

It also helps you have a deeper understanding where your money is being use giving you more confidence in your investment and lifestyle decisions. This guide outlines what an SMSF is, the obligations and responsibilities of SMSF members and includes a step-by-step guide on how to set up your own SMSF. You can also compare a range of dedicated SMSF cash accounts. The primary objective of any self – managed super fund is to secure assets and thus wealth for your retirement years.

Your financial independence or empowerment when you cannot work as you do now is the ultimate objective and the laws of the land are helping you to achieve that. A self-managed super fund (SMSF) is a savings account for your retirement that you manage yourself, rather than one that’s managed by a superannuation provider. In the ‘90s, a hard core of old establishe mainly equity trusts was backed by a narrow group of institutions, including many self-managed pension funds and life assurance companies.