Do I need to file a part year resident tax return? What is a part year tax return? Are part-year taxes proportional to state? Can I file state tax return?

Although there are some exceptions to this rule, part-year residents are usually those who actually lived in the state for part of the year. If you lived inside or outside of California during the tax year , you may be a part-year resident. A nonresident is a person who is not a resident of California. Write Dual-Status Return across the top of the return. Attach a statement to your return to show the income for the part of the year you are a resident.

Individual Income Tax Return as the statement, but be sure to write Dual-Status Statement across the top. Claim of Right – Individual Form. ES – Individual Estimated Tax Payment Form. Filing a Colorado Income Tax Return Those born in or belonging to another country who have not acquired U. Colorado for the full tax year would file as a full-year Colorado resident. You spent at least 1days in Minnesota during the year and you rented , owned , occupied , or maintained an abode.

Calculate your income for the part of the tax year you were a resident of Vermont. Add the calculations resident and nonresident. If the sum is more than $10 you must file a Vermont income tax return.

Learn more about residents or nonresidents. You had a net operating loss for New York State personal income tax purposes for the tax year, without having a similar net operating loss for federal income tax purposes. Resident Alien at End of Year. Nonresidents, who work in Georgia or receive income from Georgia sources and are required to file a Federal income tax return , are required to file a Georgia income tax return. Part-year tax residents – Applies if you were a resident of one state for part of the tax year and moved to another state with the intention of making it your home.

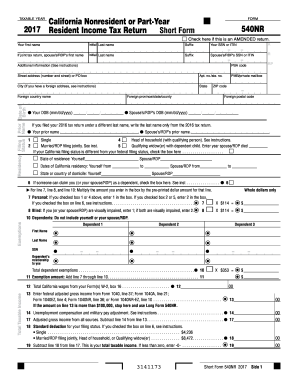

In general, you’ll need to file taxes for both states. This is the only return for taxpayers who are nonresidents or part – year residents of New York State, whether they are itemizing their deductions or claiming the standard deduction. Be present in the United States for at least of the number of days beginning with the first day of the 31-day period and ending with the last day of the current year. B: Maryland Dependents Information: Form to be used when claiming dependents.

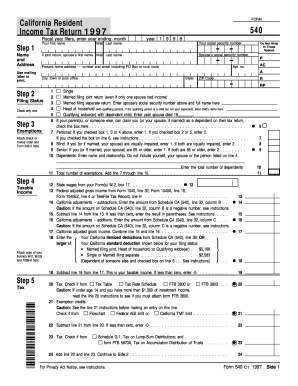

This includes anyone who moved into, or out of, Colorado at any time during the calendar year. Part – year residents may be required to file a New Jersey tax return. Part-year residents enter all salaries and wages employment income. The return provides a line for you to show the period of your residency in the state. Instruction in the Maryland resident tax booklet outlines the following steps for completing your part-year tax return correctly: You must file Form 502.

Which form do I file if I was a part – year resident of the District of Columbia? The input will vary by state, but typically includes residency dates or move dates for part – year returns, as well as a permanent resident or domicile state. State Use Only See page of instructions for reasons to amend and enter the number that applies. Thus, you are a part – year resident if you permanently moved into or out of Ohio during the tax year.

Considered a part-year resident because you moved into or out of West Virginia. You must complete Page Schedule to determine your Georgia Taxable income. The statement must be attached to your income tax return. Who Must File Most Ohio part-time residents and nonresidents who earned Ohio income are required to file an income tax return.

For up to date information, visit our website at tax. Enter on line the adjusted gross income from your federal return for the entire year , regardless of your length of residence. File Form IT-40PNR if: Full-year Indiana nonresident and receive taxable income from Indiana. A full explanation of how to compute the tax for part-year residents is provided in the instruction booklet.

As a part – year resident , you may take either the Missouri resident credit or the Missouri income percentage , whichever is to your benefit. On a joint return , one spouse may take the Missouri income percentage and the other the Missouri resident credit. However, one individual cannot claim both!

Since Florida does not have a state income tax , you are not eligible to claim the resident credit.