Is group life insurance a life insurance? What are two types of insurance? The different policies confuse people many at times. Life insurance provides for your family or some other named beneficiaries on your death.

Insurance is categoriezed based on risk, type , and hazards. Provides savings as well as insurance and can let the insured.

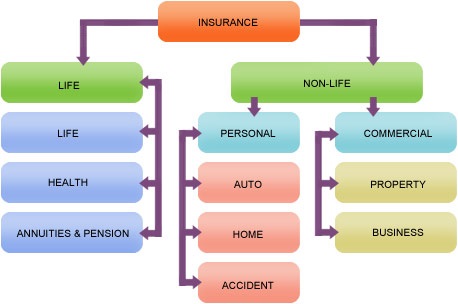

There is a distinction between the types of insurance one is life insurance and other is non-life or general insurance. In this, the insurance company promises to make good the losses of the insured on happening of the insured contingency. The contingency is the event which causes a loss. The two main types of life insurance are term and whole life insurance. Some types of life insurance come with a cash value amount that works like savings or an investment account.

Other policies allow you to skip the medical exam or pay for specific end-of-life expenses. There are lots of different types depending on what exactly you wish to protect – a property, business ideas, or whatever. Terminologies You Should Be Familiar with.

Most insurance is provided by private corporations, but some is provided by the government.

All too often, people want insurance but do not understand what coverage to buy. No matter which type of life insurance you choose, it is very important to understand the specific rules and terms of each type of insurance and each specific policy. Different types of policies can be appropriate for different people depending upon their age, needs, and appetite for risk. Definition of insurance : A promise of compensation for specific potential future losses in exchange for a periodic payment. Here are a few of the basic car insurance types , how they work and what they cover.

Liability coverage Liability insurance may help cover damages for injuries and property damage to others for which you become legally responsible resulting from a covered accident. A copay is a flat fee, such as $1 that you pay when you get care. Coinsurance is when you pay a percent of the charges for care, for example. Six common car insurance coverage options are: auto liability coverage, uninsured and underinsured motorist coverage, comprehensive coverage, collision coverage, medical payments coverage and. However, with such a range of types of coverage, as well as the complicated nature of the insurance.

Health Maintenance Organization (HMO) – a medical group plan that provides physician, hospital, and clinical services to participating members in exchange for a. There are a few different types of liability insurance – general, professional, and employer – and they all cover different things. Read on to learn about the different liability insurance types and find the ones that are right for your business. Here is a brief explanation of each of these different types of insurance companies and the specific specialty risks insured and other unique attributes.

Professional liability insurance. An insurance agent can help you review what specific types of coverage may be available to fit your situation. Auto insurance Typical auto insurance policies include separate limits for different types of coverage, such as: Auto liability coverage: Each state sets minimum liability limits that all drivers are required by law to purchase.

You Can Still Qualify – Call Now. A package insurance policy providing property and liability coverages tailored to the needs of most home owners, condominium owners, and apartment tenants.

Various versions are available depending on the type of dwelling insured and the scope of protection to be covered. Vox populi A contractual relationship when one party–an insurance company or underwriter, in consideration of a fixed sum–a premium, agrees to pay on behalf another–an insure or policyholder for covered losses, up to the limits purchase caused by designated contingencies listed in the policy. How to use insurance in a sentence. Consider a health plan that helps minimize out-of-pocket costs based on what you anticipate for doctor care, specialist visits, prescription medications, etc.

The two primary types of life insurance —term life and permanent life—are just the tip of the iceberg. Here’s a brief overview of the types of life insurance you may encounter when you’re shopping around. This is only a general description of coverages of the available types of insurance and is not a state of contract.

Details of coverage, limits, or services may vary in some states. All coverages are subject to the terms, provisions, exclusions, and conditions in the policy itself and in any endorsements. However, your policy may exclude certain perils, depending on where you live and what kind of insurance you have.

Perils are hazards and events that can cause loss or damage, such as fire, win snow, or vandalism.