There is a kind of agreement for this, and it is called the limited partnership agreement. Save, sign, print, and download your document when you are done. MaRS has created a sample template of a limited partnership agreement to help streamline business for investors, founders and their respective legal advisors. While MaRS makes this document available for educational purposes and to facilitate the negotiation of terms between investors and startups, the template is yours to use at your own risk.

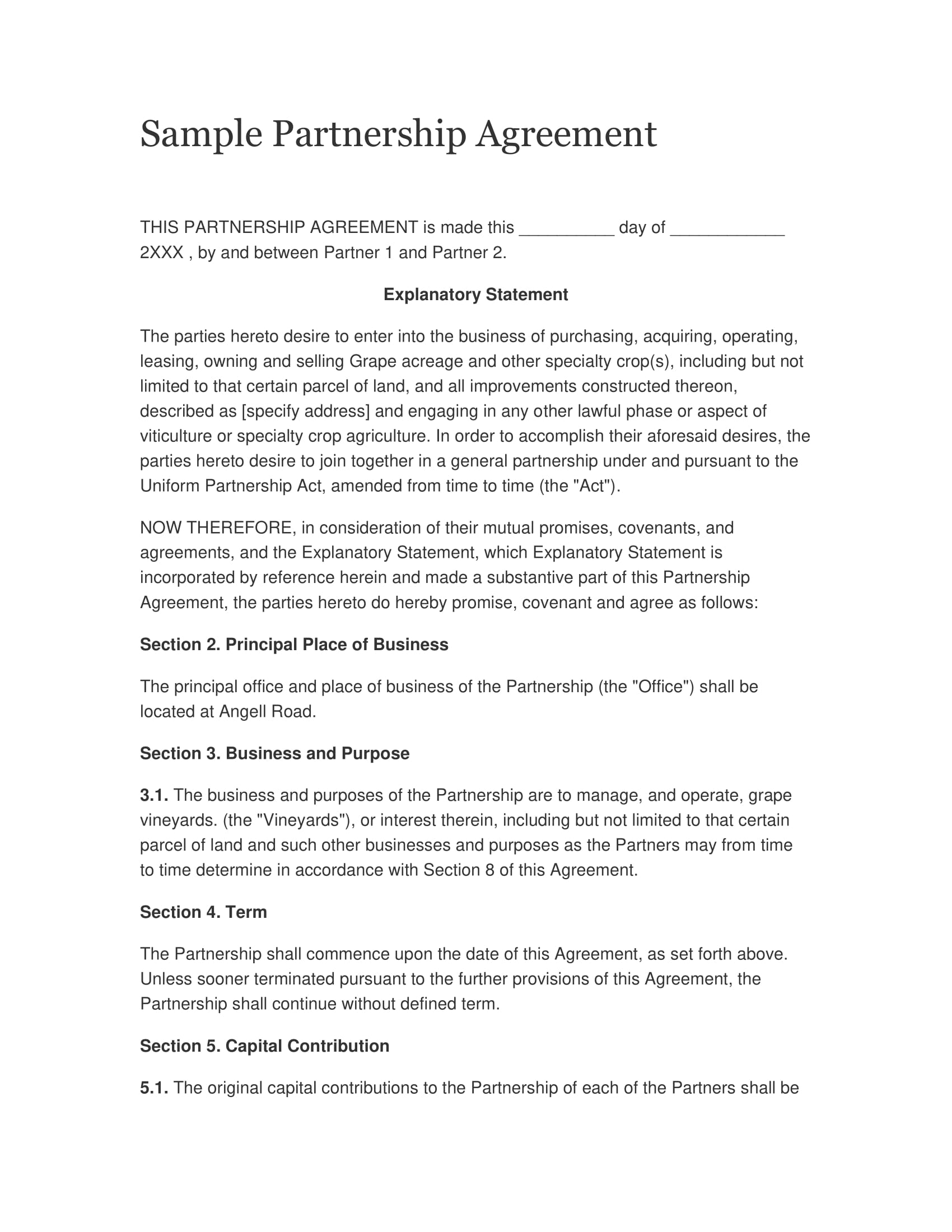

This is a document whose main purpose is to establish a formal partnership between small businesses. In this agreement , two partners are involved and both of them make capital contributions to help in running their new entrepreneurial venture immediately the partnership is formed. See full list on docformats. This is a contract that outlines clearly the arrangement between two partners whose aim is to work together in order to launch and grow a business.

Since different partnerships will aim at pursuing varying business ventures, business agreements created are usually different. Even though the agreements are different, there are some similar items found in these agreements, an example being a mutual non-disclosure agreement. For the agreement to be vali it is essential for business partners to choose a professional template.

A non-professional template may look sketchy and thus it may not be admissible in solving any disputes in the future. Percentage of Ownership – When partners are starting a business venture together , the amount of money that each partner contributes usually differ. The cash contributed may be used to cover the start-up costs that are involved while setting up a business venture or even help in acquiring equipment that the business needs in order to start running. The amount of capital that each partner contributes initially is used as the basis for establishing the percentage of ownership.

What does a limited partnership require? What is your personal liability in a partnership? A partnership agreement is a written agreement between two or more than two people who wish to join as partners and to conduct a business to earn profits. Generally, a partnership pact contains the nature of business, rights and responsibilities of the partners and their capital contribution.

The first is the name and the address of your business that should be written clearly. The form that is best utilized for this kind of partnership is the limited partnership agreement form. In this form, you will find the thorough details, explanations, and specifications of the following essential information: The ownership rights, such limits or boundaries of the individual. A partnership is a business arrangement where two or more individuals share ownership in a company and agree to share in the profits and losses of their company. This document is a crucial foundation document for running a new business.

Partnership Agreement Template. Those thirteen articles cover the several aspects, such as the introduction of the member, the contribution and distribution, the management schemes, and the dissolution. I am sure you would also like to check out our collection of Employee Non-Compete Agreement Templates.

It is very least likely that a single person can run a big company or organization. Even if he somehow manages to do perform all responsibilities for a while, at some. A LLP Agreement is an agreement between two or more individuals or businesses who would like to manage and operate a business together in order to make a profit.

LLP is an alternative corporate business form that gives the benefits of limited liability of a company and the flexibility of a partnership. For private equity funds formed as limited partnerships, the key legal document is the limited partnership agreement (LPA) which sets out in detail the legally binding relations between the investors (as limited partners in the partnership ) and the general partner (representing the fund manager). Use this limited partnership agreement template to help you write a legal agreement document between your business partners. Easy to edit and customize, just replace the highlighted text with the necessary information pertaining to the agreement.

Open this template in your favorite application in MS Word and Pages. This form of agreement is used most commonly for high risk ventures in property, finance, mining or research, where one or more partners is a limited company. Download this free general partnership agreement template below and customize it to meet your unique business legal needs.

Limited partnerships―some (“general”) partners manage the company and other (“ limited ”) partners contribute only financially. AMENDED AND RESTATED LIMITED PARTNERSHIP AGREEMENT. BLACKSTONE HOLDINGS I L. State of Delaware, as general partner, and the Limited. Usually, each member will bring to the business initial contributions such as capital, intellectual property, real property, or manufacturing space.

This general partnership agreement sample pertains to the formation of a baking company between two partners. It also lays out the various details concerning start-up investments, the division of profits, and the possibility of the partnership dissolving. The agreement describes the roles of both of the partners within the company. In its most basic form, FLP tax planning includes (1) a limited partnership agreement (or an operating agreement if an LLC), (2) a parental contribution of assets to the partnership or LLC, and (3) a parental gift or gifts to the parent’s children of interests in the partnership or LLC (not interests in the contributed assets). This JOINT PARTNERSHIP AGREEMENT shall not be amende altere or revised without the prior writer consent of the PARTNERS.

In all cases, any correspondences, notices, or other documents pursuant to this AGREEMENT , for the duration of its TERM, shall be addressed to the. Consider adding a provision that allows partners to vote to continue the partnership in the event of the death of a partner. Note what type of vote is needed to dissolve the partnership.