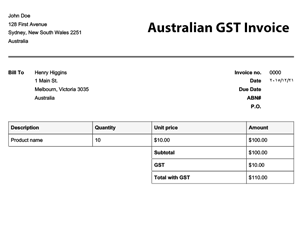

Is an invoice a receipt? While the information on a tax invoice and a receipt may be similar, a tax invoice is not a receipt. What is a tax invoice?

It includes prices, credits, discounts, taxes and total due. I think you mean through Paypal not from.

In the USA it is $6before having to declare taxes. Depending on where you are located you have to declare VAT if you are registered for it. Be careful of Paypal as they can put your account on.

If you are in business and registered for GST, you may be able to claim back the GST, in which case keep it. Otherwise, a tax invoice will often double as a receipt which may be necessary in order to return any faulty goods, to make a claim. GST is collected in most purchases and a tax invoice is not always provided for every sale, eg you go to your local corner store and they will not always give you a receipt for your purchases.

By law they are still collecting tax as part of.

The significant difference between the two is that the invoice is issued prior to the payment while the receipt is issued after the payment. The invoice is used to track the sale of goods or services. A receipt is issued post the payment.

The receipt on the other hand details how much has been paid and what the mode of payment is. An invoice is issued before the payment is made. Both invoices and receipts are paper or electronic slips that detail purchase transactions.

Invoices and receipts are not interchangeable. Customers receive invoices before they pay for a. You can set up terms to indicate how long the customer has to pay. A sales receipt is used when your customer pays you on the spot for goods or services. A VAT receipt will be provided by VAT registered suppliers to you, the customer.

It will show details of the sale including the tax date, the suppliers VAT registration number and the amount paid for the goods or services. Most importantly, it will show the amount of VAT that the supplier has charged to you (if applicable). A receipt or proof of purchase may be printed from a cash register , hand written or a tax invoice.

Complete the details below to download your transaction history. Receipt In Minutes – Start Now.

A tax invoice is often issued to another business or company for goods that will be resold or used in a manufacturing process. The main objective of the tax invoice is to avail tax credit or tax. Follow the usual steps to create an invoice or sales receipt. Make sure the Location of sale is right.

If you ship ordered items, add the Shipping to info so QuickBooks knows where to charge your sales tax. Tax Notes is the first source of essential daily news,. The compliance requirements for a VAT registered tax payer is stricter when it comes to sales invoice and official receipts. That is why you should write properly the amount, name, TIN, and address to the receipt and sales invoice. Here is a sample format on how to write on a sales invoice and official receipt.

On the flip side, a tax receipt is a document that indicates an already made payment. In other words, it serves as a proof of tax already paid. In a nutshell, the difference between a tax invoice and a tax receipt lies in the timeline. While the prior comes before tax payments, the latter often come after payments have been made.

You must keep these tax invoices issued to your customers, and those given to you by your suppliers, for at least five years.