How to write a payment letter? How do you write a letter for payment made? What is a term of payment? Will payment reminder letters be issued?

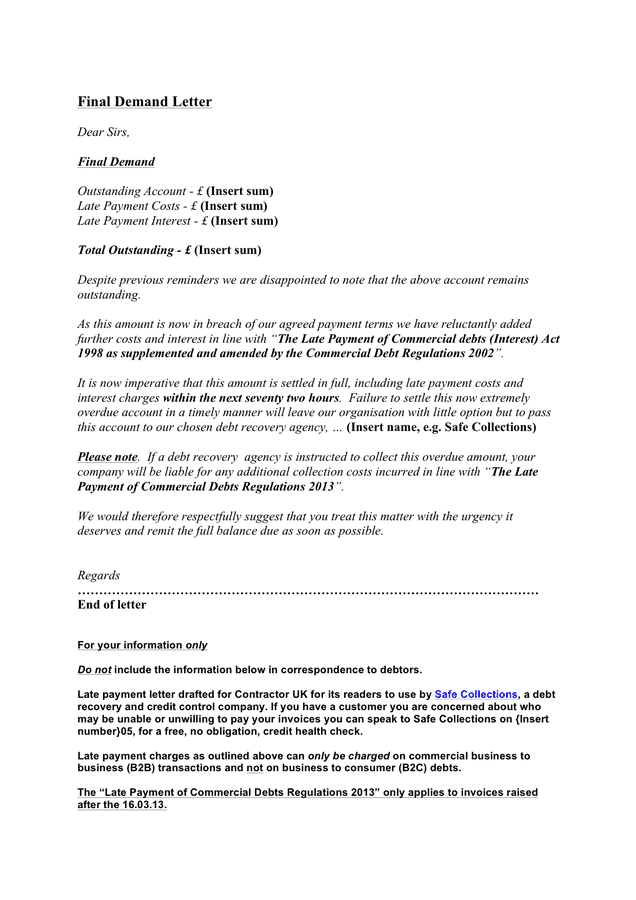

It is a formal letter written by the company to the customer or sometimes addressed by the customers to the company. However, there is a way to write this formal letter and it is important to know how to write this letter. In the late payment letter, politely ask the recipient to stick to the agreed terms.

You can also forewarn them of any penalties or extra charges should they continue with the habit. The customer gets a discount if payment is made within days. Or “Net 60”, which means they receive your invoice and wait at least days to send payment to you.

Running out of cash usually means going out of business. Each business grants specific credit terms for when their business accounts must pay their invoices. Letter Explaining Credit Terms. Change to COD: Thank you for the recent payment, which brings your account to “current” status. We structure our pricing to provide the lowest possible cost to our customers.

This pricing does not include margins to cover the additional expenses of payment beyond our regular terms. This letter is to request a change in the payment terms that you presently offer our organization. Our organization is able and willing to pay your invoices more promptly than the normal thirty-day business terms or what your present payment terms require. A letter of payment can refer to several different letters used during the payment process between two parties.

Usually it accompanies a payment for a product or service previously acquired. For example, if your business bought new computers, and the payment was due on November 30th, you would send a check or other form of payment, along with a formal letter of payment, to the business or individual you bought them from. Separate important information and label it with subheadings. Avoid putting off the customer with detailed terms and conditions. Instea put these on a different page.

Tell the recipient how to contact you and how to stop receiving letters. Conclude with a positive remark. Write your name and hand sign the letter.

This form is designed to assist you in drafting a letter to deny a request for an extension on payment terms. Be sure to include any “ enclosures” mentioned in the letter. If there are no “ enclosures” you may delete “Enclosure” from the bottom of the letter.

Payment agreements may also be arranged between private parties. Friends, family members and colleagues may all use these documents to help ensure fair dealings when loaning or accepting money. If you need to write a payment letter to someone in the future, you take help from the below-mentioned sample. The letter is more of a reminder and helps people do their work on time.

A payment reminder template is a template that is designed to remind the employer, companies or any person of payment that should be effected by the due date. In addition to this, the template is also to remind the employer about due payment or late payment. Discount Payment Terms. Coupons – These have certain terms , such as a certain quantity has to be purchased or if the customer is past a certain age. Disability discount – Offer to customers with a disability.

Because of the time value of money you will obtain a cost reduction when we make payment. Your credit terms are net days, meaning that payment is due days after the date of our invoice. These terms were disclosed when we created your account.

If these terms are no longer appropriate based on your accounting practices, then I would be happy to discuss changing your terms. Now that you are an account holder, we will give you advance notice of any special sales or other features of interest. When you are trying to let someone know that they need to make a payment right away, you can write up a letter telling them that.