What is the amount on the promissory note called? What makes a promissory note legal? What should promissory note include?

A promissory note is a written promise to pay an amount of money by a specified date (or perhaps on demand ). The maker of the promissory note agrees to pay the principal amount and interest. Promissory notes usually refer to the borrower as the maker of the note. The borrower generally is said to have made the written agreement because he or she is initiating the transaction. The lender is referred to as the payee because it is the party that first pays the money to the borrower and then receives the payments at a future date. I know this is confusing.

Just remember the maker is the borrower and the payee is the lender. See full list on myaccountingcourse. Ken’s Pizzeria is having problems with its oven and needs to purchase a new one. Unfortunately, it doesn’t have enough money to purchase one outright, so it approaches a bank. Ken, the maker of the note, asks the bank for $20to purchase its new oven.

The bank, the payee, reviews Ken’s financial statements and agrees on a 5-year note that pays percent interest. The official loan agreement is put in writing including the issue date, original principle amount, repayment date, rate of inte. The promissory note should include all terms that relate to the indebtednessDebt CapacityDebt capacity refers to the total amount of debt a business can incur and repay according to the terms of the debt agreement.

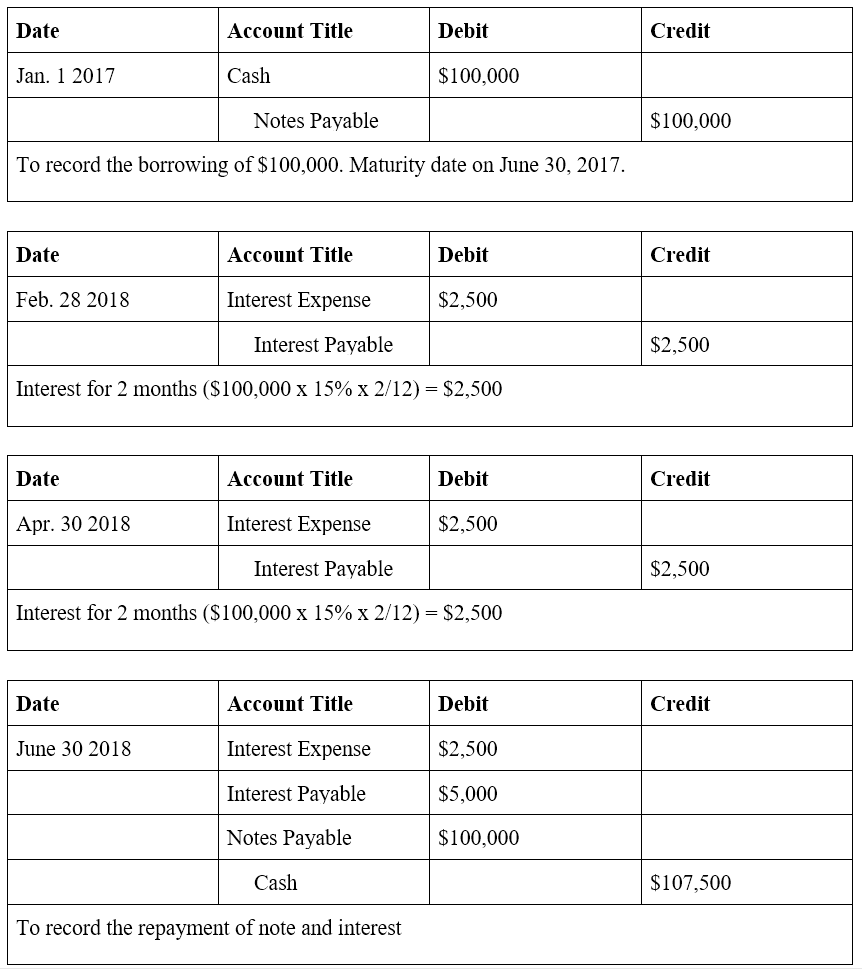

The date may be a fixed date sometime in the future, or on demand. Notes Payable are written agreements (promissory notes) in which one party agrees to pay the other party a certain amount of cash. Alternatively put, a note payable is a loan between two parties. When the company first takes on the debt, it’s recorded in the books in much the same way as a short-term debt: This example shows how to record receipt of cash from an American Bank promissory note.

Payments are also recorded in a manner similar to short-term debt: This example shows how to record payment on an American Bank promissory note. You record the initial long-term debt and make payments the same way in QuickBooks as you do for short-term debt. While how you enter the initial information isn’t very different, a big difference exists between how short- and long-term debt are shown on the financial statements. All short-term debt is shown in the Current Liability section of the balance sheet.

Long-term debt is split and shown in different line items. The portion of the debt due in the next months is shown in the Current Liabilities section, which is usually a line item named something like “Current Portion of Long-Term Debt. The remaining balance of the long-term debt du.

Sometimes a long-term liability is set up at the same time as you make a major purchase. You may pay some portion of the amount due in cash as a down payment and the remainder as a note. To show you how to record such a transaction, assume that a business has purchased a truck for $200 made a down payment of $00 and took a note at an interest rate of percent for $2000.

Here’s how you record this purchase in the books: This example shows how to record payment for the purchase of the blue truck. You then record payments on the note in the same way as any other loan payment: This example shows how to record payment on note for blue truck. When recording the payment on a long-term debt for which you have a set installment payment, you may not get a breakdown of interest and principal with every payment. For example, many times when you take out a car loan, you get a coupon book with just the total payment due each month.

Each payment includes both principal and interest, but. Why is this lack of separation a problem for recording payments? At the beginning of the loan, the principal is at its highest amount, so the amount of interest due is much higher than later in the loan payoff process when the balance is lower. Many times in the first year of notes payable on high-price items, such as a mortgage on a building, you’re paying more interest than principal. In order to record long-term debt for which you don’t receive a breakdown each month, you need to ask the bank that gave you the loan for an amortization schedule.

An amortization schedulelists the total payment, the amount of each payment that goes toward interest, the amount that goes toward principal, and the remaining balance to be paid on the note. Some banks provide an amortization schedule automatically when you sign all the paperwork for the note. If your bank can’t give you one, you can easily get one online using an am. These documents contain the terms of the agreement, including the lender, the borrower, how much is being borrowe and the frequency and amount of payments.

The note payable is a written promissory note in which the maker of the note makes an unconditional promise to pay a certain amount of money after a certain predetermined period of time or on demand. The purpose of issuing a note payable is to obtain loan form a lender (i.e., banks or other financial institution) or buy something on credit. Under this agreement, a borrower obtains a specific amount of money from a lender and promises to pay it back with interest over a predetermined time period. If a customer signs a promissory note in exchange for merchandise, the entry is recorded by debiting notes receivable and crediting sales. It can be monthly, yearly, or some other term specified in the note.

Most installment loans are types of promissory notes. Example 3: Note is classified as a compound instrument. Entity C issues 0convertible notes for $0each (total proceeds of $00000), paying an annual coupon of p. Each note is convertible into 0ordinary shares anytime between issue date and closing date (which is three years after issue date).

The face of the note payable or promissory note should show the following information. Accounting for Convertibles refers to the accounting of the debt instrument that entitles or provide rights to the holder to convert its holding into a specified number of issuing company’s shares where the difference between the fair value of total securities along with other consideration that is transferred and the fair value of the securities issued is recognized an expense in the statement of income.