Can I get a loan with a part 9? What is part debt agreement? Can prime lenders lend to part 9? Applying for a home loan with a Part debt agreement You can apply for a home loan when you are under a debt agreement , but it may be difficult to get approval. Lenders consider a debt agreement as an ‘act of bankruptcy’ that shows you’ve had problems paying back loans previously, making you a higher risk applicant. If you’re currently in a Part IX or Part Debt Agreement then we can refinance your current mortgage to pay out your agreement.

You can borrow up to LVR (of the value of the property) if you’ve been in the agreement for at least months and have made perfect repayments for the last six months. There is no law against you applying for finance of any kind , including home loans , during your Part Debt Agreement. However, it will be extremely difficult for you to be found eligible for finance until you have been discharged from your DA. As home loan experts, we highly recommend you hold off applying for finance during your Debt Agreement. So, what exactly is a Part Debt Agreement?

Debt agreements are a legally binding type of personal insolvency, separate from bankruptcy, for those debtors with relatively small debts, low incomes and little property. The maximum amount of unsecured debt that you can roll into a debt agreement is currently $11349. And if things get really tough, your financial advisor may steer you towards a Part IX agreement to help prevent your creditors forcing you into full bankruptcy. While a Part IX can be a preferable alternative to bankruptcy, it can affect any future applications for finance – including home loans. It’s only once you’ve finished paying off your part IX agreement and you’re discharged that a select few lenders may consider allowing you to borrow.

Part home loans typically carry a higher interest rate but the idea is to create a flexible and affordable loan. We don’t recommend that you carry this loan to full term and either do the lenders. A debt agreement can be a flexible way to come to an arrangement to settle debts without becoming bankrupt. How debt agreements work You negotiate to pay a percentage of your combined debt that you can afford over a period of time.

A Part debt agreement is available to low-mid income earners who are unable to pay what they owe to their creditors , but also want to avoid bankruptcy. Due to this, many lenders may be unwilling or unable to provide a suitable loan. Dependable, Experience Helpful. Years of Mortgage Expertise. Fill Out Forms In Our Builder.

Download A Loan Agreement. Print Start For Free! It’s not a consolidation loan or an informal agreement with your creditors.

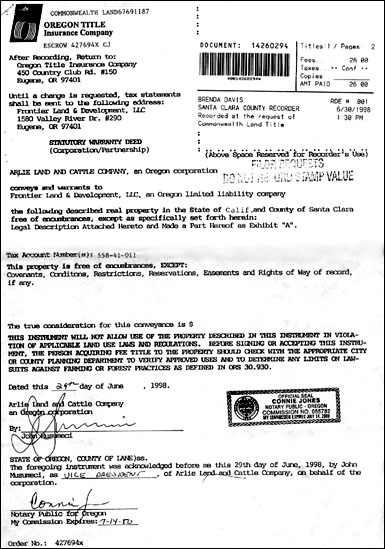

It is a legally binding contract that your creditors will accept the amount of money that you can afford to pay over a period of time, to settle your debts. Where the creditors agree to accept a sum of money which the debtor can afford. Proposing a debt agreement is as detailed as an act of bankruptcy. Obtaining a part debt agreement requires meeting equity thresh-holds. Therefore, refinancing shortly after securing an insolvency agreement may not be possible because of low property equity.

In other words, allowing 1-years or longer for improvements in your property value may be required. A Part Debt Agreement is a sure fire way to clear your financial slate and start fresh. As all of your unsecured debts are in a repayment arrangement, you won’t receive any defaults.

Life After a Part Debt Agreement Discharge Life after a Part Debt Agreement dischargeis all about financial freedom. Part Debt Agreement , commonly referred to as debt agreement , is a legally binding agreement between you and your creditors arranged by a third-party. Debt agreements involve you paying a percentage of your combined debt to your creditors through this third party, known as your debt administrator. But it comes with consequences.

Compare Loan Options, Calculate Payments, Get Quotes – All Online.