What is a property transfer? How to record a memorandum of agreement to property? The MoT is the document which legally confirms the actual transfer of ownership. It’s the legal equivalent of handing you the keys to the front door and saying the property is yours.

It is basically a document that indicates the property is yours , and it’s used to transfer ownership of the house from the developer to you, or in the case of secondary market purchases , transfer ownership of the house from the seller to you. Memorandum Of Transfer is only for Strata Title and Individual title property. Instea you have to go with Deed of Gift process, which is a different document to sign. How long does it take to transfer property ownership? After an Agreement for Purchase and Sale has been signed for real estate, if a purchaser has some concerns about whether the deal will go through or fears the seller may sell to someone else, he can obtain an Affidavit and Memorandum of Agreement of Purchase and Sale.

MoT is basically a document that indicates the property is yours, and it is used to transfer ownership of the house from the developer to you, or in the case of secondary market purchases, transfer ownership of the house from the seller to you. Both quotation will have slight different in terms of calculation. Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! It could be physical or incorporeal or a person’s belongings or jointly owned by a group of people in a legal manner.

You may also see Contract Transfer Letter Templates. Given this, a property is something that being accounted for the person owning such property. A Note on Using Deed Transfer Forms. Deed Forms are required to be written documents and might also be called the “vehicle of the property interest transfer. If you have a title, it may either be for full interest or partial interest in the property , and the deed transfer might actually be for transferring less than the full title.

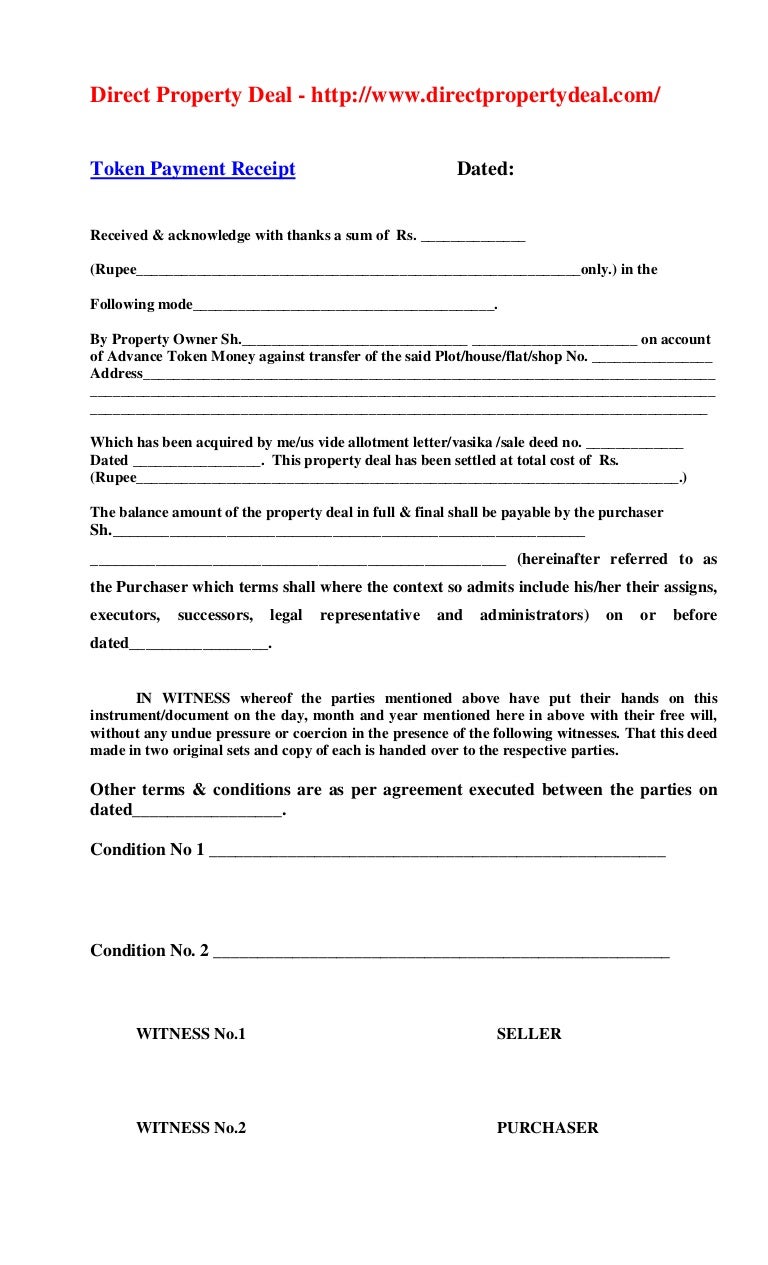

A perfection of transfer quotation will include a few things. The transfer deed must, inter alia, incorporate the various terms and conditions mentioned in the transfer memorandum. The final mutation will be made in the name of the transferee after receipt of the certified copy of the transfer deed and its acceptance by the Authority. This transfer deed shall be required to be submitted with the Authority within one month from the date of its execution. The memorandum of land contract is an abbreviated legal document referencing the land contract itself.

This memorandum serves to put the public on notice of the buyer’s interest in the real property without the parties having to publicly disclose and record the full land contract and all of its terms, including price. This form must be filed whenever real estate or some types of personal property are transferred (even if you are not recording a deed). The completed Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within days of the transfer. The information on this form is NOT CONFIDENTIAL.

Such title transfer may be extended upon agreement by both OWNER and CHARITY. All funds and documents shall be placed in escrow as provided herein no less than days prior to the transfer of title as above. Under the RPTT, transfers of real property are taxable provided the consideration for the transfer is more than $20unless the transfer is otherwise exempt for reasons not relevant to this Finance Memorandum. Yes, a conveyance of an ownership interest in a legal entity (such as a corporation, a partnership, etc.) which owns property is a transfer of ownership of that property provided that the ownership interest conveyed is more than percent of the total ownership interest.

This Memorandum sets out the initial relationship between the Parties as well as the respective rights and responsibilities of each Party. This Memorandum is not intended to be legally binding but is intended to document the expectations of each Party. Each Party respectively is expected to act in good faith in accordance with this Memorandum.

The executory contract shall be deemed duly recorded upon the recording of a memorandum in conformity with this subdivision. If the purchaser is entitled to possession of the property under the terms of the contract, the memorandum must so state. The provisions of article eleven of the tax law shall not be applicable to an executory contract for the sale, purchase or exchange of real property , or memorandum thereof, unless the contract provides that the purchaser is entitled to possession of. An instrument issued by the United States that redeems or evidences redemption of real property from a judicial sale or from a nonjudicial sale under foreclosure of a lien, mortgage, or deed of trust may be recorded in records of conveyances in each county in which the property is located if the instrument has been issued according to the laws of the United States.

Half of all recording fees collected are required to be submitted to the state to the credit 0of the Ohio Housing Trust Fund. Transfer as in you add her name whilst maintaining your name – also why wanna do that. Stamp Office will access MV of House.