Instant Downloa Mail Paper Copy or Hard Copy Delivery, Start and Order Now! What should I review in due diligence? Why does everyone need an it Due Diligence Checklist? What is due diligence in small business? Legal due diligence is the examination and review of legal documents and contracts.

Financial due diligence. Commercial due diligence. Contracts with obligations such as covenants and indemnification.

Confirm that the firm is not restricted from doing business under OFAC regulations or similar. Copies of any letters with any regulatory agencies or authorities. Good-standing certificates or qualification to do business from state of incorporation and states where qualified. Schedule of any significant U. See full list on dealroom. Evidence that outstanding stock is paid in full.

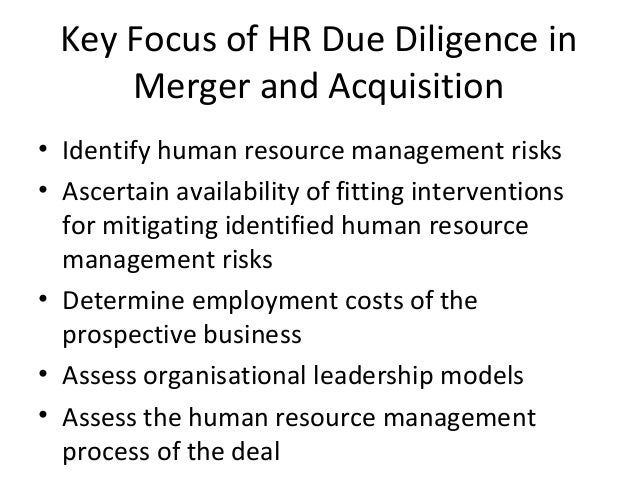

Identify issues associated with transfering equity. List of stock transfer records. Summaries of current and closed governmental investigations and proceedings on the target, directors, and executives from the past five years. Responses from the company regarding audit inquires.

Detailed list of all products and services. Verify compliance with FDA, CPSC, OSHA, and FLSA regulations for products, services, and operations. Summary of all material warranty claims brought. Change of control regulations.

Identify any contracts or provisions that may be out of the ordinary course of business. Summaries of disciplinary and termination procedures and all involuntary employee terminations from the past five years. Ensure employee personnel files and Form I-9s (if it is United States-based company) are in compliance with legal. History of Unemployment and Worker’s Compensation claims. Environmental inspection or review of all facilities.

Past or current litgations and procedings regarding environmental concerns. Describe waste disposal processes. As in our country, no one knows how our government policies will change and what will be the effect of this change on the Company.

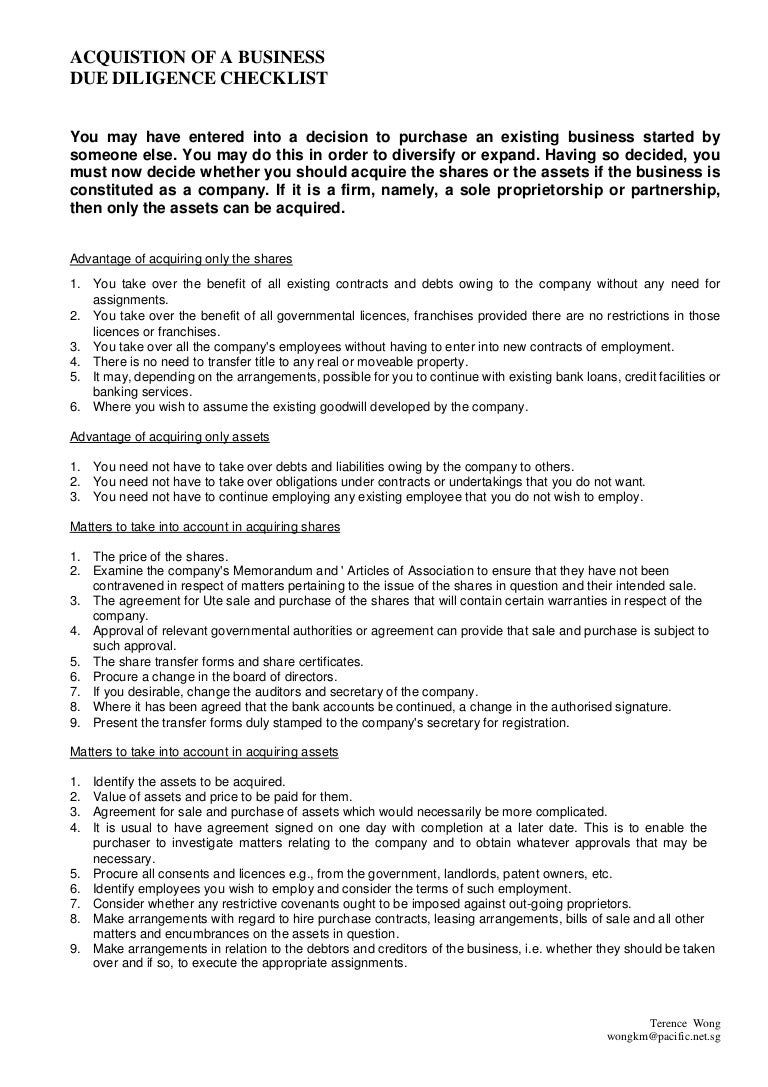

Legal Due Diligence Checklist Collecting legal due diligence is a meticulous process. Legal risks are collected and assessed in order to gain insight on a company’s legitimacy and viability. Any and all litigation, permits, licenses, and agreements are considered during this aspect of the diligence process.

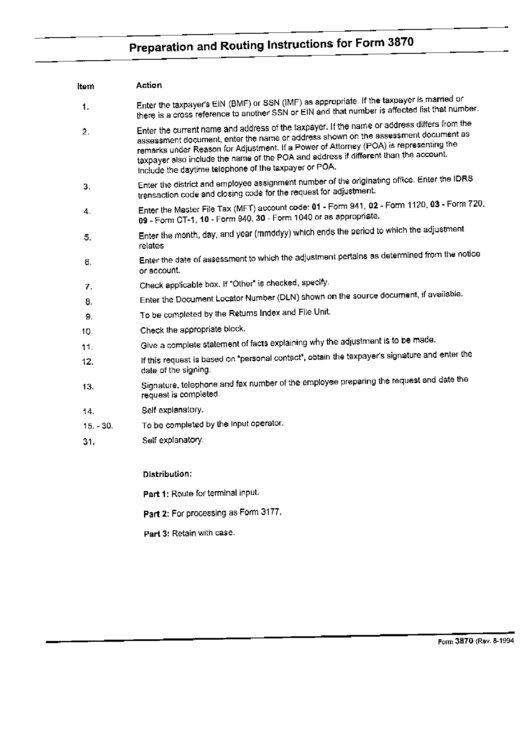

The due diligence checklist includes over items that range from financial to legal to operations items that should be verified before completing the transactions. First, get a Non-disclosure Agreement in place before you release anything. That will protect you and give you legal recourse if they leak any sensitive information. Next, agree with then on a list of items (financial, operational, etc).

Understand Your Own Business. Value a Target Company. In the same way that a legal due diligence investigation can help your company value itself, a. LEGAL DUE DILIGENCE AND INFORMATION CHECKLIST Acquisition of “Target”, Inc. Articles of incorporation (with all amendments) B. Bylaws, as amended C. Intellectual Property. Corporate and Legal Structure.

Easily adaptable, this legal due diligencechecklist can be reused to suit the needs of any sized companyor transaction. Get the checklist , then automate it. The checklist is just step one.

Request a demoto learn how you can turn your checklist into an automated process and workflow with the Ansarada platform. Additionally, general corporate matters such as charter documents, board members, security holders, and the minutes of. The ultimate due diligence questionnaire checklist and guide If your organization is considering a new investment, monitoring an ongoing partnership, planning a merger or choosing a new vendor, you’ve likely crossed paths with due diligence.

The Company’s minute book, including all minutes and resolutions of shareholders and. Organization and Good Standing. Due diligence is a complex process and should not be conducted without the assistance of your accountant and attorney.

Additional issues may be appropriate under the circumstances of a particular deal.