Follow the instructions on the second page to submit the form to your carrier. You can also get this form in Spanish. Overpayment Refund Form.

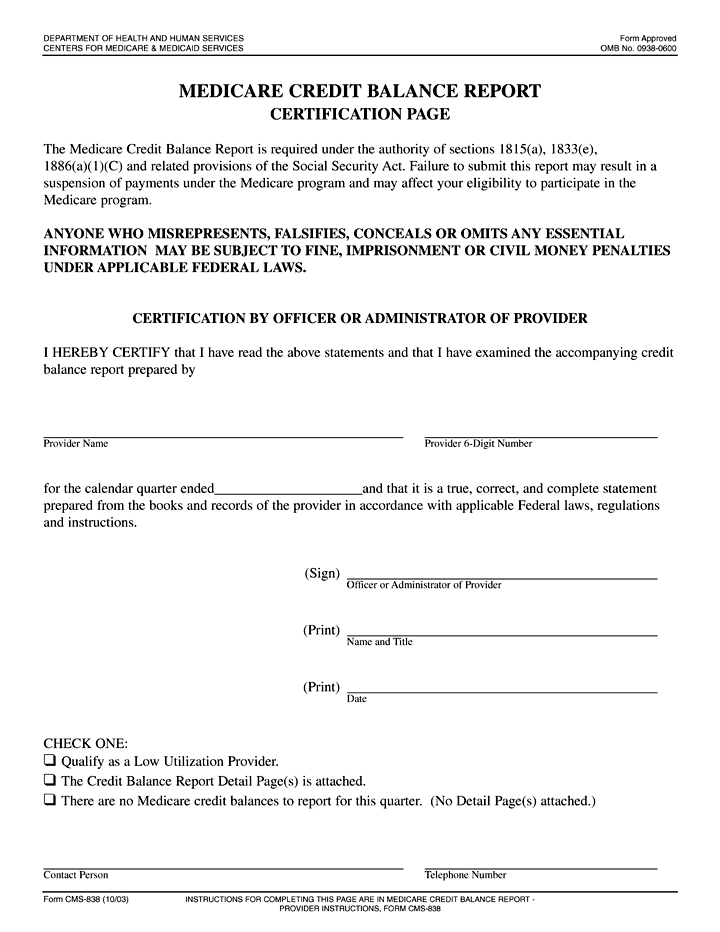

This will ensure we properly record and apply your check. Illegible forms may cause a delay in processing. There are two types of voluntary refunds Medicare Secondary Payer (MSP) and Non MSP. Return of Monies to Medicare To facilitate prompt and accurate credit of unsolicited monies or voluntary refunds to Medicare , we developed a Return of Monies to Medicare form.

Where can you get Medicare claim forms? How to claim a Medicare benefit? What does Part B cover? Fill out and submit this form to request an appeal for Medicare medications. Get Medicare forms for different situations, like filing a claim or appointing a representative.

There are also forms for filing an appeal or letting Medicare share your personal health information. Free Medicare publications. View, print, or order Medicare publications and listen to podcasts. OVERPAYMENT DEFINITION.

A Medicare overpayment is a payment that exceeds regulation and statute properly payable amounts. When Medicare identifies an overpayment, the amount becomes a debt you owe the Federal. Providers, physicians, suppliers, and other entities who are submitting a refund under the OIG’s Self-Disclosure Protocol are not afforded appeal rights as stated in the signed agreement presented by the OIG. Form must be completed in full, and used only when submitting refund check per claim. If payment include mail to: WPS GHA, P. Please complete this form and include it with your refund so that we can properly apply the check and record the receipt.

If a check is included with this correspondence, please make it payable to UnitedHealthcare and submit it with any supporting documentation. When the claim(s) is adjuste Medicare will apply the monies to the overpayment. Complete the form in its entirety as missing information will delay processing. Be sure the form is mailed to the appropriate address listed at the bottom of the form. Fill out this form if you were billed directly by a provider and would like to request reimbursement for medical care (includes dental, vision, hearing and vaccines).

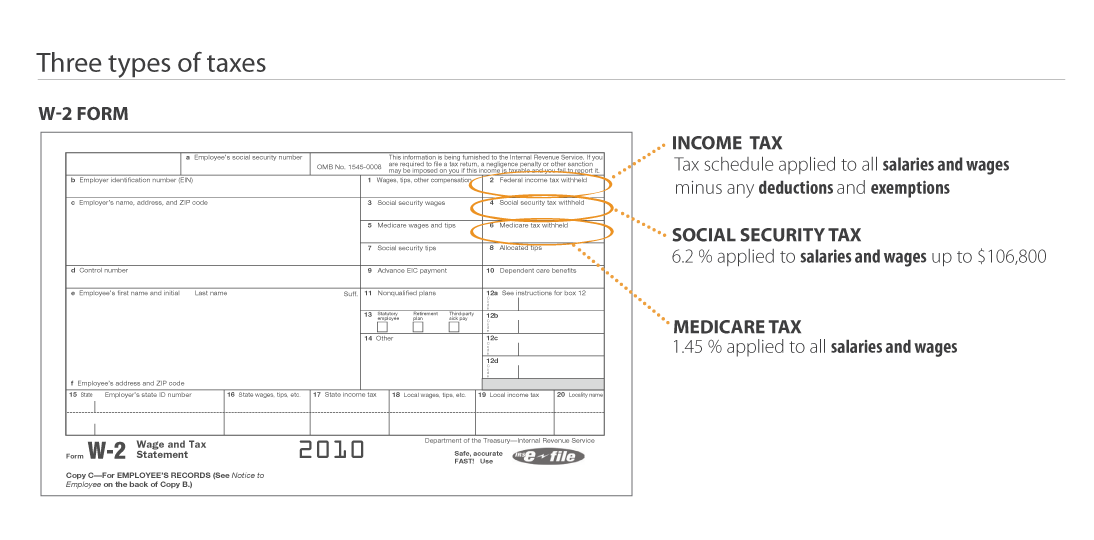

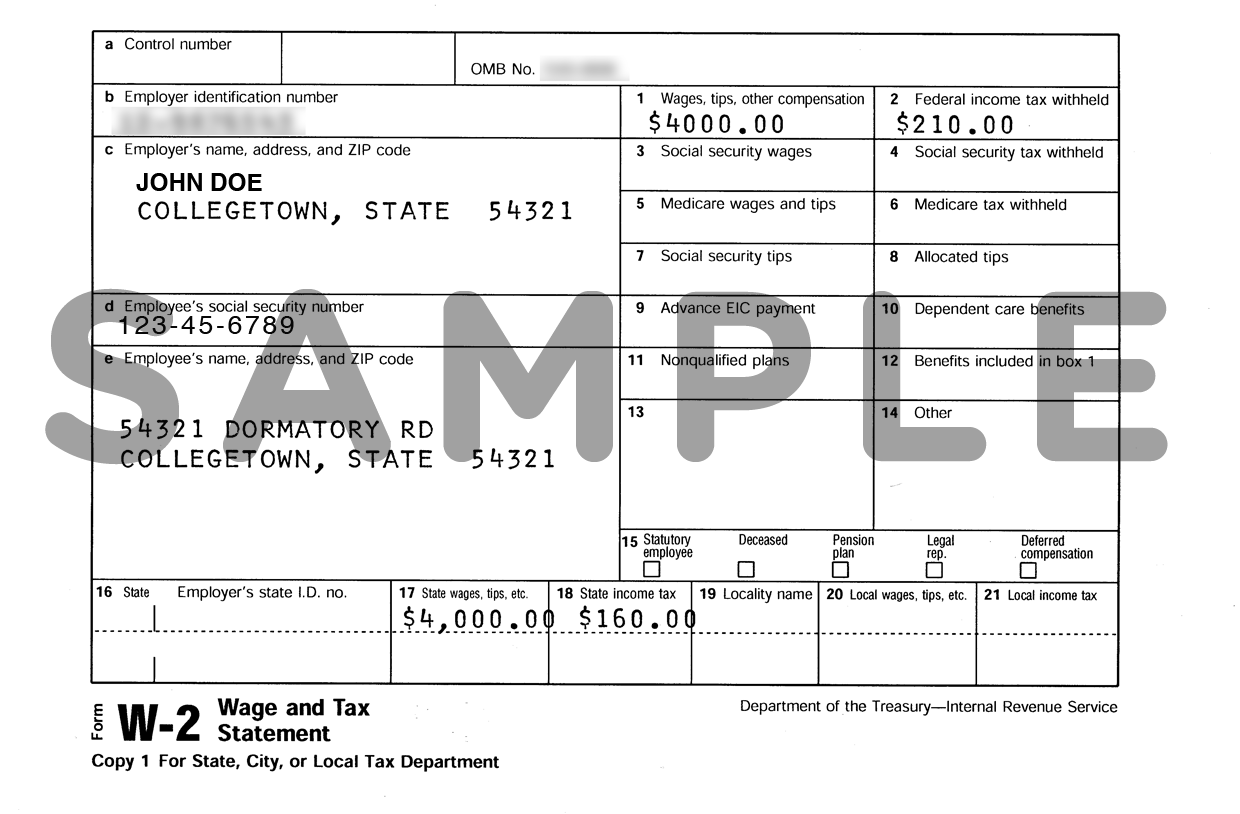

The state was the proper payer for the Medicare premiums, and the prior payments made by Mr. Dance for January through are the excess premiums. Excess withholdings of Medicare tax by a single employer who will not adjust the overcollection has been added to the list of taxes for which a refund can be claimed on Form 843. See Use Form 8to claim or request the following and Refund of excess social security, Medicare , or RRTA tax, later.

Department of Health and Human Services. Many CMS program related forms are available in Portable Document Format (pdf). All claims adjusted as a result of the voluntary refund request will be reflected on the Medicare Remittance Advice. Complete this online form to initiate a request for immediate recoupment of overpayment(s). All fields are required and the form must be completed in its entirety prior to submitting your request.

Reimbursement and the health plan has the dependent in Medicare status. Program Applicationand return it with a copy of their Medicare card to the address listed above, Attention: Medicare Unit. Question: I received the standard premium amount of $109. If you are already enrolled in Medicare Part A and you want to enroll in Part B, please complete form CMS-40B, Application for Enrollment in Medicare – Part B (medical insurance).

If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L5, Request for Employment. Downloa fax, print or fill online more fillable forms , Subscribe Now!