As mentioned above, the transfer tax is a vali legal charge, tax, applied by government. It’s specific to California state and its cities and counties, covering homes within their respective authority area (i.e. jurisdiction). The actual tax will vary by property because it is calculated on the final sale price of a property.

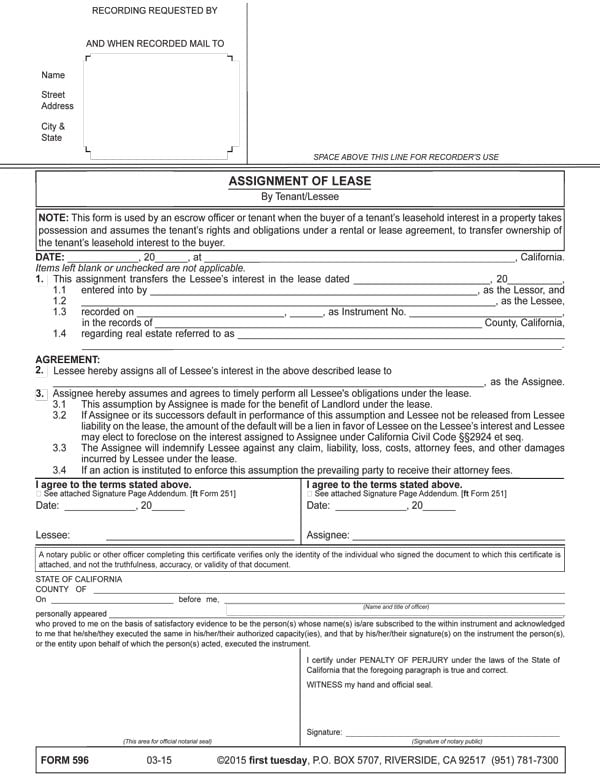

Who pays the tax depends on the sales agreement. It is almost always connected at the time the title documents are filed with the county recorder – no tax payment, no title recording. So in different instances the payer could be the buyer, the seller or both parties. This is why buyers who are not aware could agree to pay the tax buried in closing costs if they don’t look for it and negotiate the responsibility. Now this doesn’t happen all the time.

The general rule in California is that the seller is responsible for the tax payment in most jurisdictions. However, some localities have changed the rules and others have no mandate. See full list on movoto. As mentioned earlier, the actual transfer tax on a property will depend on where it is located and which government level applies its portion of the tax to the property.

So what is paid in one city or county will likely not be the same in another, but it will probably be similar. The math is driven by a percentage value of the selling property’s final sale price paid normally. However, in some cases it can be a flat charge or a scale, i. In this particular case, the County of Sacramento’s transfer tax does not include the City of Sacramento’s tax because that municipality charges a separate tax in addition.

A number of reasons for exemption from the transfer tax are listed out in the state Revenue Code sections. ALAMEDA Chartered $ 12. ALBANY Chartered $ 11. BERKELEY Chartered 1. The California Revenue and Taxation Code states that all the counties in California have to pay the same rate. The current tax rate is $1.

So, if your home sells for $3000 the property transfer tax is $330. Real Estate Transfer Taxes are collected at the time ownership of a property such as a private residence is transferred , usually by sale. How do you calculate transfer tax in California?

The tax is set at a percentage of the sale price. When is a trust subject to taxation in California? All Documentary Transfer Taxes are calculated by rounding up to the nearest $ 5, then multiplying by the tax rate. What states have a transfer tax?

For example, the County Tax for a property sold at $ 124will be rounded up to $ 125and multiplied by 0. If the transfer is not exempt, determining the documentary transfer tax can be tricky due to the interplay between county and state taxes. The California Documentary Transfer Tax Act allows counties to impose taxes at a rate of cents per $5of property value or consideration paid. How to Avoid Probate of Real Estate Get a Customized Deed Now for Only $29.

Our attorney-designed deed creation software makes it easy to create a customize ready-to-file deed in minutes. There are some jurisdictions that dictate who pays the tax but for the most part, there is no mandate and it’s up to the buyer and seller to negotiate who makes the payment. In California, the seller traditionally pays the transfer tax. Prop capped property taxes at one percent of assessed value at time of acquisition, and limited upward reassessments of property values to percent per year so long as the property didn’t.

The documentary transfer tax would therefore be $3if a buyer in Sacramento purchased a home valued at $30000: $1. When real estate changes hands, it normally triggers a reassessment at current. Under California ’s property tax system, the change in ownership of a property is an important event. When a property changes hands the taxes paid for the property typically increase—often substantially. Local government revenues increase in turn.

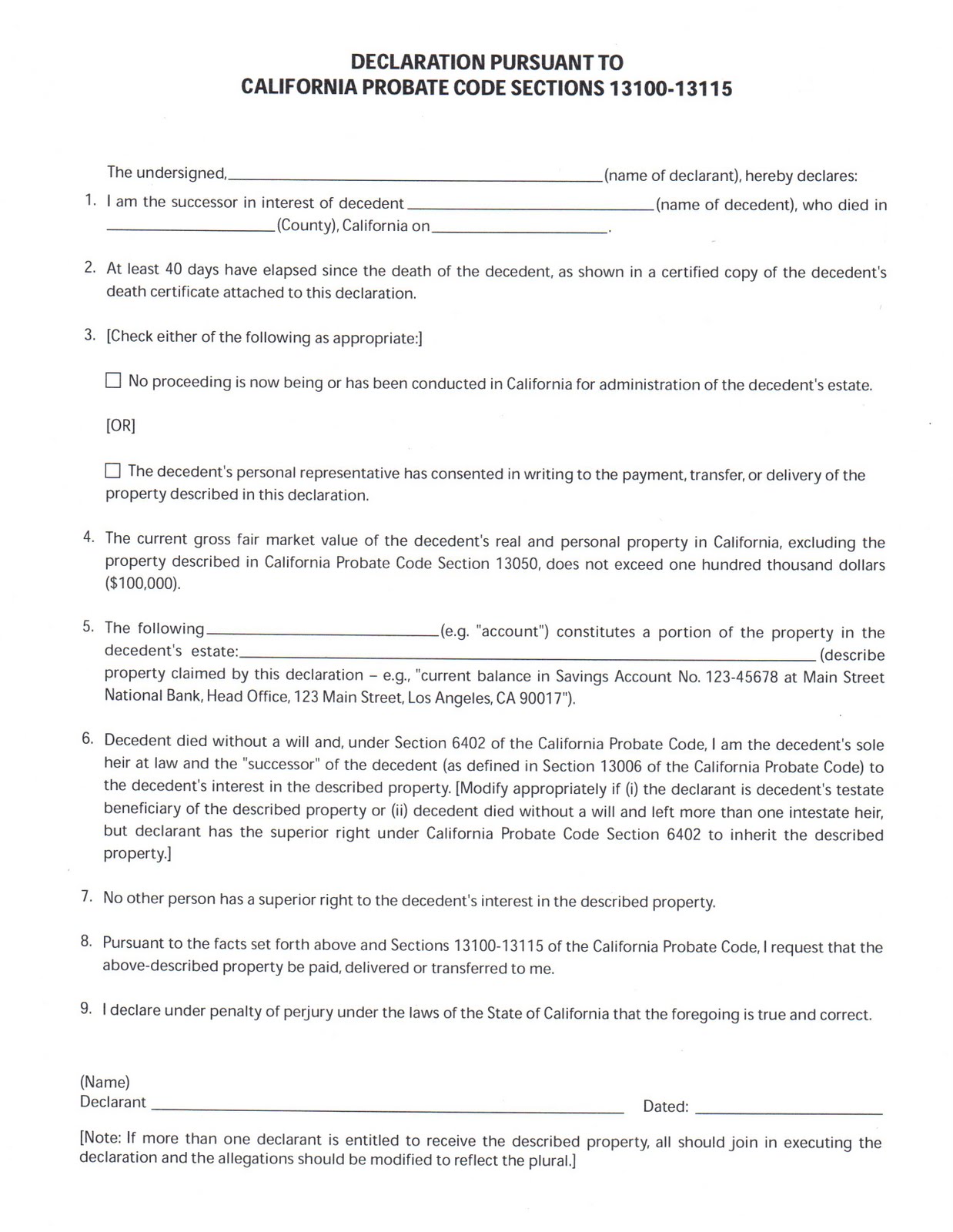

Special Rules for Inherited Properties.