Work out whether your online selling is considered a hobby or a business. High call volumes may result in long wait times. Before calling us, visit COVID-, Tax time essentials , or find to our Top call centre questions. Learn about your tax requirements if your business exports, imports or is based overseas.

Personal services income Find out if you earn PSI, so you know what tax deductions to claim. How are taxes collected in Australia?

What is GST in Australia? By logging in you agree to the terms and conditions Set up your myGovID and establish your authorisations using Relationship Authorisation Manager (RAM). An Australian resident company is subject to company tax , at a rate set by the Australian Government. A non-resident company is taxed on its Australian source income at the same rate as a resident company.

Taxable income and the tax rate may vary under limited circumstances, such as industry or business structure. For more information on company tax , including company tax rates, see ATO: Company tax rates. See full list on austrade. Capital Gains Tax (CGT) applies on any capital gain made through the disposal of assets.

It is paid as part of income tax.

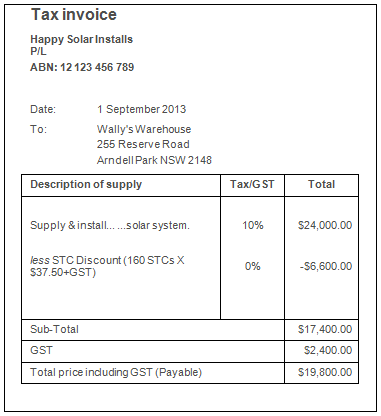

Foreign entities may be subject to CGT on assets acquired and used in carrying on a business in Australia. Businesses are required to keep records upon acquiring assets that may be subject to CGT in the future. Small businesses may also be eligible for CGT concessions under certain circumstances. For information on CGT payable on the disposal of assets in Australia , see business. The Goods and Services Tax (GST) is a national, broad-based consumer tax on most goods and services sold or consumed in Australia.

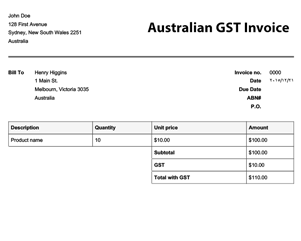

Most businesses are required to register for GST with the Australian Taxation Office. Businesses which have paid for business supplies inclusive of GST are entitled to claim an equivalent input tax credit. Certain businesses may also be eligible for GST concessions. Payroll tax is a state tax on the wages you pay to employees.

The payroll tax exemption threshold and the payroll tax rate varies between states and territories. There may be other Australian Government and state and territory government taxes relevant to certain business activities. This may include items such as land tax and fringe benefits tax (FBT).

Businesses and investors should review these taxes to determine whether they apply in your particular case. For further information on other business taxes, see business. When is your tax return due? Superannuation, though not a tax , is a requirement if you employ staff.

Find out more information on paying superannuation to your staff. Many businesses have been affected by COVID-1 affecting their ability to meet GST obligations. We understand that many businesses have been affected by COVID-and this may affect your ability to meet your Australian GST obligations.

GST registration number – your Australian reference number (ARN) 2. Australian goods and services tax (GST) may apply to you for retail sales of low value goods, services or digital products to Australia. Retailers, online marketplaces and goods re-deliverers may need to register and pay GST to the Australian Taxation Office (ATO). GST is a consumption tax similar to sales tax or value-added tax. GST applies to retail sales of low value goods (A$0or less) to Australia , when purchased by consumers.

For low value goods, GST is collected through the sale, instead of at the border. GST on low value imported goods 2. GST does not apply to certain services and digital products provided within Australia by overseas businesses to Australian businesses. Information on the application of Australian GST has been translated for businesses in China.

To lodge online with myTax you will need a myGov account linked to the ATO. If you need to create an account, see Get started with myGov and ATO online services. If you already have an account, start your return with myTax. By clicking the link below you will be taken away from ato. The ATO is the Government’s principal revenue collection agency.

Our role is to manage and shape the tax , excise and superannuation systems that fund services for Australians. We offer low and affordable fees to Xero and Quickbooks users. Start page for the Business Portal.

GST registered sole trader tax return– there is no hidden additional charge for our service. The Australian Government has proposed changes to goods and services tax (GST) legislation. The new legislation affects both Australian and international retailers – particularly if you sell your products online, or if they’re digital in nature. The two key changes small business owners need to be aware of, especially at EOFY, are the low-value import tax, and the digital goods and services tax. Online tax return: Australia business tax Needless to say, there are many different types of businesses, so there’s no one-size-fits-all approach to lodging online tax returns for businesses.

Tax deductions: Tax deductions not guaranteed due to being subject to user data entry errors. To a maximum of 0business kilometres per car (Deductions are only applicable to cars). Consider the goals of your business , your business model and what you sell, before you decide which approach is best for you.

Directories Online directories may suit your business if you just want to list your business ’s contact details online. You can ask our tax advisors an unlimited number of questions at no extra cost (excludes business returns).