Business and personal services income. Do you include allowances in gross payments? Gross payments Include all salary, wages, bonuses and commissions you paid the payee as an employee, company director or office holder. Include the total gross amount before amounts are withheld. This form is for payments to payees who: 1. See full list on help.

You don’t need to select which ones you want to complete. AccountRight will select the right one for you, based on the information entered in your employees’ cards and the information you enter into the assistant. If you have terminated employees, and enter ETP amounts into the assistant, an ETP payment summary will be prepared for them. When working out if your income is PSI, you need to look at the income received from each separate contract or invoice.

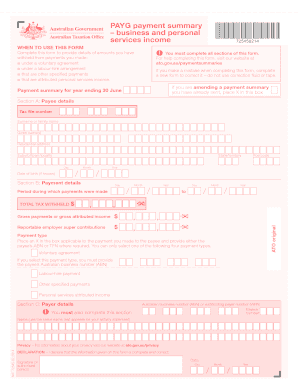

PAYG payment summary – business and personal services. The tax is withheld and paid quarterly. Label H-Tax withheld where Australian business number not quoted.

This amount will be the sum of entries from the Payment Summary (PS) where the Income type is P and the payment type is N. I am setting up a new data fle for a company that previously did manual group certificates. You will notice on our website that there are a number of different types of payment summaries. Employment termination payment. Please note: If a self-print facility is included in the software, the requirements of the Self-printing pay as you go ( PAYG ) withholding payment summary test scenario, which is available on. Superannuation lump sum payment.

Foreign employment payment summary data record 20. Every payment summary must state the total amount of payments made to that employee over the course of the financial year. In addition, DHS has little knowledge or oversight over the ATO’s processes associated with the PAYG program. This information will be sent directly to the ATO by your employer. You will then be able to view them through your ATO online services.

An income statement – if your employer reports your income , tax and super information to us through Single Touch Payroll (STP) they are no longer required to give you a payment summary , this information will be made available to you through ATO online services via myGov and finalised by July. Have you received any income , excluding income earned as an employee, which was mainly a reward for your personal efforts or skills? If yes, please provide copies. Personal Services Income Yes No ? The Directors in most cases also the owners of the business should also receive an annual PAYG Summary and remit the amounts on their personal return at item 2. These items are often overlooked for work cover as well, and careful attention should be taken to ensure that all employees obligations are met, and payroll administration and your. Pay As You Go ( PAYG ) Instalments is a system for paying instalments during the income year towards your expected tax liability on your business and investment income.

Your actual tax liability is worked out at the end of the income year when your annual income tax return is assessed. When will a personal services entity be a personal services payment remitter? Payment summary also called PAYG ( Pay as you go ) and contain all same details in the document.

The employer may issue a receipt, remittance advice or group certificate. The member is under years and has a death benefit capped defined income stream (where the deceased was years or over when they died). If you have no tax that you need to withhold from a member’s super, then you are required to provide the individual with a pension payment summary and lodge a PAYG withholding summary with the ATO. If you print your Payment Summaries on Blank paper (i.e. not the preprinted documents supplied by the ATO) you will have to submit the Payment Summary data electronically. It’s used for reporting and paying goods and services tax (GST), pay as you go ( PAYG ) instalments, PAYG withholding tax and other tax obligations.

A payment summary shows the income you received and the amount of any tax withheld over the financial year. It may also show information about allowances, deductions, fringe benefits or other payments relating to your income tax or super.