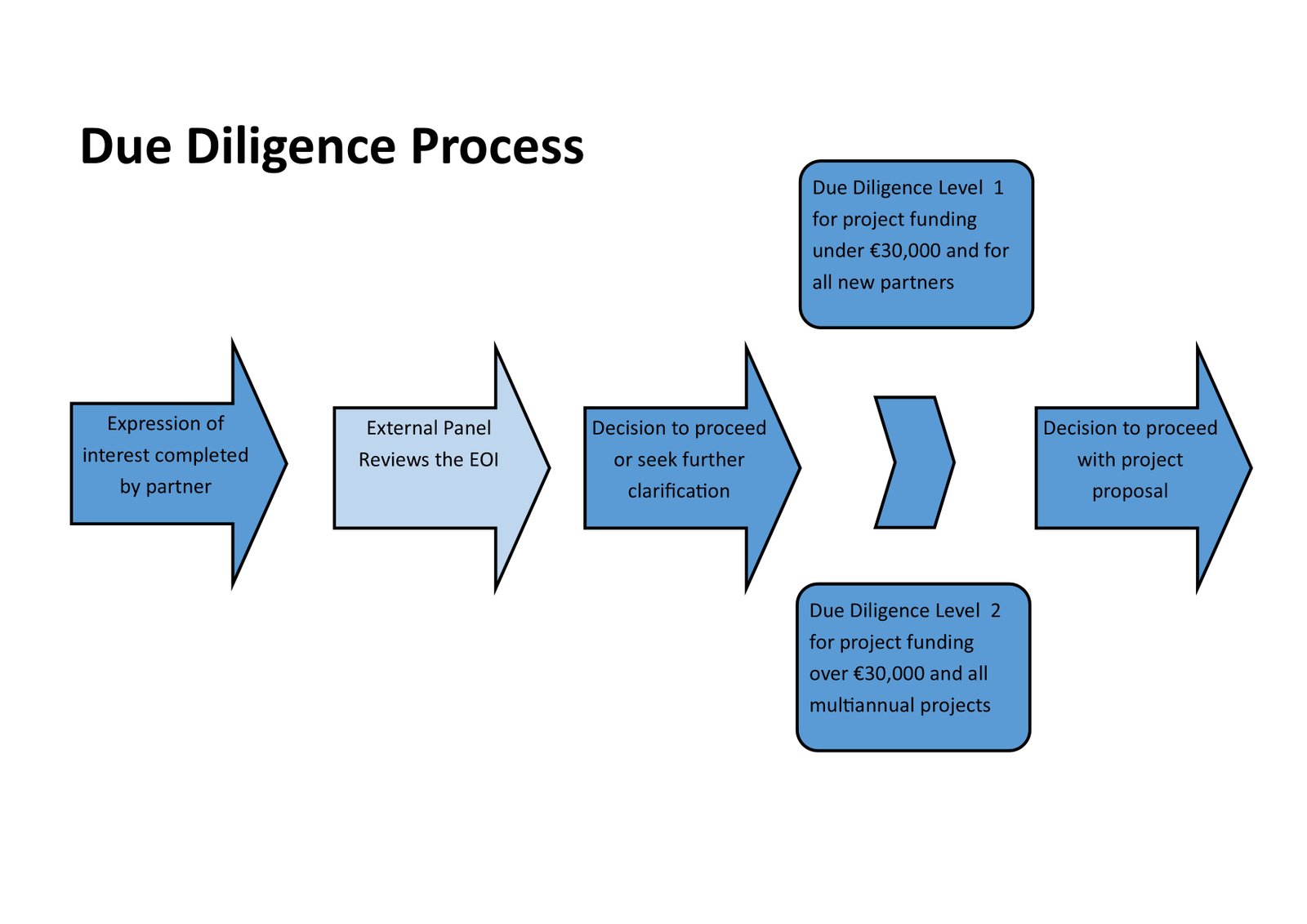

What should I review in due diligence? What do you need to know about due diligence? What are the best due diligence questions? Financing Transactions (Public and Private ): An underwriter performs due diligence to manage risk exposure. Due diligence is the first step in determining if your project is feasible, and assuring the stages of your project occur in the proper sequence.

The information includes, but is not limited to, city, county, state and federal contacts that may have programs or services to assist you. As each project is different, so are the requirements. Environment: study of external and internal factors which affect the project in different respects, along with risks and. Site assessment: geodesic,. A due diligence checklist helps ensure that the final decision is based on a thorough investigation of all aspects of the business.

Project Documentation (a) Have the following documents been provided? Due Diligence Checklist – Acquisition of Power Station 1. DealRoom created a mergers and acquisitions due diligence checklist that enables to track the diligence progress and secure important documents. Due diligence in project finance is a process that consists of multiple steps to ensure the most comprehensive analysis: 1. Assessment of promoter history and background 2. Evaluation of the company and project business model 3. Legal due diligence 4. This guide will teach you to perform financial statement analysis of the income statement, balance sheet, and cash flow statement in. See full list on corporatefinanceinstitute.

While there are multiple steps when conducting due diligence in project finance, there are four key processes that require significant evaluation. Thank you for reading CFI’s guide to due diligence in project finance. To learn more, see the following resources: 1. Projecting Balance Sheet Line ItemsProjecting Balance Sheet Line ItemsProjecting balance sheet line items involves analyzing working capital, PPE, debt share capital and net income.

Research and evaluation of environmental conditions such as project risks. Examination of project goals, documents and assumptions, including the project plan. Checking whether project expenditures are adequate to the project plan and expected outcomes.

Letter of Intent (a) Confirmation of Parties (b) Adequate description of essential terms (c) Access Agreement (Binding) (d) Insurance (e) Confidentiality 2. Purchase and Sale Agreement (a) Confirmation of Parties (b) Description of Property (c) Inspection Period (d) Extensions (e) Closing Date 3. Indicate if an item is a red flag, needs further review, or not applicable to the due. SHARE Request to reuse this Add to my. The success and profitability of most development sites is established before the site has even been purchased during the due diligence stage. It is here that all the risks, opportunities and options must be considered and it is critical for all developers to complete this stage of the process with care and patience. A Project Manager (PM), typically an engineer, is assigned to each due diligence study.

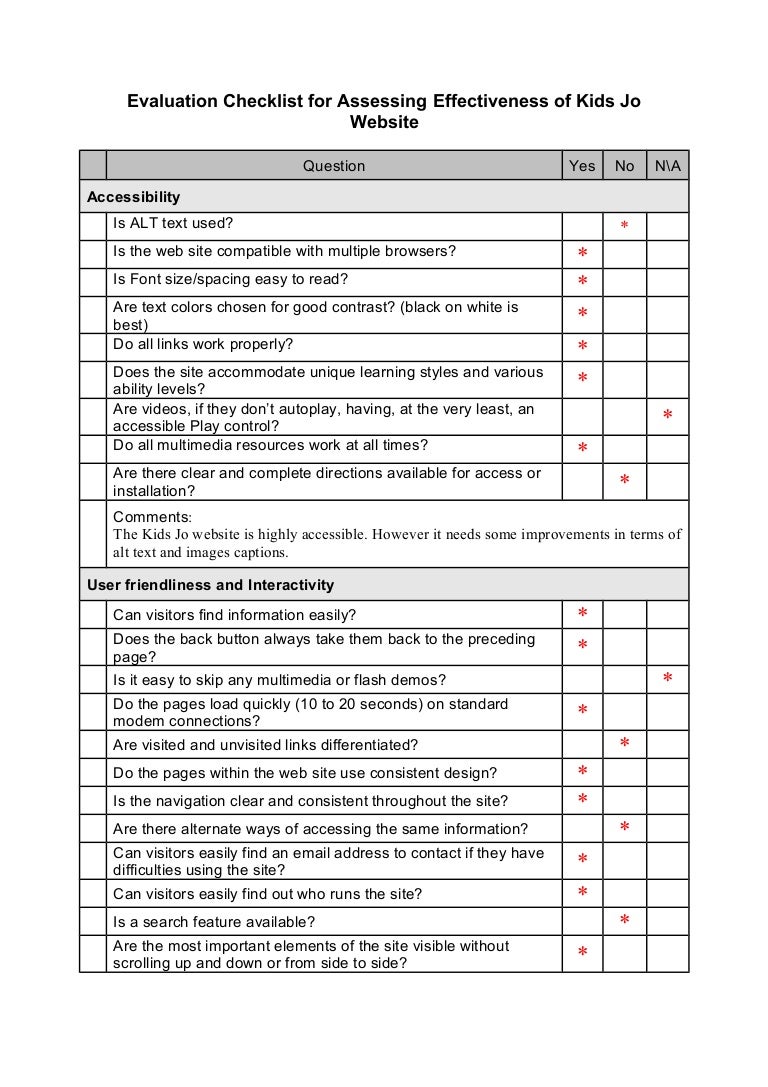

A proper due diligence goes beyond searching and finding flaws. A scope checklist is a great way to make sure things don’t fall through the cracks. A checklist helps keep a team on the same page and clarifies individual roles and tasks. Checklists bring focus and minimize sidetracking down unnecessary paths.

Social and economic desktop study. Cumulative impact report. Statement of community involvement. Visual impact assessment. Sustainability statement.

Contact insurance to arrange for coverage 18. Current market reports and vacancy data B. PROPERTY OPERATIONS 1.