They’re important for holding the borrower accountable for paying back a loan from a private investor or bank. They are also useful for keeping documented records of the loan for all parties involved and for tax purposes. The first step is to write the terms and conditions of the lender.

Promissory Note ( Loan Agreement ) – EXPLAINED -. After you have written the terms and conditions, it is time to decide the. For official documents, please consult to your attorney as well. Mention the payer or debtor, to whom the money is given. These word templates are useful when parties involving in a loan transaction don’t know how to document it for later use or reference.

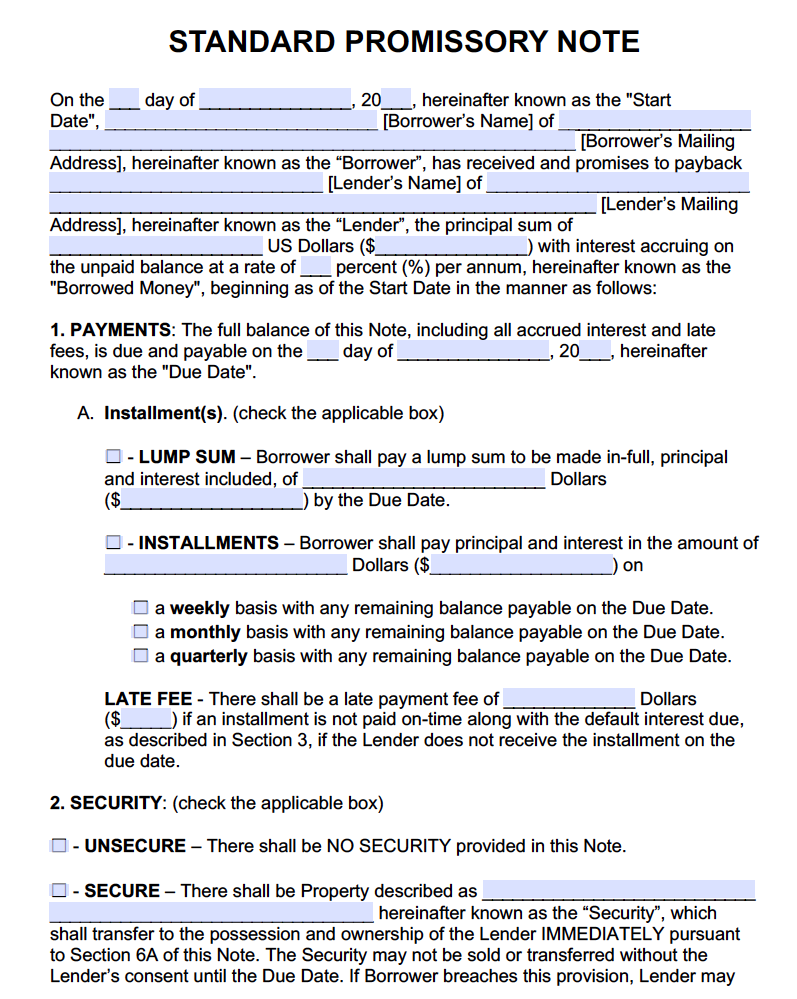

For a more detailed loan, an in-depth Loan Agreement can be used. The document is created before your eyes as you respond to the questions. Types Blank Template. A basic promissory note which allows for the amount owe period of loan, and interest rate ( ). A sample template to show an individual how to structure the agreement.

Allows the creditor to obtain an asset from the borrower if the note is not paid on time. This is a written document that officially recognizes a legally binding relationship between two parties — a lender and a borrower. True to its name, it serves as a written and enforceable promise to pay a certain amount of money owed.

Both parties understand that money is being borrowed and will be repaid at a future date. Secured – The borrower has agreed to surrender their property as col. See full list on legaltemplates.

There are generally four types of promissory notes, or repayment options. Choose the template that makes the most sense for your situation. You can download a blank promissory note below for free or create one using our state-of-the-art legal template builder. Installment Payments – Installment payments are frequently used to buy expensive items like cars, boats, and appliances.

The consequences of not having a valid promissory note may be severe. The following is a chart of the suffering that this document can help prevent:Preventable Suffering: Lenders vs. A simple note in writing should answer six basic questions:1. The note should name who is receiving money or a line of credit (the “borrower”) and who will be repaid (the “lender” ). Only the borrower must sign the note, but it is good practice to also have the lender’s signature.

Always consult your local and state laws to verify signature and witness requirements. How much needs to be paid back? A promissory note is an agreement to borrow money from someone else stating specific time-periods for being paid-back along with an interest rate, late payment penalties, and any other terms the parties agree upon. Release Form – After a note has been paid in full, the lender will usually issue a release (or can be requested by the borrower). All Major Categories Covered.

Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! Create and download your promissory note in minutes. A promissory note template is a legal document containing a written promise to pay a specific amount of money to a certain individual at a particular date as well as agreed terms and conditions.

These conditions must be addressed in the promissory note and thereafter signed by the parties involved. What does a promissory note contain? It is secured in that it is backed by collateral which may be sold or confiscated in the event of a default.

A secured promissory note is a legally-binding agreement between a lender (Promisee) and a borrower (Promisor). The note is a written statement by the borrower to promise to pay back the funds within a specific time-frame and interest rate.