Can you get a loan without a credit check? Can I get a loan with no credit check? How can I get personal loans with no credit check? Home Loans With Bad Credit.

Unlike much of the United States, mortgage are typically not nonrecourse debt. Our company takes the pressure out of shopping loans and comparing rates. Our professionals will help you compare home loan programs while discussing opportunities for first time home buyers and people with low ficos and limited credit.

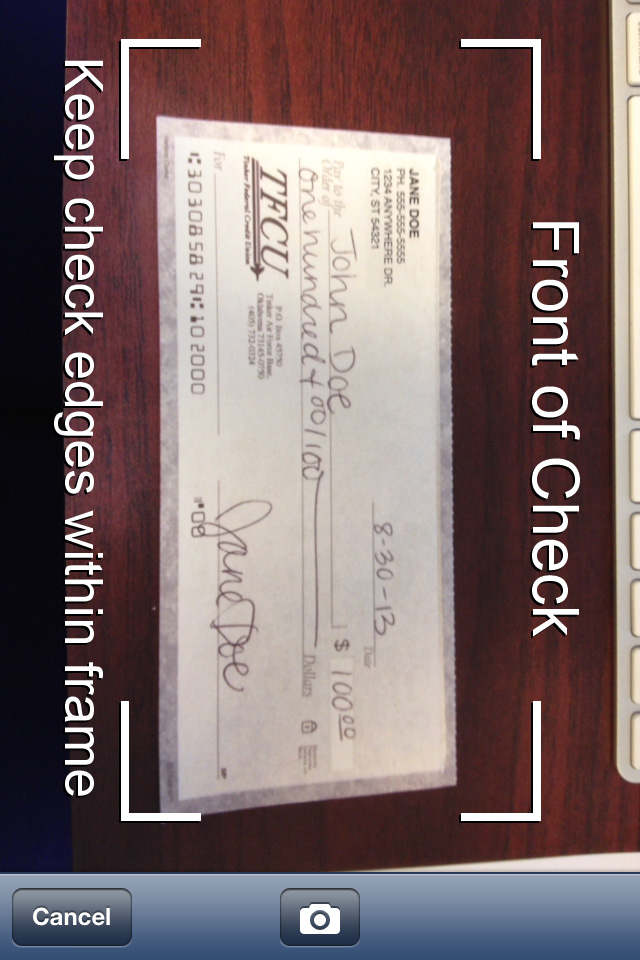

When buying a home or refinancing a mortgage, the lender will need to look at your credit report. Yes we have loan programs that do not have a minimum credit score, but we do not offer no credit check loans. No credit check home loans did exist in the past but with the introduction of the Uniform Consumer Credit Code (UCCC), most lenders went on to complete a credit check. As credit reporting in Australia vastly improve it became more effective and more lenders started using it to assess a home loan application.

This type of home loan refinance is available only for existing FHA mortgages. They cannot be used to refinance a conventional or other non-FHA mortgage. Your monthly mortgage payments on a 15-year loan should be no more than of your take- home pay.

How to Get a Mortgage Without Credit. Not every lender offers manual underwriting—but Churchill Mortgage is one lender that does. The specialists at Churchill know it’s a hassle to get a mortgage without a credit score.

Check the USDA map here. Because there is no down payment, the credit score requirements for USDA mortgages is a little higher than FHA. The provision of home loans is basically a credit facility that is extended to consumers in order to aid them in the purchase of real estate. By remaining to use this site, you consent to this. Allow small loans to stay small and do not permit the build-up of extra fees for late settlements.

Churchill’s Loan Specialists show you the true cost—and savings—of each loan option. They coach you to make the best decision based on your budget and goals. Office Locations Nationwide Churchill Mortgage has a large network of experts with offices nationwide, including San Diego, Phoenix, Dallas, and Washington D. No Income Verification. May allow 2nd mortgages on Property. Investment Properties only.

TRADITIONAL COMMERCIAL LOAN PROGRAMS No loan committee meetings to wait for. See below some highlights of the program. USDA home loans , like VA loans , are a 1 financing home loan.

If you have a personal relationship with a lender, such as a small, hometown bank, they may be willing to do the manual underwriting that is necessary in order to process an alternative data no – credit home loan application. With no credit check home loan you can easily avail a loan to buy your dream home without going through any credit check. Yes you heard it right no credit check home loans can be availed by everyone including bad credit borrowers. You will have to place your home as collateral in order to.

Online Loans No Credit. Shop for a HELOC Line for Poor Credit Scores. We were pleased to announce that bad credit scores and past bankruptcies are allowed if you have enough equity to qualify for several new credit line programs and home equity loans for bad credit that are not solely ficscore driven.

If you are on the market for a home and have no credit or bad credit , it does not mean that you cannot be approved for a mortgage loan. Rather, you will have to work a little harder to find a no credit check mortgage. No Credit Score Loans Buying a home is a major part of the American dream and one of the most important decisions you will ever make. Our first time home buyer programs will allow you to make your dream come true.

No -income verification mortgage programs generally require a higher credit score than a regular loan with income documents. Make a big down payment. The down payment minimum on no -doc mortgage loans usually starts at.

Expect higher interest rates. For example, the State of New York Mortgage Agency provides help to first-time homebuyers. There’s no minimum for credit scores for SONYMA loans , although there are other eligibility requirements.