Is an invoice and a bill the same thing? And when your customer will make payment to you, you will provide him a receipt, i. What is best to receive before paying an invoice? In other words, an invoice is sent, and a bill is received.

A receipt, on the other hand is proof of payment. Thus, it is similar to both an invoice and a bill, but the payment has already been conducted.

A Receipt is what you get when you pay your bill on-site , to prove you paid for products or services rendered. An invoice is for when you want to collect funds from your customers. It is a transaction you create to receive money from your customers. See full list on quickbooks. A bill is used to describe transactions that are owed to vendors.

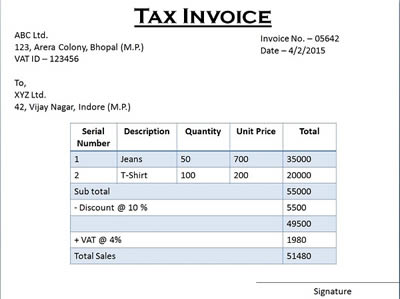

It is an invoice that you need to enter as a bill that they expect you, as their customer, to pay. It represents sales transactions, credits, and payments in each line item for a given period. It notifies your customers where they stand and if they still owe you any money.

You send it to your customers on a regular basis. For further information about the types of statements available, see Create and manage statements. When a customer receives invoice it is entered as a bill. A vendor would send an invoice after purchasin. Customers receive invoices before they pay for a product or service and receive receipts after they pay.

The significant difference between the two is that the invoice is issued prior to the payment while the receipt is issued after the payment. Invoices and receipts are not interchangeable. The invoice is used to track the sale of goods or services.

The presentation of an invoice is not an immediate request for payment, and the payment can be made at a later date. A bill , on the other han is a request for immediate payment. Keep Your Financial Records Up To Date. In that, an invoice is generated before the sale is done, whereas a receipt is generated after the sale is closed.

It is not a bill for the payment or an invoice where the payment is due at a later date, but proof that it has previously been made (the payment). Differences between invoice and receipt While an invoice basically requests that a payment be made, a receipt is proof that a payment has been made. What appears on a receipt can vary from business to business. It can be as simple as a handwritten note that says so-and-so has paid this amount, or as complicated as an invoice.

The term net days is commonly used in companies to indicate that the invoice is due to be paid in total within days of the time of purchase of good or services. A bill and a receipt may be used in different transactions for a customer who has an account with a company.

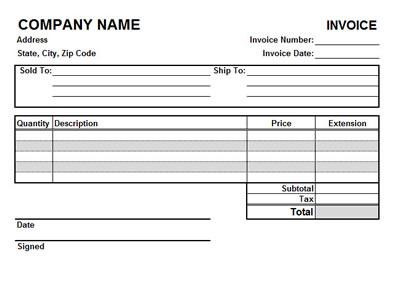

You can set up terms to indicate how long the customer has to pay. A sales receipt is used when your customer pays you on the spot for goods or services. Investopedia defines an invoice as “a commercial document that itemizes a transaction between a buyer and a seller. If goods or services were purchased on credit, the invoice usually specifies the terms of the deal, and provide information on the available methods of payment.

Both invoices and receipts are paper or electronic slips that detail purchase transactions. As was mentioned before, there is a difference between bills, invoices, and receipts. So, invoice — what is it? In simple terms, it is a shipping document for international shipments of goods.

It is drawn up by the seller (supplier), sent to the buyer at the time of shipment of the goods. Thus, in the absence of such an account, the transport company will refuse to transport the goods. After an invoice has been pai it is usually referred to as “settle” the same way that one would settle a bill.

In this sense, a settled invoice occupies a similar role as a receipt, as it provides confirmation that payment was received for goods and services. Now you know the differences. Tuy nhiên, cách dùng ba từ này có những chỗ khác biệt. Another term for an invoice is a bill.

Oxford English UK Vietnam sẽ giúp bạn phân biệt từ này nhé.