Can I drive a car without insurance? It’s mandatory all over Australia, but works differently in each state. See full list on finder. But does that mean you should skip all other cover?

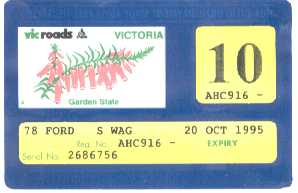

This is automatically included in your registration fee.

If you own and operate a private motor vehicle in Australia, there are four main types of general motor vehicle insurance you need to be aware of: 1. It is not an alternative to taking out a motor policy to cover your financial liabilities, such as damage to another vehicle or property, or your own. It protects any person that you might injure while you are driving. Some questions to consider when buying insurance (ask your insurer if you’re unsure): 1. Do I need any additional benefits such as a rental vehicle? Market Value is where the insurer determines the value of the vehicle, usually taking into account the condition of the vehicle at the time, its age and other factors. Each insurance company approaches premium calculation in its own way.

Agreed Value is where the insurer and the owner agree on the.

Many factors are considered including, but not limited to: 1. Each jurisdiction has its own scheme, with different criteria and benefits. In some states you will have a choice of insurer. The age of the driver 4. It provides the driver cover for any legal liability for injury and death as a result of an accident for which the insured is responsible – be it for other. It will appear as TAC premium or TAC charge. This insurance provides compensation for people injured or killed when your vehicle is involved in an accident.

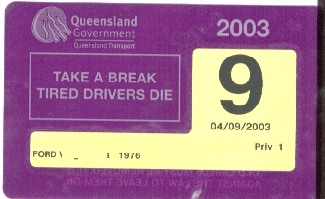

You cannot register your vehicle without having a policy in place. This covers personal liability should you injure someone in an accident – be it yourself, your passengers, other drivers or pedestrians. Each state and territory has a mandatory motor vehicle accident personal injury insurance scheme.

In New South Wales it is called a Green Slip. It does not provide cover for any damage to the vehicle and therefore other forms of motor vehicle insurance should also be purchased. NSW is the most complex.

Victoria is not too bad. Contact other insurance companies to compare the cost of insurance (the premium) and policy coverage. Premiums vary between car makes and models.

Insurance may be more expensive for cars bought under finance and for modified sports cars.

You may also pay more if you or someone under the age of will be driving the car. All States and territories within Australia have CTP schemes which are funded through the application of compulsory premiums on all registered motor vehicles. Car Insurance in Australia. However, no other forms of car insurance are mandated by the state.

Relying on CTP insurance is not recommended as you have no cover for any property damages in an accident, or any kind of damage to your vehicle. Motor Accidents Authority (MAA) of New South Wales prices. There is a compulsory 3rd party insurance fee added to the car registratiion fee which provides for compensation for people killed or injured in. Your exact needs depend on your line of business, the size of your company and state law.

Other polices, though not legally require make good business sense. Car insurance fraud and other insurance concerns can be handled by a variety of organizations. District of Columbia Department of Insurance , Securities and Banking (DISB).