If the particulars have not been reported to Companies Registry, they must be updated using form ND2B. See full list on companyincorporation-hongkong. Select the capacity of the Director – This may be either Director or Alternative Director.

If this is alternative director, state who. The Reserve Director is applicable only for a private company with only one member who is also the sole director of the company. For a private company, tick the box to make the Statement.

Particulars of members of a non-listed company are listed in Schedule or 2. Either the director or company secretary must sign and fill in the name and date. Fill in the number of pages for each continuation sheets in a table. Non-listed company having a share capital must complete this page. Enter Class of Shares and Total Number of Issued Shares in this Class. The particulars include name, address, shares of current holding, shares of transferred (with number and date), and percentage of issued shares held in this class.

Listed company having a share capital must complete this page. Under For Listed Company, enter the Date to which this Return is Made Up. Must provide the particulars of members who held or more of the issued shares in any class of the company’s shares as at the date to which this return is made up. What details will be included while filing form NAR?

As the name suggests, Hong Kong annual return is a return that holds the most updated company’s particulars of persons such as the directors, shareholders, company secretary etc. Form NARfor registration. This pamphlet is intended to provide a general guide.

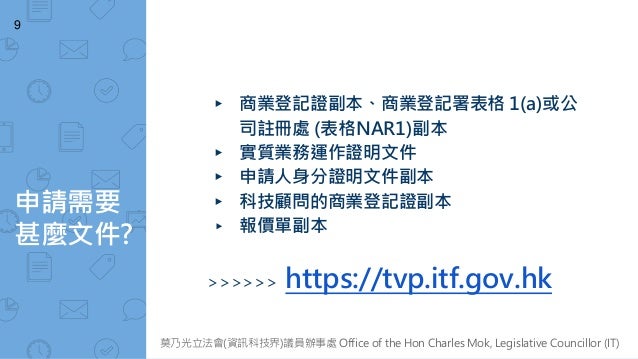

It should be read in conjunction with the provisions of the Companies Ordinance (Chapter 6of the Laws of Hong Kong ) and should not be regarded as a substitute for reading it. A Hong Kong company shall prepare its form NARto the Company Registry every year. The filing due date is within days after the anniversary date of company incorporation. A company is required to file annual return (form NAR) with CR, which details the corporate particulars i. NNCand NNC1G are Hong Kong company incorporation forms for limited by shares and limited by guarantee. A CD-ROM containing a full set of the forms (HK$each) and hard copies of individual forms (HK$or HK$each) are available for purchase at the Information Counter on the 14th floor of the Queensway Government Offices, Queensway, Hong Kong.

Enjoy off bursary discount for designated courses. A Hong Kong incorporated private company must file an annual return each year via the NARform. Let’s start with the important bit. Filing an annual return to Companies Registry is not a choice, it is something you need to do legally.

If you own an incorporated company in Hong Kong , this quick guide will help you get up to speed on the process. Hong Kong is one of the leading Asian centers for both finance and commerce. It is a major gateway for investment and finance into China and the rest of Asia.

We can incorporate Hong Kong companies with a name of your choice or from our shelf list quickly and efficiently. Banking accounts can be opened for Hong Kong companies in different. This is done annually, usually within days of the incorporation of the business.

Startupr makes sure that it is filled on time for our clients. Companies in Hong Kong are required to fill out a NARAnnual Return form every year, and submit it to the Companies Registry. For a small fee, anybody can perform a lookup on any registered company. Public Company Public companies must file an annual return within days from the return date being months after the end of its accounting reference period.

English form (but not instructions) translated into. Neither the Registrar, the Registry, the Government of the Hong Kong Special Administrative Region, nor their officers or employees shall be responsible for any delays or failure in transmission, receipt or execution of information, messages or instructions due to a breakdown or failure of communication facilities or to any other cause.