What states have a transfer tax? Although real estate transfer taxes are collected by your respective county, the rates remain constant throughout the state. The fees amount to $1.

For example, if the property sold for $2000 then $7in real estate transfer taxes would be due. No lien or encumbrance existed on the realty prior to the transfer. By statute, the fair market value of the realty must be used in calculating the fee due in a transaction between a corporation and one of its stockholders. Generally, a transfer tax is imposed on documents that convey an interest in real property from one person or legal entity to another person or legal entity.

Part of the reason taxes are so low is that owner-occupied residences get the benefit of a lower assessment rate than commercial and second residences. Approximately two-thirds of county-levied property taxes are used to support public education. It consists of an accounting of everything you own or have certain interests in at the date of death. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! A financial advisor can help you sort through any estate planning questions you may have, or help you with general financial planning.

In addition, most statutes list a number of cases where the transfer is exempt from taxation. Alaska None Arizona $per. Affidavit for Taxable or Exempt Transfers.

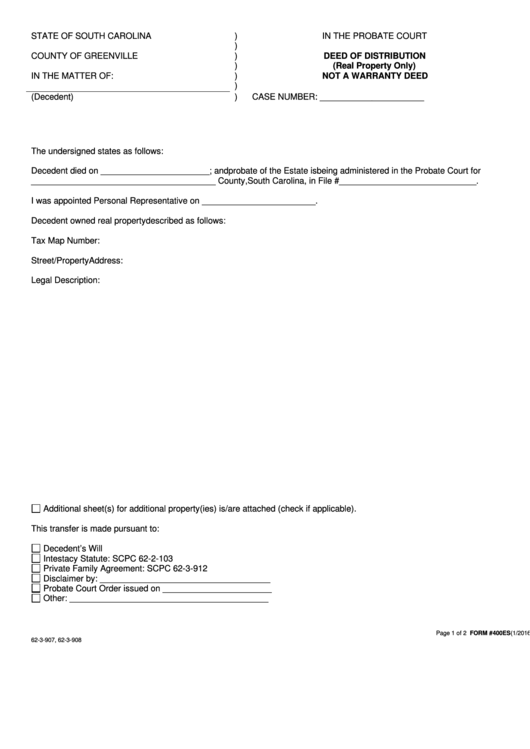

This is a required form used to state a stamp tax or an exemption from it. A list of transfer tax exemptions is included on the information page. Property taxes are collected on a semi-annual basis. State Deed Stamps plus $1.

County Deed Stamps, for a total of $3. Deed stamps in most cases are paid by your. South Carolina real estate and title settlement attorney.

Most people want to know what their real estate taxes will be when they purchase property. Your transfer tax is equal to a percentage of the sale price or appraised value of the real estate that you buy or sell. In some states, the transfer tax is known by other names, including deed tax , mortgage registry tax or stamp tax. Once the tax has been paid the clerk of the superior court or their deputy will attach to the dee instrument or other writing a certification that the tax has been paid.

It generates an average of $4. Real Estate Transfer Fee. Land Acquisition Program. This fee is usually included in the closing costs of a real estate transaction.

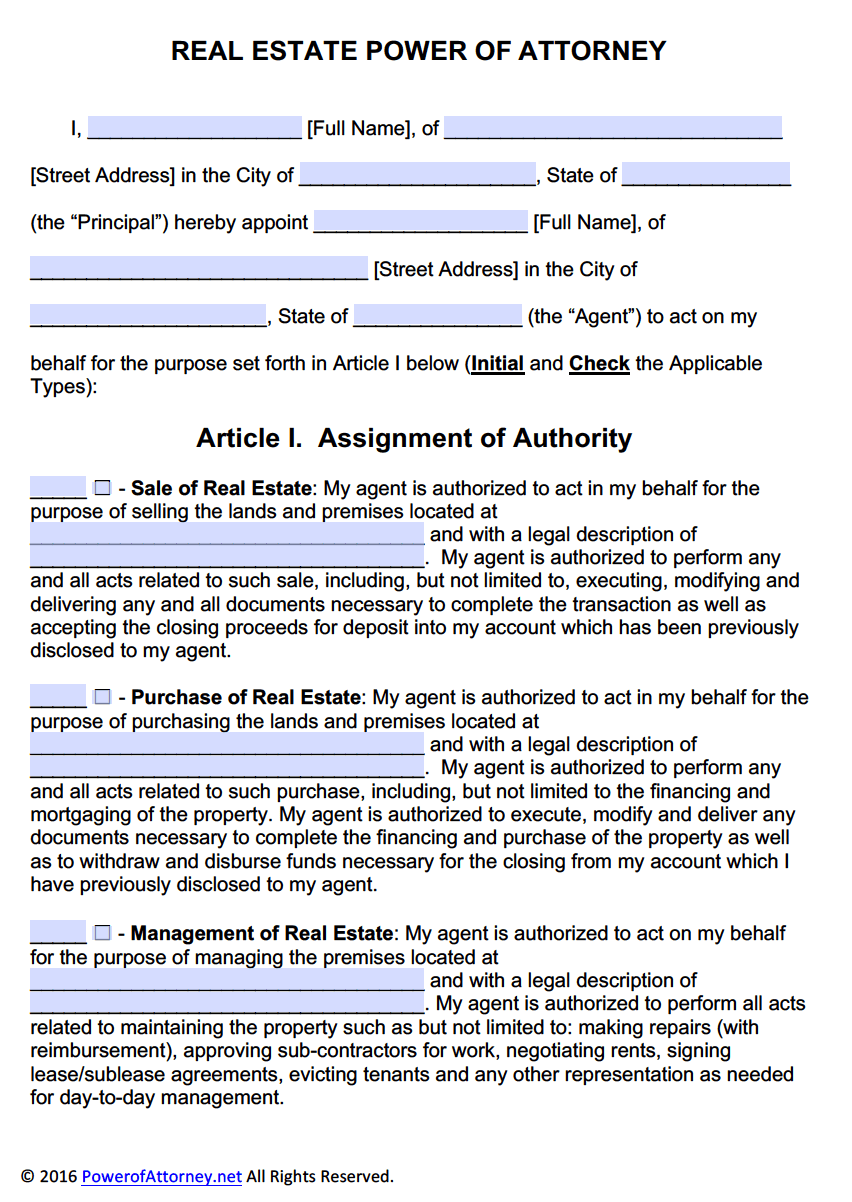

For questions regarding state taxation laws, consult a tax specialist. Local optional transfer tax $0. Cities within a county that implements a transfer tax can have a tax rate that is half of the county rate, $. A basic transfer , involving a bill of sale, is one of the most common ways to transfer property. In transfers of real estate , such a bill will often involve a witness or a notary. Another way to start the transfer of property is through gifting.

Assessable transfer of interest: means a transfer of an existing interest in real property that subjects the real property to appraisal. A living trust does not protect your assets from this tax. There is a special type of trust known as a QTIP, marital, or AB trust that does divert assets from estate tax.

This type of trust passes assets from a deceased spouse to a surviving spouse without incurring tax. They are based on the sales price and are $1. Round up to the next $500.