How to prepare a prenup agreement? Are there any restrictions on prenuptial agreements? What to put in prenup? You’ll need your customers to make a comprehensive rundown of their benefits and.

Conjugal property depicts the possessions and obligations that couples will aggregate together. Administration of Assets. Prenuptial Agreement Checklist. Ask well in advance – at least six months, and the more in advance the better. Premarital Cohabitation: a. Was there any period of cohabitation before marriage?

This canbe any type of property, such as your savings and brokerage accounts, pensionsand retirement funds earned up through the date of the wedding, a car, jewelry,a home, or employee stock options. Generallyspeaking, separate property belongs to the spouse that acquired it. It’s also good practice to beup front and straightforward in your discussions about financial issues withyour soon-to-be spouse. How will you handle premarital asse. See full list on divorcenet.

Will you use another arrangement? Below are somequestions to think about regarding marital property: 1. People tend to be either spenders or savers. Given thatopposites attract, it’s typical for a couple to have verydifferent money styles. That can work out just fine, provided that you eachknow about the other’s priorities and goals and provided you can work out a wayfor each person’s needs to be met. For example, one partner might be concernedabout retirement savings and future security.

Can these styles be reconciled? The answer isyes, of course, provided that you have a plan for what will be set aside forretirement and what’s available to use for enjoyment. Some questions to askyourself regarding the management of assets and income are: 1. Who will make the financial decisions and handlethe checkbook? Will you do it together, or will one person be the primaryfinancial manager? Does your spouseneed to ask you before.

Have you seen each other’s credit reports? Now might be agood time to have a serious talk about credit scores and priorities withrespect to paying off old debt or accumulating new debt. Consider some of thefollowing questions: 1. Is it likely that either of you mightover-borrow? Or refuse to borrow no matter how much sense it makes to the otherperson? Does either of you have bad credit?

Will you andyour spouse jointly sign on new credit obligations? Jointly, individually, and from which checkbook? If so, how will they bepaid? Most states recognize these typesof contributions during a marriage, but it’s important that you share yourattitude, and that you know your fiancé’s attitude about these types of rolesin a marriage. Below you will find some questions to think about in regards towork: 1. Do either of you anticipate a career change atany point in time?

Other jobs pay less but are very personallyrewarding. Teachers and non-profit positions typically don’t pay very well. Howwould you feel if your spouse changed careers for a lower-paying but rewardingposition? When do you plan to retire?

As early aspossible, or do you plan to work as long as you’re able 5. Do you anticipate both of you continuing to workafter having children? Or would one of you stay home? How do you feel about alimony, also called spousal support? You don’t have to address this in your agreement if you don’twant to, but it makes sense to talk about it. Some issues you may want totalk about are the following: 1. Will there be any limitations on the amount,terms, and duration of support in the event of a divorce?

Do you want to make agreements about spousalsupport or alimony that are different than what your state law allows? Do you both expect to work and contribute to thehousehold? This discussion may be difficult to have while you and yourpartner are trying to plan a romantic wedding celebration,but if you want to enter into a prenuptial, a conversation that covers theseand other topics is essential. You cannot have one attorney representyou both. An attorney can explain how specific terms in a prenup will affectyour rights, and can negotiate for changes to the agreement on your behalf.

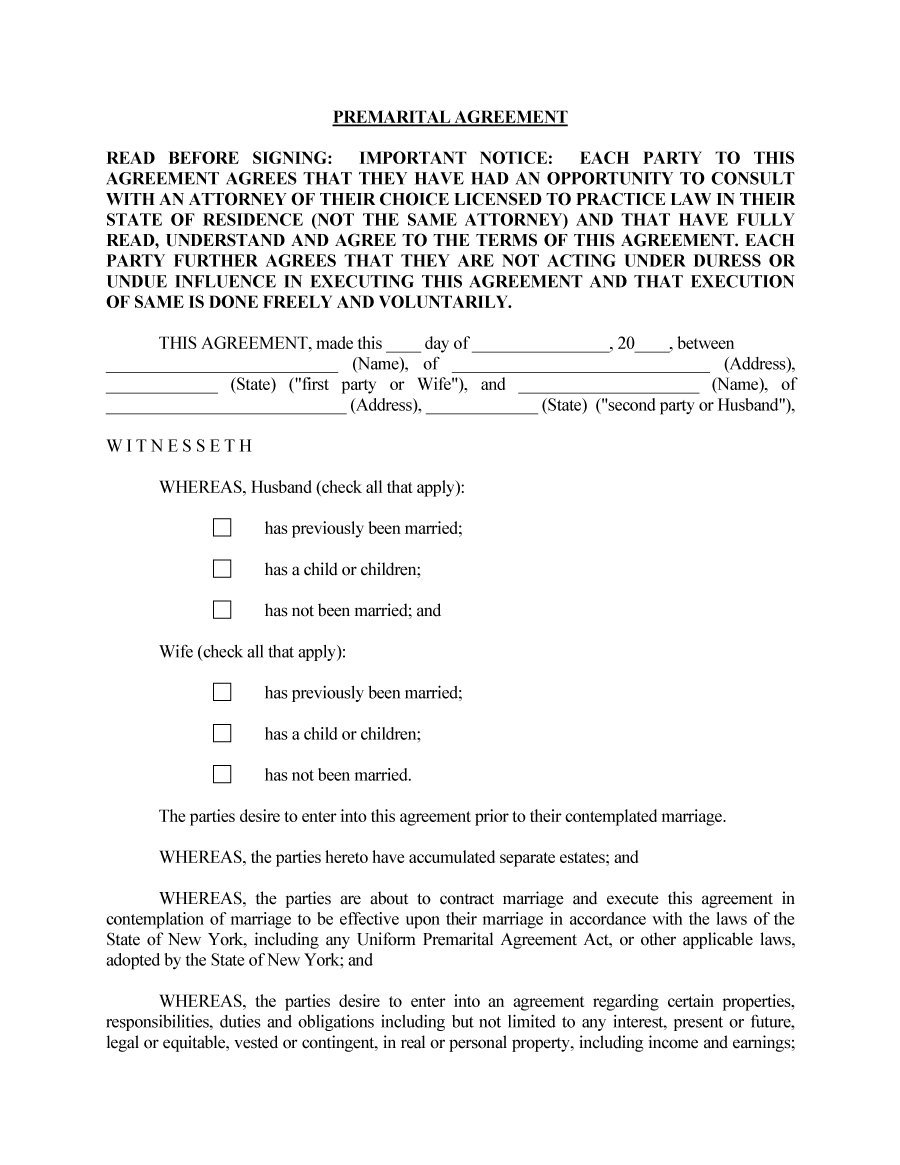

If you have questions about a prenuptial agreement, youshould contact an experienced family law attorney in your area for help. Here’s a list of issues to think about before you speak to your fiancé and your lawyer regarding a premarital agreement. Below, see a prenuptial agreement sample for New York that Schpoont provided for us.

Following is a summary of issues and questions related to the drafting of a prenuptial agreement. This is only a summary of the main issues involved in such an agreement. Property: The Agreement describes all of the property currently owned by the Parties and allows them to dictate how. Debts: This Agreement allows the Parties to describe any debts that they are bringing to the marriage.

Separate property owned at the time of your marriage. Nearly everyone wants to be sure they can keep property they already owned in their own name when they married. On what date do you propose to be married? How many living children does your prospective spouse presently have?

Name Age Financially Independent? To make sure your new spouse can take advantage of all the benefits available to them, make sure you go through each item on this handy checklist. A declares that he has been represented by __________________________and that he fully understands his legal rights.

If either Party contests the validity of this. For example, in the absence of a prenup stating otherwise, a spouse usually has the right to: share ownership of property acquired during marriage, with the expectation that the property will be divided between the. That way, if the marriage fails — as roughly one.

This can be especially important when parties enter the marriage with separate property.