Refinance Online Today! More Veterans Than Ever are Buying with $Down. Also offers loan performance graphs, biweekly savings comparisons and easy to print amortization schedules.

Includes taxes, insurance, PMI and the latest mortgage rates. Your next step after playing with the numbers:. Lenders define it as the money borrowed to pay for real estate.

A mortgage is a loan secured by property, usually real estate property. Each month, a payment is made from buyer to lender. A portion of the monthly payment is called the principal, which is the original amount borrowed. The other portion is interest, which is the cost p. See full list on calculator.

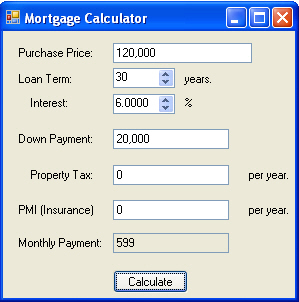

A real estate mortgage usually includes the following key components: 1. Loan amount—the amount borrowed from a lender or bank. The maximum loan amount one can borrow normally correlates with household income or affordability. To estimate an affordable amount, please use our House Affordability Calculator. Down payment—the upfront payment of the purchase, usually a percentage of the total price. In the US, if the down payment is less than of the total property price, typically, private.

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other important costs to keep in mind. These costs are separated into two categories, recurring and non-recurring. Recurring CostsMost recurring costs persist throughout and beyond the life of a mortgage , they are a significant financial factor.

Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. There are optional inputs. In many situations, mortgage borrowers may want to pay off mortgages earlier rather than later, either in whole or in part, for reasons including but not limited to interest savings, home selling, or refinancing. However, before doing so, it is important to first check with mortgage lenders to see if they accept early or extra payments, as some will have prepayment penalties. Prepayment PenaltyA prepayment penalty is an agreement, most likely explained in a mortgage contract, between a borrowe.

View matching homes in your price range and see what you can afford. Use the helpful realtor. Which mortgage calculator is the best? How to calculate the true cost of a mortgage?

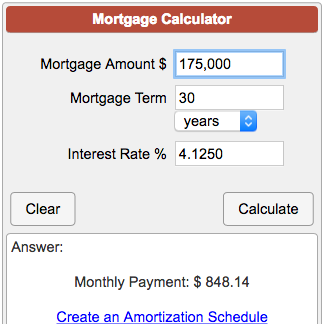

How do I calculate how much home I can afford? For example, if you bring home $0a month, your monthly mortgage payment should be no more than $250. Using our easy mortgage calculator , you’ll find that means you can afford a $210home on a 15-year fixed-rate loan at a interest rate with a down payment. This free mortgage calculator helps you estimate your monthly payment with the principal and interest components, property taxes, PMI, homeowner’s insurance and HOA fees.

Our Mortgage Process Is Fast And Easy. Find Out How Our Experts Could Save You Money. How Do Your Savings Measure Up? Get A Low Rate On Your ARM Today. Our calculator includes amoritization tables, bi-weekly savings estimates, refinance info, current rates and helpful tips.

Payments, Get Quotes – Start Today! Our easy-to-use mortgage calculator helps determine how much you will pay on your home loan. To figure out if a home is out of my price range – Because a mortgage calculator allows prospective borrowers to calculate their monthly costs, it can help buyers decide on a good price range for. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculator. It also calculates the sum total of all payments including one-time down payment, total PITI amount and total HOA fees during the entire amortization period.

When you pay extra on your principal balance, you reduce the amount of your loan and save money on interest. Amortization is paying off a debt over time in equal installments. Part of each payment goes toward the loan principal, and part goes toward interest. With mortgage amortization, the amount going. Add Valuable Interactive Content to Your Website.

Real Estate, Landlord Tenant, Estate Planning, Power of Attorney, Affidavits and More! All Major Categories Covered.