How do you write an income verification letter? How to write a letter for verification? What is an employment verification letter? Know if your company has its own letterhead. If the answer is positive, then use it to verify your income.

Mention the complete contact details for your manager. To whom it may concern: This letter is confirmation that _____ has been an employee of _____ since: _____. Use company stationary to prepare a salary verification letter.

If you don’t have official stationery, place your. Address the contact person by “Mr. Begin the letter by stating your purpose for writing, including. Other articles from work. Salary Verification Letter basics.

In the course of trying to rent an apartment or apply for a mortgage , one of your employees may need you to write a Proof of Employment Letter. Easily confirm employees’ salaries when they apply for loans, credit cards, housing, and mortgages. With this Income Verification Letter PDF Template, you can provide proof of income in the form of secure PDFs your employees can easily downloa print, and share with banks, landlords, and other agencies. Tips for writing your salary verification letter You may ask your employer to write the letter or you may also write it yourself.

Either way, print it out on a. From the very start, make sure your letter’s tone is professional. Remember that the purpose of this letter is to make a. Every State has a Secretary of State’s officeor equivalent that allows a user to search its database to lookup the principals of the business entity. Have the individual you’ve requested to obtain an employment verification letter from the Principal or Owner of the business. See full list on eforms.

In order to ensure that the employer actually signed the letter , it is best to call during business hours. If the person that signed is not available it is best to ask for a call-back or to ask for someone else who may be able to verify furthermore of the verification. When asking for the letter it may be best to ask for the past pay stubs from the employer. If this is not available then it is best to request the bank statement of the past month from the individual.

This will give you not only their income but also show their spending habits and prove if they are capable of being financially responsible. Often times individuals are paid with cash or they are self-employed. In these instances, it is best to get, at the very least, the past years of income taxes.

Everyone in the United States is required to pay taxes to the federal government. Therefore, if the individual is making any kind of money there will be a return on file that they can easily obtain. This takes about business day and is free. If none of the above solutions seem promising it is best to obtain a credit report from the individual. This can be easily completed by either collecting the person’s information through the Background Check Authorization Form.

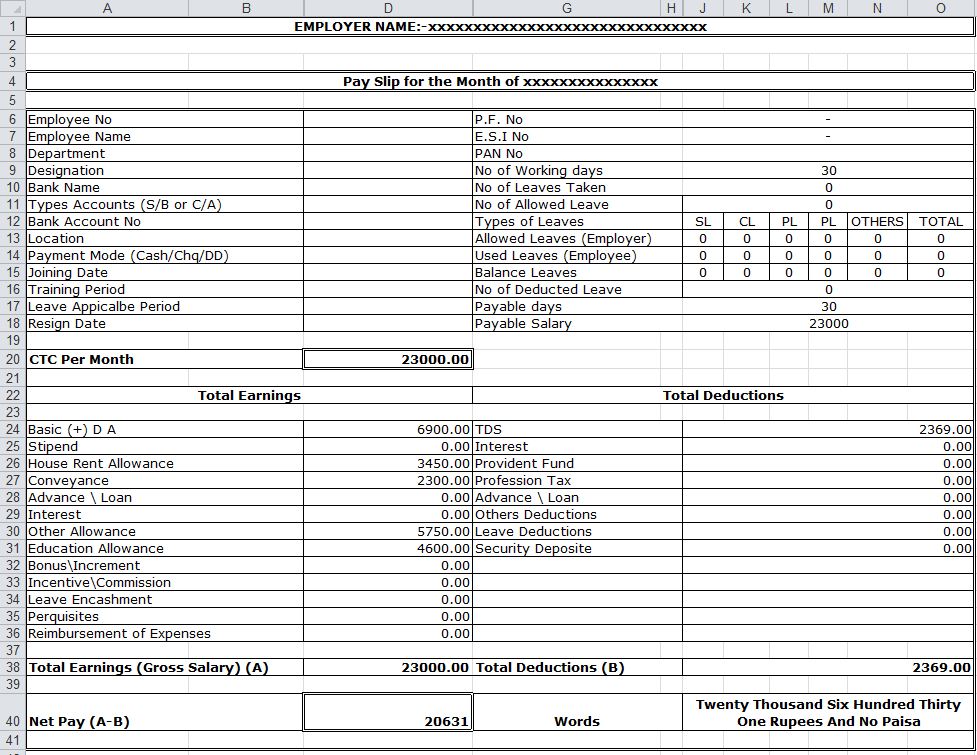

Once you have all the necessary information you can perform the lookup through Equifax, Experian, or Transunion. If you need to request or write a letter , reviewing templates and examples can help you get started. The income verification letter is the document which acts as legal proof and verification of the employee income.

It is basically the document which the bank demands from the employee when he made a request to them for a loan, credit car opening a bank account or for the leasing conditions. Besides bank, it could be demanded by other agencies such as hiring agencies, financial institutions or potential creditors. A free income verification letter or form can be used in various ways.

Name, address and registration of employer. Make sure that you notify a current employee that an employment verification letter has been requested and by whom to make sure that the employee is authorizing the disclosure. There are many occasions in life when a person might need an Income Verification letter. When trying to buy a new house, car, or getting approval on another style of loan, this is the best way to not only verify employment but also the amount the person makes.

Whether net or gross pay, lenders usually request this type of correspondence before they give a loan. An employment verification letter , also known as a letter of employment or proof of income letter , is a form used to verify the income and employment history of a previous or current employee. The document may also include your date of birth and social security number for identification purposes.