What is living away from home allowance? How long can you be away from home? Is it tax exempt to live away from home? Living away from home allowance fringe benefits.

The Queensland Government , Department of Education , provides financial assistance to eligible Queensland families , who do not have reasonable daily access to a Queensland Government school with the relevant school year level. These expenses include such costs as accommodation and meals. What are the eligibility considerations ? The scheme provides financial support through allowances: 1. Remote Area Disability Supplement (RADS)—helps with addi. With regards to special circumstances, consideration may be given to applicants who do not meet residential distance criteria.

Special circumstances include impassable roads (PDF, 159KB), itinerant occupations (PDF, 162KB) and additional special circumstances (PDF, 408KB). For more information about eligibility criteria: 1. See full list on qld. Semester – monthly payments will start once school attendance is confirmed. Allowances are paid by electronic funds transfer as follows: 1. RATuA—paid direct to boarding schools to offset school tuition fee accounts 2. The application form must be received by the Department of Education no later than December for the year of application to receive allowances.

Bypass school procedure 7. Distance education and boarding schools – information about rural and remote schools and support for students. Youth Allowance for students and apprentices If you’re or younger and a student or Australian Apprentice studying full time, read how we can help. Single, no children, younger than 1 and live at your parent’s home.

Coronavirus Supplement. The Queensland Government, Department of Education, provides financial assistance to eligible Queensland families, who do not have reasonable daily access to a Queensland Government school with the relevant school year level. You could package accommodation costs incurred for the first months while living away from home.

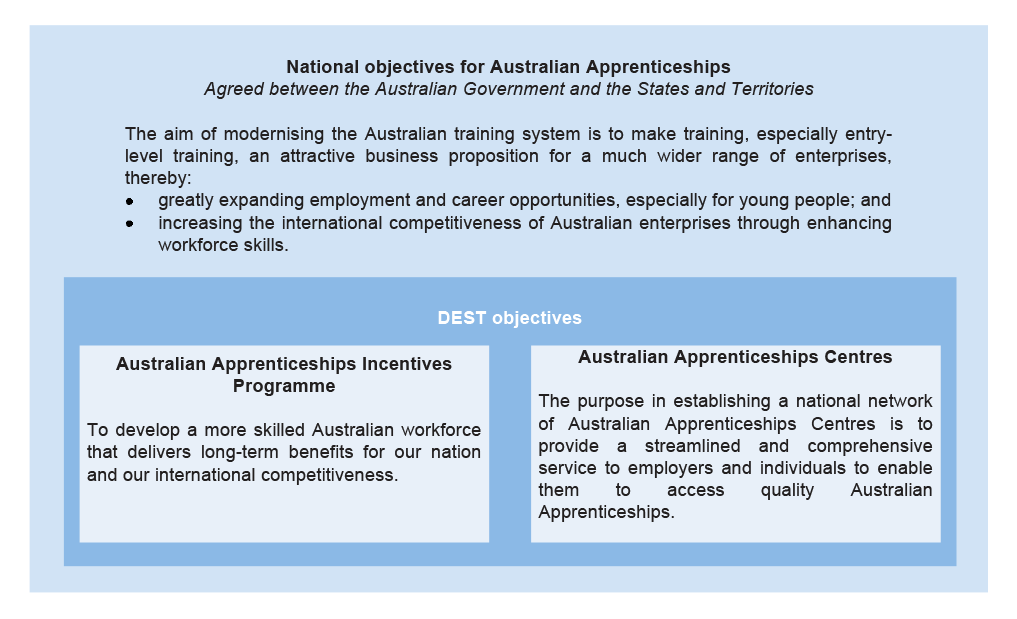

It does not apply to your typical fly or drive in and out worker who has a permanent work site. LAFHAS online form 2. As an employer who provides a living – away – from – home allowance to your employees, you must receive all employee living – away – from – home declarations no later than the day on which your fringe benefits tax (FBT) return is due to be lodged. You’ll get a higher rate if you’re a full time independent student or Australian Apprentice living away from your parents’ or guardians’ home. The Relocation Scholarship is paid once yearly for each year the student is required to live away form home to undertake the course. Free advice and support is available to both employers and apprentices through the Australian Apprenticeship Support Network Providers.

Pre-conditions for eligibility relate to income and distance from the nearest public secondary school or school of preferred religion. A: Anyone who is required by their work to temporarily live away from their usual place of residence may be eligible to receive a tax free ‘ Living – Away – From-Home ’ allowance. This is with the provision that they intend to return after the cessation of their contract.

This blog only applies to workers who are transferred to a temporary work location for a period of less than months. Are you Living Away from Home , Relocating or travelling? You may be eligible for a Living Away From Home Allowance.

Secondary students (NSW 7–12) must be enrolled at either a government secondary school or a non-government school of preferred religion. The employee’s living standards before the required move. In most cases, the rental allowance given will reflect the employee’s actual rental expenditure. If there are more siblings these thresholds increase significantly.

Accommodation allowances and expenses when travelling away from home for work. As a general rule, you must declare any travel allowance you receive as income in your tax return.