Create a Custom Sign In. Can a de facto couple make a financial agreement? Can I file for a property settlement after a de facto partner?

Our combined defacto prenup agreement kit deals with all the usual issues your clients you may face when dividing financial resources, such as ownership of real estate, personal property (cars, furniture, etc), superannuation entitlements, shares, debt, spousal maintenance etc. De facto relationships and marriages are not lifelong commitments anymore so you still have to survive and thrive after a break up. If you’re coming into a relationship at a mature age, it also can financially effect your children so you need to think about protecting everyone involve” Wood said.

Greg and Yana are a professional couple, each of them recovering from a previous marriage split. Although they both feel their new relationship will be strong and withstand the test of time, they are nervous about combining all of their finances before they have been together for a longer period. See full list on financialagreements.

Greg and Yana can enter into the next phase of their life together and still take care of the financial arrangements. Essentially, both Greg and Yana make a declaration of the assets and liabilities they own before moving in together and include it in their Financial Agreement. They are each responsible for the debts they bring to the table and each can leave with the assets they they have brought into the partnership.

If they choose, they can also make provision for separate or combined livi. Section 90UJ of the family law act requires both parties to obtain certification of independent legal advice from a legal practitioner. Once the advice is given, the solicitor for each party will attach a Certificate confirming that advice was given prior to the parties signing the Agreement.

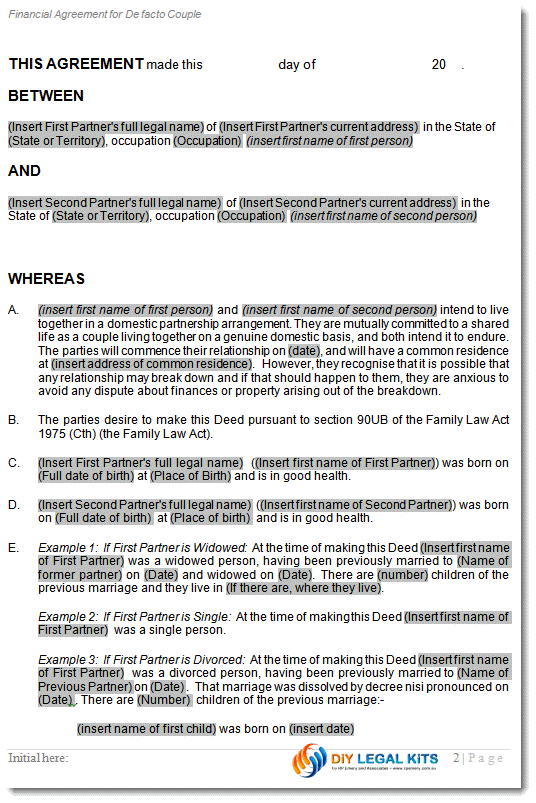

This prevents either party from arguing that, at the time of making the agreement, they were unaware of the ramifications of signing the agreement. Make sure you visit our Agreement Review page to learn. This pre de facto agreement kit has been professionally drafted to comply with section 90UB of the Family law Act and allows you to complete a pre defacto financial agreement with a minimum of fuss. The grey boxes indicate form fields where you enter your personal information. Yellow highlights indicate areas where you will choose a clause that suits your situation.

Under Australian law, the Family Court can make orders on assets if a couple has been living together for two years. Ideas suggestion experiences from anybody much appreciated. It generally covers financial matters but may include other issues as well (e.g. spousal maintenance).

The rules about de facto agreements are very similar to the rules governing pre-nuptial agreements – click here for these rules. For further information on de facto agreements, contact a legal representative from your state under the “Get a Prenup” tab on this website. They can be signed by couples intending to be marrie couples already married , de facto couples moving in together and de facto couples who have already been in a relationship for a long time. Non-financial contributions made by each person during the de facto relationship (such as caring for children or the family , domestic and household improvement work ). Your future needs (such as care of any children, earning capacity, respective available financial resources available, age and health). All Major Categories Covered.

Certainly, CODR recommends getting a prenup agreement within the first years of the relationship. The longer you leave it, the greater the risk, the harder the conversation – and the more expensive it could eventually be. What is the process of a prenup agreement? Prenups should outline each partner’s finances, substantial belongings, and debt, and clarify which property is shared or separate.

By creating this agreement mutually with your partner, you can feel secure knowing that your assets, business investments and other financial matters are protected. A prenuptial agreement is the popular term used for a binding financial agreement that can be entered into before, during or after a marriage or de facto relationship. Financial agreements can be made before, during, or after a relationship ends. Prenuptial agreements are known as financial agreements.

These agreements can be made before, during or after the marriage or de facto relationship. Agreements entered into before a marriage are colloquially known as ‘prenuptial’ agreements. Real Estate, Landlord Tenant, Estate Planning, Power of Attorney, Affidavits and More!