When do you need to get a quitclaim deed? In order to properly submit this request, there must be consideration provided (purchase price), sufficient description of the premises, with the form properly signed (depends on the State’s laws). A Quitclaim Deed is a document stating that a person is giving up their legal interest in a real property , such as land or a house.

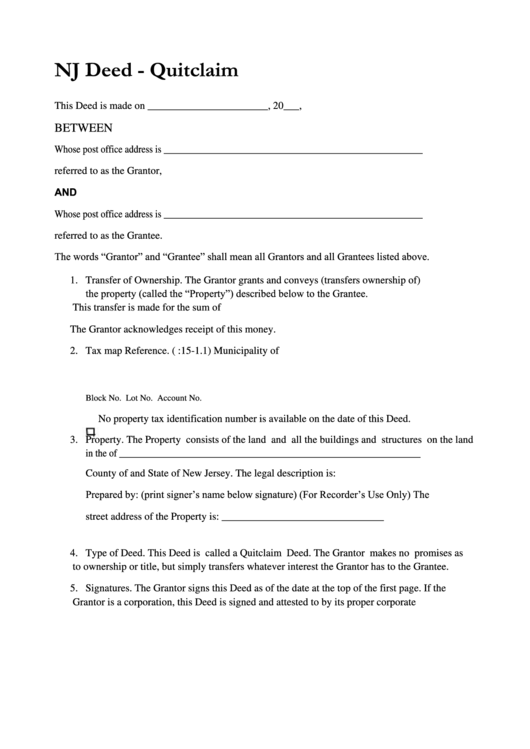

It offers little protection to the person receiving the interest, so it is most often used between family members who have already established trust (such as gifting a house to a close relative). To execute the Quitclaim Deed , the grantor needs to sign the deed in front of a notary public. Some states require witnesses to sign the deed in addition to a notary public. Once it has been signe the Quitclaim Deed is filed in the local County Clerk or Registry Office and sent to the grantee after it has been recorded. This quitclaim deed form begins with deed tax due , followed by the agreement between the grantor and the grantee regarding the transfer of the property.

There is legible space for a sizeable description of the property. Once the quitclaim deed has been prepare execute and accepted by the grantee it should be recorded in the jurisdiction where the property is located. While an unrecorded quitclaim deed can still be vali recording the document provides constructive notice to the world and enters the document into the property’s chain of title enabling. Transfers Between Family Members 1. Quitclaims are often used to transfer property to and from family members.

Adding Or Removing A Spouse From Title 1. Whether resulting from a divorce or a marriage, a property owner can use a quitclaim to add a spouse to or remove a spouse from the title of the property. Owner Name Changes 1. See full list on deeds. Preparing the document 1. You can create the document from scratch 2. A fill in the blank type form can be used 3. An attorney or legal professional can be hired to prepare the document for you 2. Almost every quitclaim document will need to have the grantor sign 2. A few states, Florida for example, require witnesses 4. While each County has specific formatting requirements for the recording of documents there are main elements that are common to all legal deeds. The title of a legal document tells the world what type of document it is.

This is the date that the legal document was complete signe and executed. Quitclaim deeds can have an impact on the continuance of title insurance. Executing a deed can also create issues with your mortgage such as triggering a due on sale clause. Check with your title insurance provider or lender prior to executing a deed to see if there will be any affect on your policy coverage or mortgage. It is common during a divorce for one spouse to quitclaim their interest in a property to the other spouse.

If there is a mortgage on the property it is importan. Unfortunately, there has been an increase in real estate fraud in recent years and many cases involve a quitclaim. Theft by forgery is the most common fraud committed.

If you are purchasing real estate, especially from someone you do not know, and they offer to transfer the property to you using a quitclaim deed you should seek the advice of a legal professional or at the very least consult someone at a title company. If you own real estate and are asked to sign a quitclaim deed , kn. Each state has its own statutory requirements for quitclaim deed forms. These requirements determine the content or text that is in the deed. Quitclaim forms must meet statutory conditions for content and format.

In addition, many local recording authorities add requirements for margins, paper size, property identification, and many other details. If a deed form is not in accordance with both the local and state standards, there may be additional fees charged for recording or. Prior to that, real property was transferred primarily via a process that involved warrants, surveys, and land patents. The quitclaim gained popularity because of the inefficiency of the early land record systems.

Recording – The form may be filed at the County Recorder’s Office where the property is located. Signing – Required to be executed with a Notary Public viewing the grantor (s) signature (s). But you should know that, u nlike general or special warranty deeds , the quitclaim includes no protections for the buyer. For this reason, grantees are urged to take the following precautions before using the forPerform a title search.

Performing a title search allows both parties to confirm the nature of the grantor’s interest. Only execute this the form with someone that can be trusted. Given the risks involve. A quitclaim deed form is used to transfer the ownership of land or a home to another person. However, they must contain the required information about the parties and the property.

It is extensively used while transferring property between members of a family. The quit claim (or quitclaim ) deed is a different form of a warranty deed. It covers no guarantees, warranties or promises to the grantee.

Sellers demanding for quit claim deeds do not want to convey any covenants to the interested party. Quit claim deeds are used when the sellers do not want to guarantee for the liabilities and titles. Some of the things that should be present in a quit claim deed form for validity include: The signature of the grantor, as well as their full legal names, mailing address, and in some states, their marital. Having witnesses is an option, but only in some states The grantee’s name, mailing address,. It is often used to transfer property between family members or other parties who know each other.

A Quitclaim Deed can also be used to relinquish co-owned property in situations such as divorce. DELETE AFTER READING: Before entering data, “SAVE AS” under a separate file name. Quit Claim Deed Form free download. Use the TAB key to move to each field.

Repeated info will auto-populate throughout the form.