Other articles from accountingcoach. This is treated as an asset by the holder of the note. Overdue accounts receivable are sometimes converted into notes receivable, thereby giving the debtor more time to pay, while also sometimes including a personal guarantee by the owner of the debtor. In other words, a note receivable is lender’s contract with the borrower. It entitles the lender to receive principle and interest payments from the borrower in the future.

An asset representing the right to receive the principal amount contained in a written promissory note. Why are notes receivable considered an asset? What does note receivable mean?

Who is the payee on notes receivable? Specifically, a note receivable is a written promise to receive money at a future date. Often a business will allow a customer to convert their overdue accounts into a notes receivable.

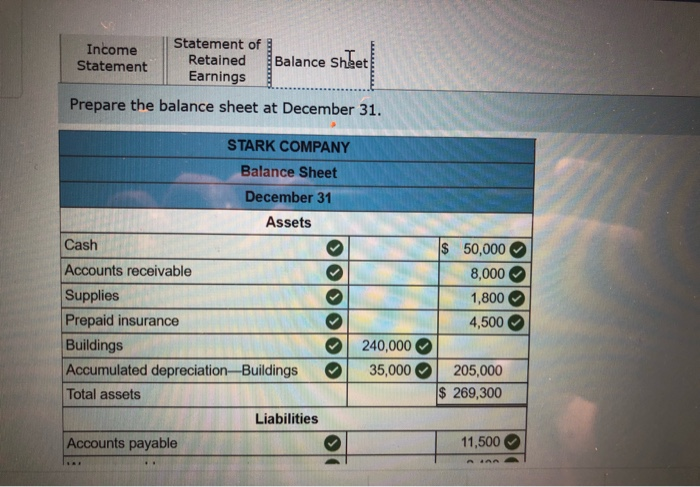

Doing so gives the debtor more time to pay. Any portion of the notes receivable that is not due within one year of the balance sheet date is reported as a long term asset. On the balance sheet of the lender (payee), a note is a receivable. A customer may give a note to a business for an amount due on an account receivable or for the sale of a large item such as a refrigerator. A written promissory note that allows one to collect a specific amount of.

Example of Accounting for. Browse through all study tools. He, by preparing notes, promises to pay the specified amount to. Calculating interest. Such notes can arise from a variety of circumstances, not the least of which is when credit is extended to a new customer with no formal prior credit history.

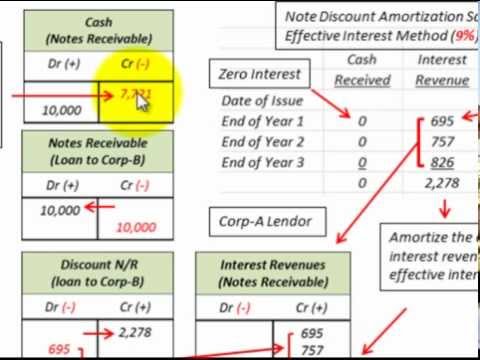

Holder of the note will receive interest payment in addition to the face amount of the note. If the note does not pay interest or interest rate is lower than usual, holder of the note should recognize imputed interest revenue. The payee holds the note.

It follows the note receivable , amortized over the five-year life. It moves from the balance sheet to the income statement via interest revenue using the effective-interest method. A note receivable earns interest revenue for the holder. It provides information on how much money. They are considered a liquid asset, because they can be used as.

Receivable represented by promissory notes Promissory notes indicate the face amount and due date. To illustrate the accounting for a note receivable , assume that Butchko initially sold. Interest bearing note. Summary Accounts receivable is an informal agreement between customer and company, with collection occurring in less than a. That is, they require the debtor to pay the promised amount at a definite time or on demand.

These types of notes issue for the present value of the cash the lender gives to the debtor. Note receivable is a formal promissory note that is written by a debtor in favor of a creditor. Notes and Adjusting Entries. After writing the note, the debtor signs and gives it to the creditor. This is done by giving a discount on notes receivable to a bank or other lender prior to their maturity date.

Financing Receivable , Troubled Debt Restructuring : text: Tabular disclosure of financing receivable modified as troubled debt restructuring. This credit line requires the customer to make payments for an.