A tax file number (TFN) is your personal reference number in the tax and superannuation systems. It is free to apply for a TFN. Help make myGov better We are working on making it easier to find information on government payments and services. Please give us feedback on the new myGov website.

Where can I Find my Tax File Number? What is a tax file number? How to contact MyGov? Can I access My my myGov account online? Hope this helps, JodieH.

You should tell us as soon as possible if your TFN is stolen or misused. You can make accessing your myGov account more secure by opting to receive a security code via SMS. It’s a quick and secure way to sign in to access ATO online services.

Find out how to apply for a TFN and keep your details safe. Any help would be appreciate thankyou. Unable to verify The Australian Taxation Office (ATO) is unable to verify your identity. You will find your Tax File Number on your Taxation Notice of Assessment, which is issued to you by the ATO after your tax return has been lodged and assessed. But unfortunately I lost my Tax file number.

I need your guidence and help inorder to claim my super. For my daughter she not sure of her taxfile number she has no credit to ring but needs her taxfile number asap. If you’ve lost your Tax File Number myGov. This is the fastest, cheapest and most efficient way possible to find your lost tax file number. Fill out the code and you are in.

Information for Aboriginal and Torres Strait Islander people. If you don’t have one, you could pay too much tax. This number is digits and is used to claim various grant credits, collect tax credits, file invoices, and more. An ABN is necessary for most business activity and can be obtained through the Australian Government. Tax file number The tax file number , or TFN, is used for withholding taxes from employee pay and filing taxes with the government.

Here are ways to find out your TFN, should you ever need to relocate it. For a direct approach, you can contact the ATO. Just be prepared with your ABN or some form of identification. If you already have a myGov account linked to our online services, you can also at any time to find your TFN online.

STUDENT FACT SHEET: TAX FILE NUMBER (TFN) MISMATCH Why do I have to supply my TFN to access a HELP or VET Student loan? When you access a Higher Education Loan Program (HELP) loan or a VET Student Loan you need to provide your TFN because repayments of your loan are made through the tax system. JavaScript is not currently enabled in this browser.

Your document may consist of more than file. For example, you may have photographed each page separately. You can drag and drop your files into the Drop files here box or choose Select your file. We accept jpg, png, pdf or tiff file formats.

It will be on your income tax notice (notice of assessment), group certificate or super statement, or in your myGov account. Why are you asked to provide your TFN? Any interest earned on your bank accounts is part of your assessable income, and needs to be reported to the Australian Tax Office (ATO).

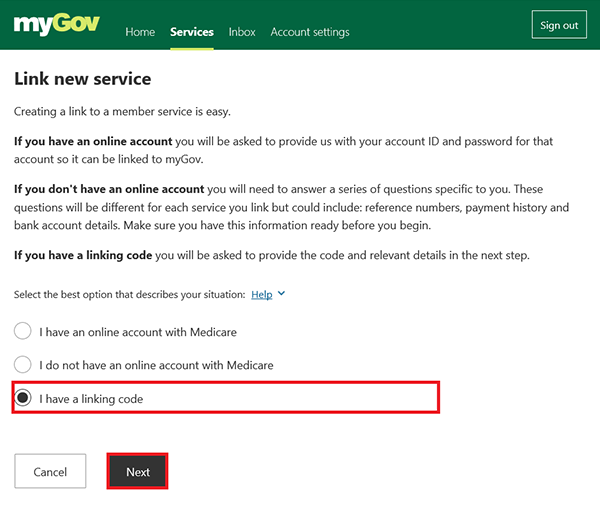

Once your application has been submitted the Australian Tax Office (ATO) states that it can take between and working days for your Tax File Number application to be processe from our experience, the Tax File Number ( TFN ) Verification Letters have been received within a week to the Australian postal address provided. To do your tax return at myGov , you need to set up a myGov account and enter all your personal details on the Government online system. Then you connect that account with “ATO online” and enter more details there.