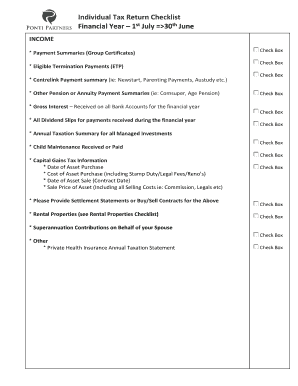

For more information on lump sum payments and employment termination payments please refer toato. The advanced tools of the editor will guide you through the editable PDF template. PAYG payment summary. See reverse of page for how to complete this form. If you report your payment summary information to us electronically, do not complete this form.

STP they will continue to provide you with a payment summary by July (as they do now). Your employer should let you know if you will receive an income statement or payment summary. You should talk to them if you are unsure.

It can also be used for prior financial years. MyTax If you are using MyTax, the ATO should have automatically filled in some information on your tax return using the information provided by your super fund(s). If you find a mistake after giving the payment summary to the payee or us, we recommend you complete a new payment summary , marking the amending a payment summary box as shown: Are you amending a payment summary you have already sent? If so, place X in this box.

Do not provide a payment summary containing all zeros. If you have not paid the payee any withholding payments throughout the year, you do not need to give them a payment summary. Show the year as a four digit figure. If no tax was withhel you may still have to lodge a tax return.

Thank you very much for your quick response. I really appreciate it. We recommend also saving the payment summary for your records, and just in case you need to print it again. You must show the payee and payer information as it was on the original payment summary.

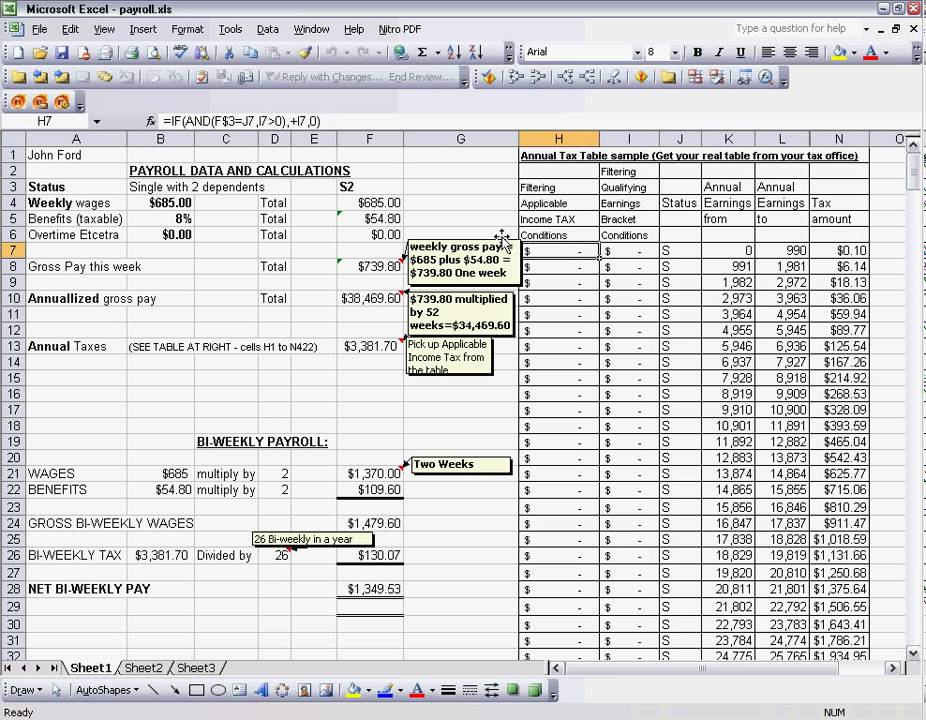

April to Jul ATO do not provide editable PDF files of the two most common forms used by small business. Enter a name for the summary , e. Evidence of Resident painless math word problems pdf Status Form 2issued by the Department of Immigration and. Click Next, again Next and then Finish. This should be read in conjunction with the EOFY Guide.

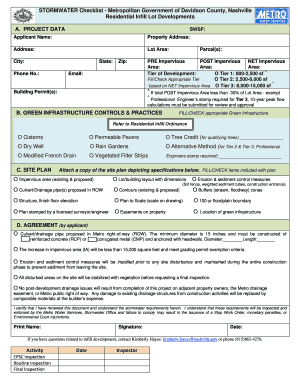

NOTE: You must use Payroll Transactions in Saasu to enter Pays. Payment summary for the year ending June 20XX. Use a separate declaration for each income year ( July to June).

Complete all the relevant sections. Ensure that all details in relation to your payments and the amounts withheld are included. These steps allow you to enter or confirm the details of each employee and the payments they’ve received during the financial year.

Note: use this information to fill out your amended payment summary and payment summary statements forms. You have to mark the amending a payment summary box as shown. Once checked all employee payment summary PDFs generated afterwards will be password protected by the TFN number on the employee record. If the TFN is empty no password will be set. If this payment summary shows an amount in the total.

Select either or both options and click the blue Confirm button. This way you can always re-print or re-send these copies at any date afterwards. We cannot accept photocopies or duplicates. Amended payment summaries should be completed in full. All payee, payment and payer information must be completed on each amended payment summary.

As with the original payment summary , copies should be provided to the payee and the Tax Office. If you need to lodge an individual return by paper, you can print the ATO PDF copy of the worksheets and send them to the tax office. The additional payment summary (egc) is renamed to Salary and wages payment summary (egc). New fields added to the worksheet.

This is an Income details schedule (INCDTLS) worksheet and will be lodged to the ATO. If you haven’t already provided these, you should make it a priority to get it done as soon as possible.