What is a Sale of a Business as a Going Concern ? Is a sale of a business a sale of one asset? The vendor operates the cafe until the settlement date and you are registered for GST. Seller agrees to sell and Buyer agrees to purchase, free from all liabilities and encumbrances , the above‑described business, including the lease to such premises, the goodwill of the business as a going concern, all of Seller’s rights under its contracts, licenses, and agreements, and all assets and property owned and used by Seller in such business as specified in Exhibit A, other than property specifically excluded. Leaving significant items out of the contract, containing hard and intangible liabilities and assets, can cause problems months after the sale goes through. The Business agreement templates come along with the massive popularity and states the excellent financial facts.

Payment terms are another important feature of the contract. The supply of a business as a going concern is GST free when the seller and the buyer have a written agreement stating that the supply is a going concern. Whether “ Business Transfer Agreement ” as a going concern on slump sale basis is exempted from the levy of GST in terms of serial no.

Central Tax (Rate) dated 28. Gujarat Foils Limited. Before deciding to sell check whether you: 1. See full list on smallbusiness. Ideally, you will begin preparing for sale well before you put your business on the market. This could include: 1. Ensuring employees have documented job descriptions.

Obtaining written agreements from suppliers and review contracts to make sure they don’t expire during the sale. Selling obsolete or slow moving stock. Reviewing plant and equipment and selling anything not required. Collecting outstanding debts and paying your creditors. Making sure premises are well presented.

Obtaining audited financial statements for at least the previous three financial years. Reducing employee leave liabilities by encouraging them to take leave, if possible. Potential buyers will want to undertake their own due diligence into y. Determining the value of your business can be very difficult.

You may want to obtain advice from your financial adviser, accountant or a registered business broker with experience in selling similar businesses. Generally businesses are valued using one of the following methods. The sale of a business usually is not a sale of one asset. Instea all the assets of the business are sold. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now!

Important to note is that it is not an exemption from VAT, but applying VAT at a zero rate. Generally, when this occurs, each asset is treated as being sold separately for determining the treatment of gain or loss. Subject to the terms and conditions of the agreement, the purchaser agrees to purchase from the seller and the seller agrees to sell, transfer, convey and deliver to the purchaser all the rights, title and interest of the seller in the Sitarganj business free of all encumbrances. Requirements for the sale of a going concern. Business Sales Agreement is a contract used to get the ownership of a business from a buyer.

It includes the term of sale. To do so, a transfer agreement gets passed in which license get generated. Then by mutually signing the license agreement , you become the owner of the business.

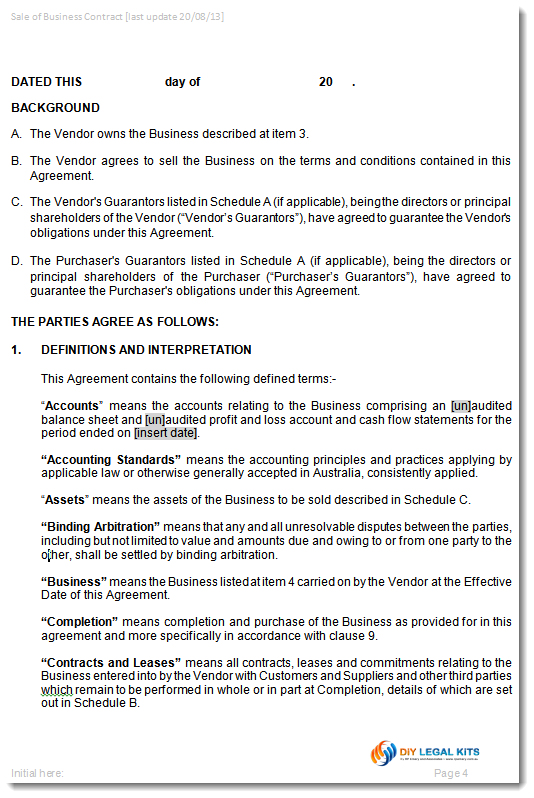

It is a good idea to involve a professional business broker, settlement agent or lawyer in the sale of your business. A contract for sale of a business as a going concern should include all the details, and terms and conditions, negotiated and agreed with the buyer. A Business Sale Agreement , also sometimes called a Business Purchase Agreement , is a document which the seller of a company and their chosen buyer can enter into when an entire business is being sold.