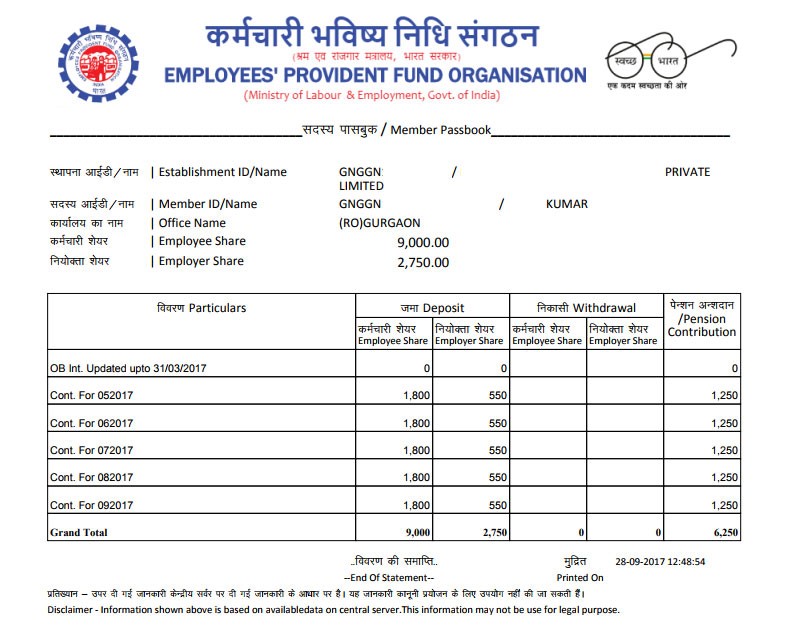

Award-Winning Client Service. Do I need joint loan? Whose credit score is used on a joint mortgage? What is a joint auto loan? Each applicant has three scores—one from each major credit bureau—and the lender looks at the middle score for each.

So, if your median score is a 7but your partner’s is a 6, lenders will base interest rates off that lower score. In a joint application for a mortgage, lenders will usually use the lower of your two credit scores. This is when it might make more sense to apply on your own. The question of whose credit score is used on a joint auto loan is probably one of the most important.

Incomes can be combine but credit scores, unfortunately, cannot. The truth is that it is important for both parties to have an acceptable credit score and payment history. However, if one of you has a poor credit history then opening a joint account or creating a financial association means the other person will be co-scored , potentially lowering their credit score.

Having another credit score and income contributing the loan application can help qualify for a home loan. When you enter a mortgage agreement with a co-borrower who is equally responsible to repay the loan , it is called a joint loan. For example, LendingClub’s minimum credit score for single applicants is 60 but a secondary borrower on a joint loan can have a score as low as 540. Since you have Credit Karma , you have an idea of your score (s), so that should help. And remember, if you shop around for an auto loan , do it within the same day period and all inquiries ( credit checks) will only count against your credit score.

Get A Decision As Soon As Today! Loan Experts Can Help! Refinance Online Today! This means they pull a tri-merged credit report for each of you. This includes scores from Experian, Trans Union, and Equifax.

If you were to apply for the loan on your own, the middle score would be the qualifying score for any loan programs. Could take on a larger loan – You could qualify for a bigger loan with the additional income of the co-borrower. In general, the better your score, the better the terms and interest rate on your loans.

A credit score of 5is the bare minimum to qualify for an FHA loan. To qualify for the lowest down payment, however, you’ll need a score of at least 580. Underwriters review your credit score and credit history, and may require letters of explanation for any delinquencies. Each veteran’s income must be sufficient to repay their portion of the loan. A joint account can help improve your credit.

If the account is kept in good standing, after a period of time, a joint account can help lift the credit scores of a cardholder who needs more help in. Talk to Our Experienced Debt Relief Experts. Easy application, instant approval, express payout.

Check out your options now. Get a decision as soon as today. Customer service you can count on. The publication of the solicitation is the first step in the process of evaluating new credit score models, said FHFA Director Mark Calabria. Generally, lenders take the lowest middle credit score between two.

Avoiding One Partner’s Credit Score. Can you omit his credit score. For example, you might have an 800-credit score, but if your spouse has a 600-credit score, it’s going to be much harder to get approved for a joint loan.

DU loan casefiles: DU performs its own analysis of the credit report data, but in no case will credit scores be lower than. Borrowers should check their credit score six-to-twelve months before applying for a mortgage to identify and correct any issues. It can complicate the mortgage approval process if only one of you has a high credit score and the other the higher income. When a couple’s incomes and credit scores don’t jive, qualifying for a mortgage loan can be a problem.

He has a good credit score of 720-ish, but I have a bad score , TransUnion 587. If my dad is the primary applicant, will his credit score be the one considered for the loan ?