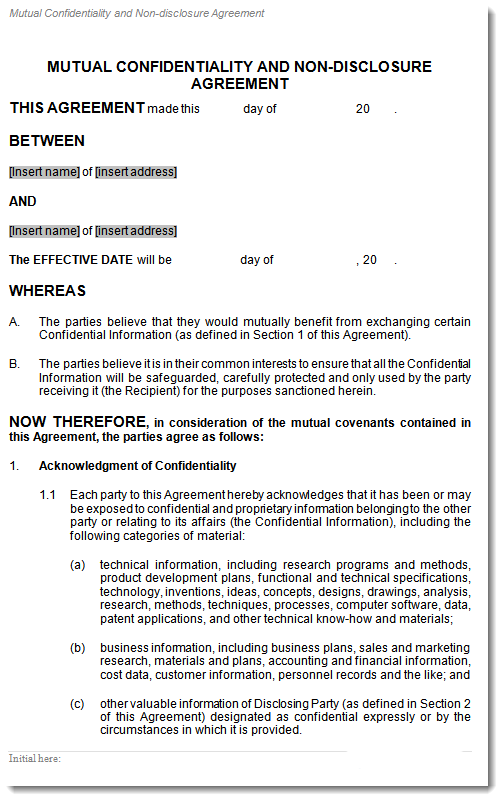

Customisable Online Legal Documents. Offered much needed reassurance. Damin immediately understood. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now!

Warning: This is a binding contract. You should obtain the advice of a solicitor before you sign. It is important that you understand your rights and obligations under the contract and that you undertake thorough due diligence on the business before purchasing it. What is Victorian sale of business contract? Can I Sell my real estate contract?

Once signed by a buyer, a contract is a written offer to buy a property. The tender arrangement can be by sole or panel supplier. However, a nominal duty may still be payable if the business sale includes a transfer of lease and goods.

The nominal duty payable is $10. See full list on legalvision. The Office of State Revenue Queensland is the responsible authority. In QL stamp duty is payable on dutiable property, which includes all business assets except: 1. The purchaser will have to pay stamp duty when they sign the transfer agreement. The stamp duty is generally payable within days, at the relevant rate.

The State Revenue Office Victoria is the responsible authority for all stamp duty enquiries in the state. Liability for stamp duty for a sale of business arises when the relevant dutiable transaction occurs and is payable within days at the relevant rate. In Western Australia, stamp duty is payable on the sale of business assets, including goodwill and intellectual property. You have to pay stamp duty once exchange of business assets has occurred.

If you are selling your business in the NT, your sale of business agreement should be lodged with the Territory Revenue Officeto assess the stamp duty payable on the sale. After the sale of business agreement has been signed by the parties, stamp duty is payable within days at the relevant rate. The only exception is for real property assets. There is no stamp duty or nominal fee payable on a sale of business in the ACT. The ACT Revenue Officeis the responsible authority for all duty enquiries in ACT.

However, stamp duty will still apply on the transfer of land or a motor vehicle that is included as part of the sale of the business. Stamp duty is generally payable within days of the relevant agreement at the relevant rate. Revenue SA is the responsible authority for all stamp duty enquiries in SA. The responsible authority for all duty enquiries is the State Revenue Office of Tasmania. Stamp duty for a sale of business is generally payable within three months of the relevant transaction at the applicable rates.

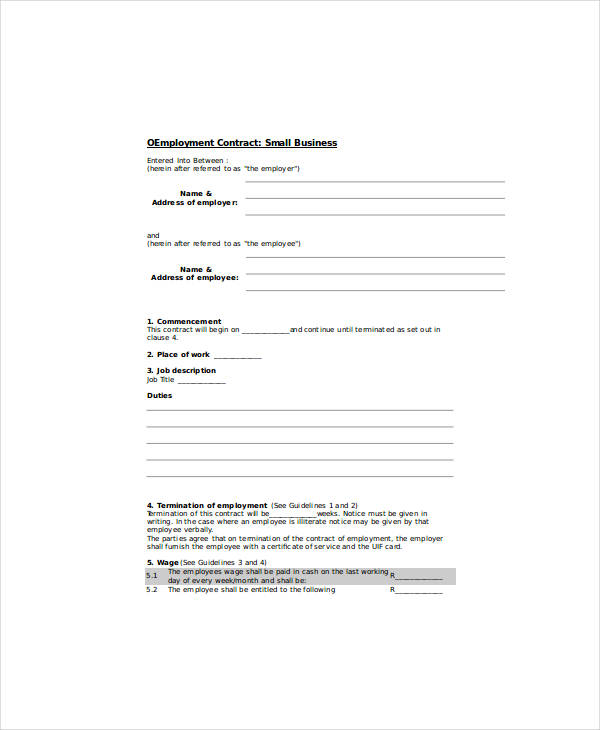

The cooling off period is designed to allow you time to consider your purchase and cancel the contract immediately if you decide you do not want to proceed. Before you sign the contract Read and check the documentation. This BUSINESS SALE CONTRACT is compliant in all states of Australia, has been drafted in Plain English and will provide strong legal protection in the event of a misunderstanding. You would sign loan documents which would entitle you to instalments and interest over a particular period.

The seller will deliver a bill of sale to the buyer no later than days after the business sale. Any and all terms and warranties included in this business sale agreement will survive the closing of this sale. Business Sale Agreement.

This includes the property’s identification, purchaser’s full names, agreed price, deposit, settlement date and terms of sale.