When do you pay workers a payment summary? This form provides an outline of all payment summaries you issued to your payees for the financial year. PAYG payment summary statement. Where a member turns during a year and receives pension payments both before and after turning they will receive two payment summaries.

Welcome to the Reckon Community. You will need to create a new company file starting from the date of the Company Administrator appointment date and enter all transactions into that file. Single Touch Payroll. I could not find where to print them.

Could we still print them out or save all individuals in p. STP they will continue to provide you with a payment summary by July (as they do now). Your employer should let you know if you will receive an income statement or payment summary. You should talk to them if you are unsure.

Note: Electronic submission of payment summaries is not allowed when the payee address details are incomplete, or when employees have supplied an invalid TFN. You can now select Yes, this is an amendment. Your formula should look somehow like in the picture below. I have run all my reports and balanced my PAYG.

Then entered FBT and finalised the payroll information through the Payroll Reporting Centre. Enter a name for the summary , e. Choose what summary you want to create, e. Important tax numbers are include salary and earnings are note and tax liabilities are defined. This means each payee has all the relevant details needed for their own purpose and you will also have this information at your fingertips to use whenever you need it. Payment Summary Template. To make the process as simple as possible, you can lodge the report electronically to the ATO, directly from the payroll platform.

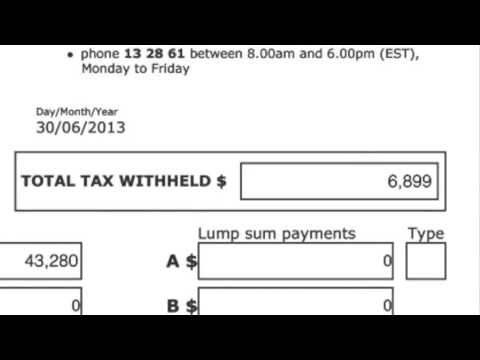

This includes salary, wages, commissions and bonus payments. It will show gross income, tax withheld and the Australian Business Number of your employer. To reprint a payment summary.

He said he was witheld tax for those years. Click Review payment summaries. In particular we noted that compulsory superannuation contribtions were NOT required to be reported on the new forms. As the Australian Taxation Office embraces new technologies, payment summaries are being phased out and replaced by digital reporting of tax and superannuation. Question Updated years ago Answered (Edited) Me Too.

This does not change the way you are pai only the way tax and superannuation information is reported to the ATO. Calculate your take home pay from hourly wage or salary. Do not include amounts paid under a salary sacrifice arrangement at GROSS PAYMENTS. Only amounts that are paid to a superannuation fund under a salary sacrifice arrangement must be reported at Reportable employer superannuation contributions.

If you need to amend a payment summary because only the dollar amounts change report the amendment to ATO with a new electronic file. If your software can’t produce an amended file, you must use printed forms. Kindly advise as soon as possible. The Fair Work Ombudsman defines payment summaries as ‘an extra pay slip and recording-keeping requirement’. Essentially, the summary outlines all the payments that you have made your payees during the financial year.

In addition, the law mandates the provision of payment summaries whilst the Australian Taxation Office enforces its provision. Some of the links and information provided in this thread may no longer be available or relevant. If the payroll category is linked to a different payment summary fiel the Total Tax Withheld shown on your payment summaries will be missing.

These documents include payment summaries , payment summary annual reports and annual reports for withholding where ABN not quoted. Income statement FAQs How can I access my income statement this year? This year your income statement will be available in myGov.