Get The Maximum Buyout. Sell With Confidence. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! What is the amount on the promissory note called? What makes a promissory note legal?

Does a promissory note have to be notarized and? How to collect a promissory note with no due date? See full list on how. The promissory note can be prepared by a bank or lender or any loan officer.

It is better to write a promissory note by yourself and this is also a legal and binding contract. Typically, promissory notes are drafted when providing services, lending monies, selling goods, or during other transactions when extending credit. A promissory note is a written promise to pay a specific amount on a predetermined date or upon demand. A client who is unable to pay for the goods, service, loan, etc.

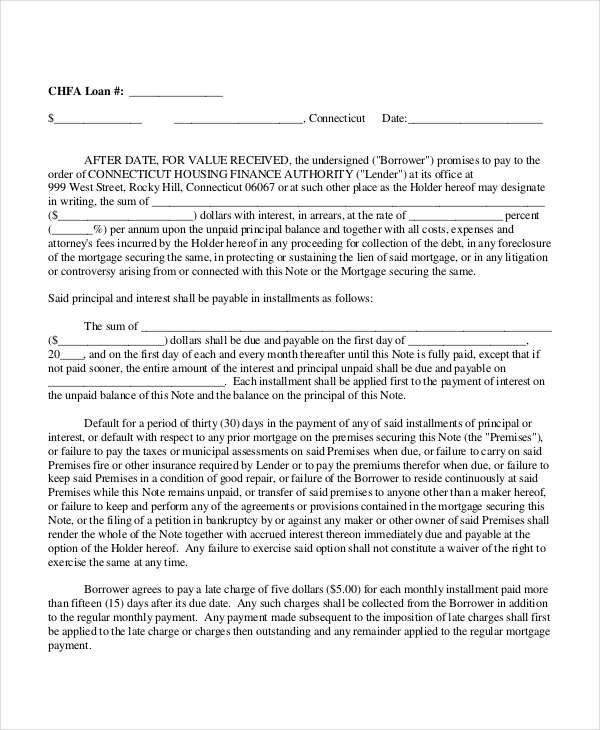

This agreement contains a payer, who is actually the maker of the promissory note, and the payee, who is the lender. The document holds the borrower accountable for paying back the money (plus interest , if any). There are types of promissory notes, secured and unsecured. The mortgage secures the promissory note with the title to the house and it is also recorded in the public records.

The payer is the person who promises to repay the loan, while the payee is the person who is entitled to receive the loan payment. All Major Categories Covered. As such, a default on your promissory note could result in serious tax issues.

Promissory notes are generally unrecorded. They will likely add in other costs and fees, such as attorneys and collection costs. An individual may sign a promissory note when she wants to make a purchase but does not have the cash to pay for the item. Consumers also sign promissory notes when they need to borrow money.

These loans must be repaid by the estate, unless the deceased person made arrangements to forgive the debt at death. A vehicle promissory note is a legally binding document that functions as a written promise to pay someone for a car loan. Medical debt is one kind of written contract. Home loans and student loans are two examples of promissory notes. You bought a boat for personal use for $200 paying $0down and signing a recourse note for $1000.

After paying down $0on the note , you are no longer able to make payments. The boat dealer repossesses the boat, which is now worth $1000. Higher payments would allow higher amounts of debt to be satisfie up to $50to eliminate a $million debt.

A judge would have to decide what the intent of the parties was at the time of the signing of the promissory note. It documents the amount loaned and how it will be repaid. It is often a personal loan between friends or family members, but it can be between businesses as well. This type of Note is a bit more formalized than an IOU or handshake agreement, but easier to obtain than a bank loan.

An unsecured promissory note is a financial instrument which showcases some written promise to repay a given amount of money in the future or on-demand. It contains all the tiny details of the loan like how the borrower intends to repay the debt and the associated timeline. It is written or prepared by legal attorney, bank or lending institutions.

While the legal promissory note or promissory letter protects the lender by securing payment from the borrower either through collateral or legal recourse, once the promissory note terms have been met and the note pai it is equally important for the borrower to secure a release of the promissory note.