Deed Forms are required to be written documents and might also be called the “vehicle of the property interest transfer. If you have a title, it may either be for full interest or partial interest in the property, and the deed transfer might actually be for transferring less than the full title. Remember, the grantor is the party that owns the property and is selling or transferring title to the grantee. Grantors and grantees may be either individuals or business entities.

However, a married couple deeding or receiving title should be counted as only ONE grantor or grantee. For example, if a married couple owns a home and is deeding the home to another married couple, then you would select grantor and grantee. Note that if a grantor wants to remain an owner of the property and simply wishes to add additional owners on the title, then that grantor should be included as a grantee as wel. See full list on legalnature.

You will need to specify whether each grantor and grantee is a married individual, a non-married individual, a trustee, or a business. If a party is receiving the property as a trustee, then the trustee should be named as the grantee, not the trust itself. The deed will state that the trustee is receiving the property on behalf of the trust.

If there are multiple co-trustees, you may list the name of any one of the trustees. If a business is receiving the property , then you will name the business as the grantee and enter the name of the agent who will sign on behalf of the business. The agent should be someone with proper authority to sign binding contracts on the behalf of the business, such as an owner, executive, or manager. This option should be selected if the first grantor th. You should select Sole owner only if no other person will share ownership with the grantee after the deed is signed.

Select Co-owner if more than one person or business will share ownership of the property with the grantee after the deed is signed. This would be the case, for example, if the grantor is a tenant in common and is transferring his or her interest to the grantee. The other tenants in common would not necessarily join in the deed as grantors, since only the grantor is changing his or her interest. Here you should indicate what type of joint property interest the grantees are receiving.

Depending on your state, you can choose between a tenancy in common, a joint tenancy, a tenancy by the entirety or community property interest, and a partnership. A tenancy in common is a joint property interest in which each tenant ( property owner) owns an undivided share in the whole property. Each tenant may transfer his or her interest without the need for the other tenants to join in the deed.

When a tenant dies, his or her share passes according to their willor under state intestacy law when no will exists. Multiple businesses sharing ownership often choose to own as tenants in common due to the simplicity and flexibility of these ownership interests. A joint tenancy is the same but with a few important differences.

First, each tenant owns an equal interest. Also, a joint tenant may not sell or transfer his or her interest without the consent of the other tenants. This means that all joint tenants must sign as grantors when transferring or changing ownership and must sign together as grantees when receiving ownership.

Lastly, each tenant has the right of survivorship, so when a joint tenant dies, his or her interest automatically passes to the other joint tenants in equal shares. Tenancy by the entirety and community property interests are basically identical in nature and only differ in name. They are both similar to a joint tenancy but are for married couples. The same rules apply, including right of survivorship.

If California businesses are sharing ownership, then they can consider choosing a partnership interest, which is similar to a tenancy in common but may offer certain advantages under state law. Record your deed with your local land title office, usually known as the County Recorder’s Office or County Clerk’s Office. Each county has its own unique filing requirements.

Be sure not to write in the margins of the pages of your dee as your office may need to write in these. Most counties want at least a three-inch margin at the top of the first page for official use. Do not staple the pages of your deed together. All signatures on the document must be originals—not copie printe or stamped. If the seller is conveying any part of the marital homestea both spouses must sign where indicated.

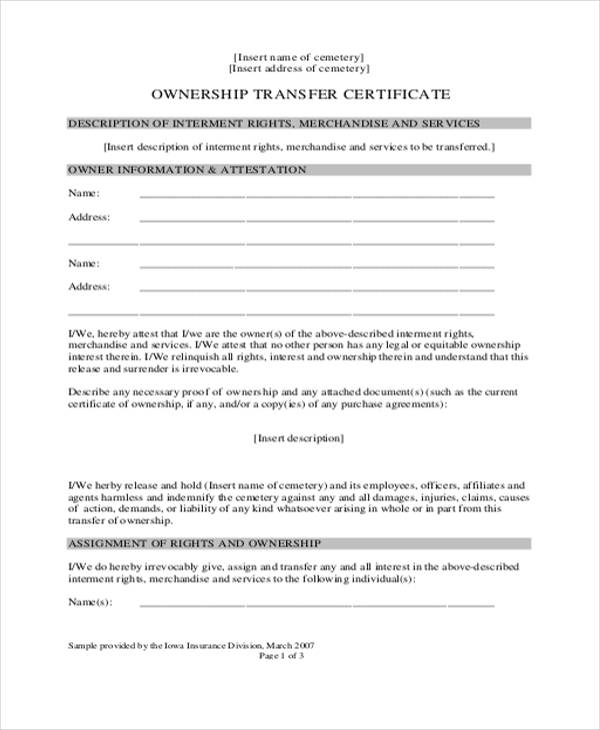

Normally, only the grantor needs to sign a property deed. However, a few counties also require the grantee to sign the dee especially in Kentucky. A deed is a legal document that formally allows the transfer of ownership of property from one person to another. The owner of the property is referred to as the grantor, while the receiver of the property is referred to as the grantee. Before a person could transfer his property to another person, he must first fill out certain Deed Forms.

He then has to affix his signature in it and have it notarized to make it official. Quit Claim – Mainly for situations when the owner of real estate transfers due to business, divorce, litigation, or between family. Typically, there is not a financial transfer from the party receiving title to the party that is granting it.

Tenants by the Entirety 3. There is no guarantee given. Signing Requirements 4. By more than one (1) individual or entity, there are three (3) types of ownership interest in property:Joint Tenants (Rights of Survivorship) – If one (1) of the Spouses were to die then the other Spouse would obtain their ownership interest in the Property. Tenants in Common – Spouses are allowed to sell their ownership interest without the approval of the other and if one (1) of the Spouses were to die the ownership of the property would transfer to the Heirs listed in their Last Will and Te.

In each of the following States , the Grantor (s) only, will have to sign the Deed with the following requirements. After the deed has been completed and signed it is ready to be filed with the Recorder’s Office (in some States it is with the Clerk of Court). Below you can find which office to file the deed in your State. Step – The writer of the Deed will want to verify with the County Registry to ensure that the Grantor (Seller) is, in fact, the owner of the Property. When viewing the deed it should detail how the said deed was transferred to the Grantor.

It will usually read one of three (3) options: General Warranty, Quit-Claim, or Special Warranty. Barring any setbacks by the Title Insurance Company, it will be the same deed type. Step – Input the information of the Buyer and Seller or Grantee and Gran. Deed forms are the essential legal document used to transfer real property.

Just as professions each have their own language, so do business transactions. Real estate is just another word for property, and it has its own language as well. The real estate deed form you use must meet statutory conditions for content and format.

In addition, many counties add requirements for margins, paper size, property identification, and many other details. How do you transfer a deed to property? What type of deed is used to transfer property?

What do you need to know about deeds and property transfer? Can I get a deed transfer notarized in? The California deeds are forms that allow for the transfer of real property from a seller , or the “ grantor” , to a buyer , or the “ grantee”.

The documents vary due to the different scenarios that surround the conveyance. Grant deeds are used when the seller warrants that he or she owns the property and that no others have a claim to it. A filing fee is also required. Instruments that are transferring an interest in real property to or from an individual must include a confidentiality notice , as required by Texas Statutes Sec.

A property deed is used to transfer property , such as a home or lan from the old owner to the new owner. The parties, the buyer and the seller, are identified by special terms. The buyer is referred to as the grantee. A new deed is required whenever you add or remove a personapos;s name from your property title, gift your property , or place your property in a living trust.

Preparing and filing a deed can be difficult. LegalZoom makes it easy to prepare a deed to legally change the title to your property. A transfer-on-death deed form (also called a TOD deed form) is a deed that serves as a substitute for a will. Like a will, a transfer-on-death deed allows property owners to designate one or more people or organizations to inherit property on the property owner’s death. To begin the transfer of real estate, the seller should find a blank deed form and get the legal description of property.

Some states require you to record the deed in the land records office instea so make sure you know where to file. TRANSFER OF REAL PROPERTY : Documents evidencing a transfer of title of real property must be accompanied by an Affidavit of Property Value, as set forth in A. All documents submitted without an affidavit or with any incomplete or missing information as required by the statute will be rejected and returned to the submitter. This form must be filed whenever real estate or some types of personal property are transferred (even if you are not recording a deed ). The completed Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within days of the transfer.

The information on this form is NOT CONFIDENTIAL.