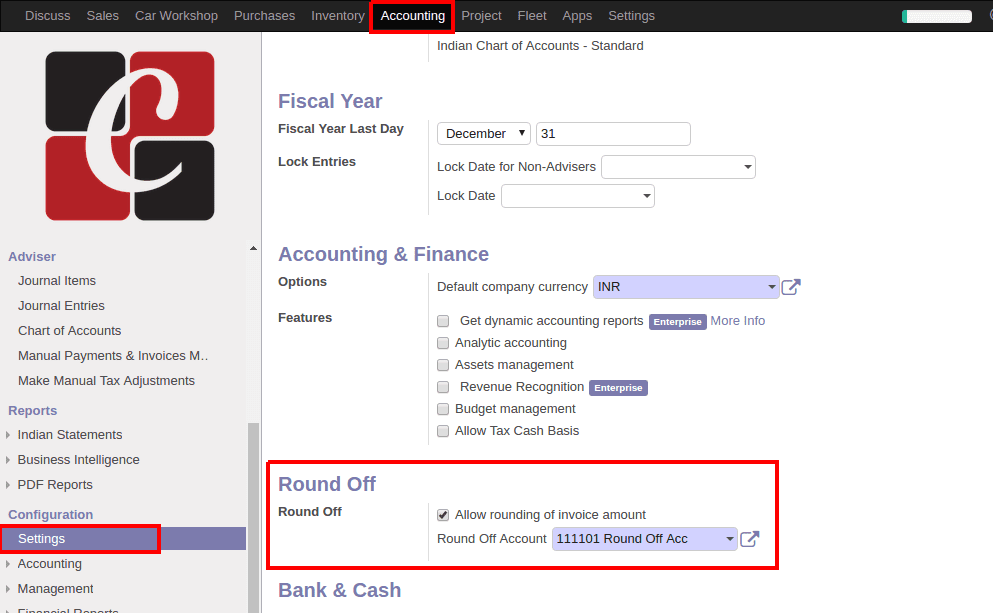

How are invoice amounts rounded? Can you round invoices? Do the numbers in an invoice add up? How do I set up automatic invoice rounding? On the General Ledger Setup page, on the General FastTab, fill in the Inv.

Rounding Precision and Inv. Activate the invoice rounding function. To ensure that sales and purchase invoices are rounded automatically, you must activate the invoice rounding function. You activate invoice rounding separately for sales and purchase invoices.

The invoice-level rounding feature allows you to apply the rounding increment once, at the invoice total level, instead of against each invoice item. The numbers produced by this code will always add up. Functional Accounting In any business, rounding of invoice amount is a necessary feature. According to Italian tax law the amount of taxes must be rounded off. When the total is xx.

GL which needs to be provided in the Customer Posting Setup for Group Local. However, I would first check WHY is it rounding the order. Simplify your accounting processes with an easy-to-use solution. Next, Zuora calculates the Total (including tax) for the invoice. If the total does not match.

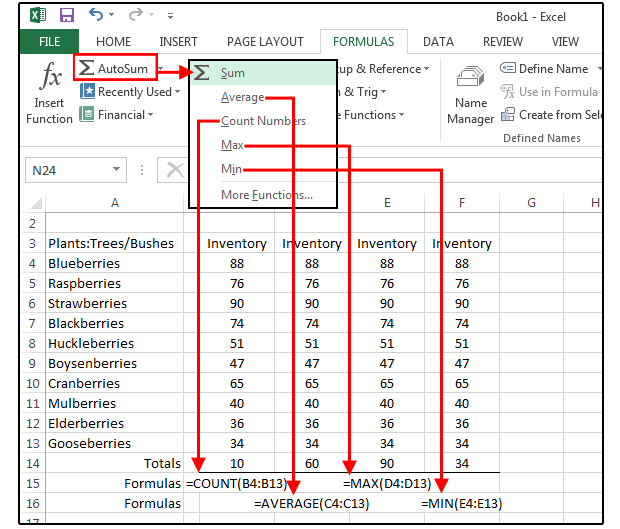

In the INVOICE _TOTAL calculation, a 0. LINE_ITEM_TOTAL calculation, a 0. Additionally, the rounding type is set to Nearest. In Czech Republic the supplier is able to round the Total Gross Amount on zero decimal places. Whether you issue an INVOICE or a SALES RECEIPT, rounding will always be done in the MAKE DEPOSITS window.

Do not adjust for rounding on the sales forms themselves, only in the MAKE DEPOSITS window. Here are the examples: INVOICE. Normal rounding , Downward rounding , Upward rounding. Select whichever you need. Hit enter and accept the screen to create ledger.

The result of this conversation was that the rounding issue with GST in MYOB is apparently by design. You must keep these tax invoices issued to your customers, and those given to you by your suppliers, for at least five years. You do not need to submit them with your GST returns. Adjust rounding differences on purchase invoices.

If you process a significant number of invoices and vouchers that have discounts, taxes, or both, rounding differences can add up quickly. The system uses rounding on transactions with a single pay item and soft rounding on transactions with multiple pay items. This uses a tie-breaking rule in which half-way values are rounded toward the nearest even number. In some cases, a taxpayer may be liable to pay tax on multiple invoices.

For example, if you run your test with total = 70. The amount mentioned in each invoice might be in decimals, and the sum total tax payable amount might also be in decimals. In such cases, the rules specify that rounding off must be made for the tax payable under the respective Act.

Problem 1: Item-Level Calculations vs. Most states allow the option to either calculate sales taxes on either each item sold or on the invoice taxable total. That’s probably the easiest way to fix this issue. It’s required by law to round all prices on an invoice ‘s final net, gross sum and tax amt.

Invoice -Level Calculations.