Part B covers types of services. The home health agency caring for you is approved by. Medicare Part A coverage—skilled nursing facility care. You’re eligible if you’re and older or under age with certain disabilities.

Generally speaking, you’re eligible for Part A if you’re or older, have a disability, or have end stage renal disease. Other articles from healthline.

It helps to cover some of the costs of stays at various medical and healthcare facilities, should you need inpatient care. Some people will be automatically. Part A also pays for some home health care and hospice care. This includes stays in a hospital or nursing facility.

It also pays for some home care and hospice. Initial Enrollment Period. Learn more about how you qualify for Medicare. If you don’t have a myMedicare.

You may go to any doctor, specialist, or hospital that accepts Medicare. Part A is free for those with the qualifying number of Social Security credits. Since TFL provides drug coverage, though, you don’t need to enroll in Part D. Costs may not be covered by Part A if you are in the hospital for observation. It is probably most well-known for covering services provided on an “inpatient” basis in the hospital.

It covers a few other skilled services I never want to use like hospice, home health, and skilled nursing care. If this is the case, you qualify for a Special Enrollment Period when you decide to enroll in. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

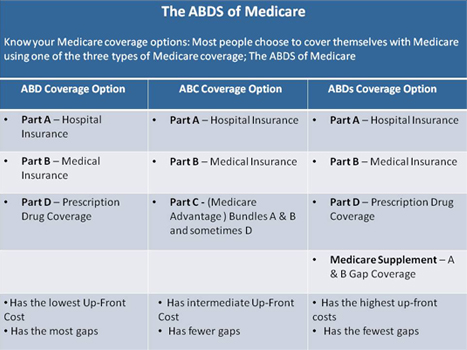

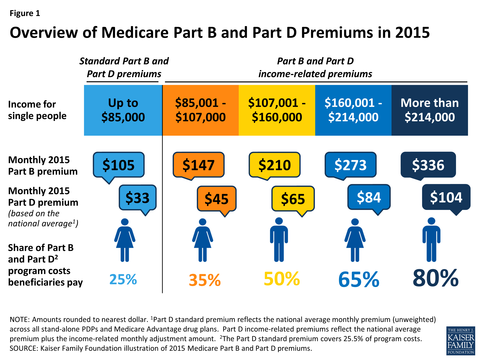

You pay a premium each month. Get Started with Medicare. For the most comprehensive experience, we encourage you to visit Medicare. Part C plans are only available through private health insurance companies.

They cover everything Parts A and B cover, plus more. These premiums are adjusted annually. The biggest exception is for people who suffer from End Stage Renal Disease ESRD and qualify for Original Medicare.

Eighty-five percent are placed on the highest tier of a formulary, and undergo prior. After days, you are charged a copayment for each additional day you are hospitalized.

Part A covers services and supplies considered medically necessary to treat a sickness or a condition. There is an advantage to these plans. You can receive more coverage beyond parts A and B. The period ends when this enrollee has not been an inpatient at either a hospital or a skilled nursing facility for a continuous 60-day period.

After days, it’s possible to tap into lifetime reserve days. Lifetime reserve days are like a bank account of extra hospital days covered by Medicare. SNF billers work with hundreds of diagnosis and procedure codes, known as ICD-9-CM, HCPCS, and CPT codes. However, one situation comes with a very strong practical reason for opting out of Part A. This is the home page for Jurisdiction Part A.