Refinance Online Today! Find Out How Much You Can Afford. More Veterans Than Ever are Buying with $Down. Prequalification indicates whether you meet the minimum requirements for a loan and.

These are important questions to answer if you want to pre- qualify for a home loan, and our loan prequalification calculator is a great tool to help you get started.

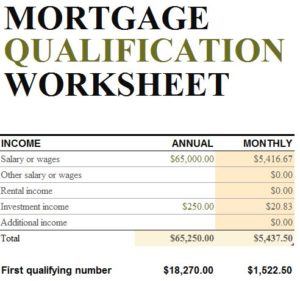

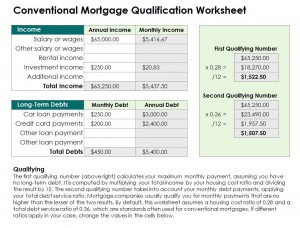

Other articles from freeandclear. The first step in buying a house is determining your budget. The mortgage qualifier calculator steps you through the process of finding out how much you can borrow. You can calculate your mortgage qualification based on income, purchase price or total monthly payment.

What is the formula to qualify for a mortgage? Our mortgage pre- qualification calculator shows how lenders see you. Which mortgage calculator is the best? How do you qualify for a mortgage?

How much house you can afford calculator? Use the loan pre- qualification calculator to help determine affordability. Getting pre-qualified for a mortgage is an informal way for you to get an idea of how much you can afford to spend on a home purchase. Factor in income, taxes and more to better understand your ideal loan amount. How to use our mortgage income qualification calculator.

Use this mortgage income qualification calculator to determine the required income for the amount you want to borrow. Payments, Get Quotes – Start Today! However, if you are applying for an FHA loan, you can qualify with a much lower score.

If you plan on having a 3. Though you will need to meet with a mortgage lender to get a precise understanding of how your financial circumstances affect how much money you can afford to borrow, using the above income qualification calculator can help you get an understanding of what you are likely to be able to afford before you ever start the process of looking for a home or getting pre-qualified. FICO of 5or above. It also shows how much the lender would be willing to lend you.

Get A Low Rate On Your ARM Today. Begin by clicking in the first entry field and follow the instructions that appear in the Help box. The calculator will then determine if you would qualify for a mortgage , and if so, tell you the mortgage amount and the home price amount.

We suggest that all buyers get pre-qualified or pre-approved prior to starting their new home search.

You selected an adjustable rate mortgage or ARM. Contact a mortgage loan officer to learn more about these important pieces of the home-buying journey. Get to some basic home affordability questions. Explore other calculators for specific mortgage loan types.

Fixed-rate mortgage calculator. Federal Housing Administration (FHA) loan. To qualify , the FHA charges single upfront mortgage insurance payments (MIP) along with annual mortgage insurance premiums.

The upfront MIP are the same for all, which is 1. Use our home affordability calculator to figure out how much house you can afford. That home payment assumes a 30-year mortgage at current rates, and includes property tax and 0. Mortgage Insurance Premiums.